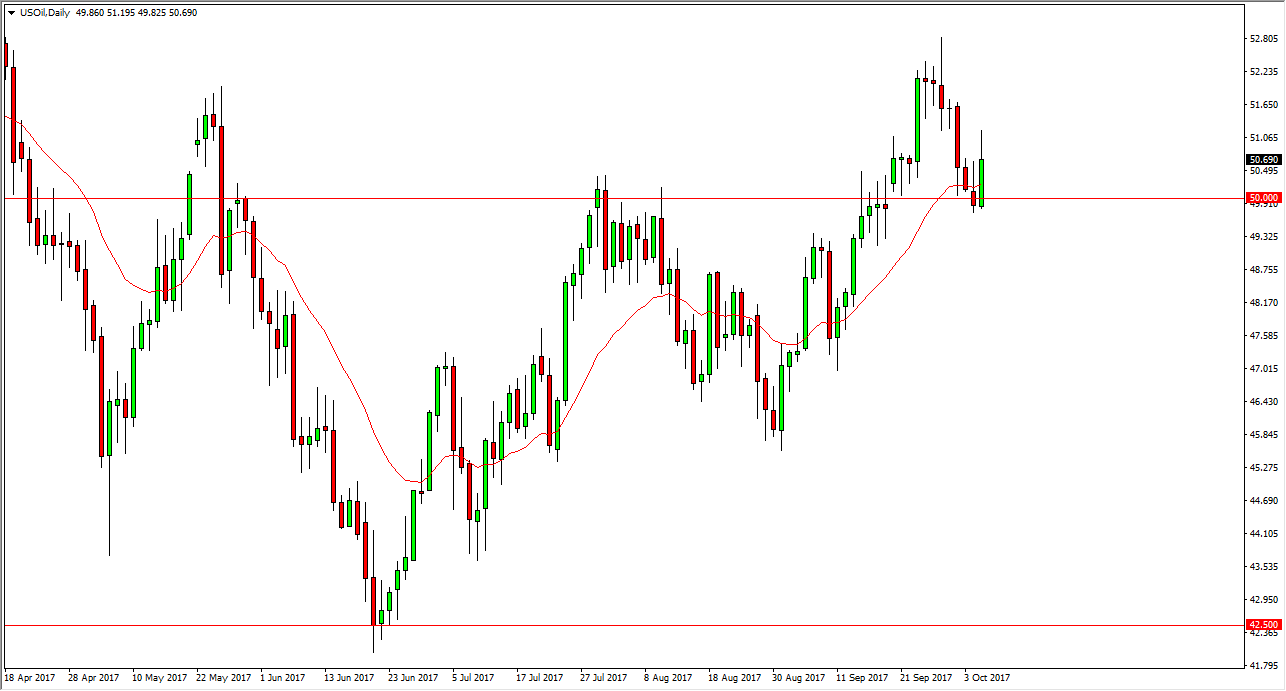

WTI Crude Oil

The WTI Crude Oil market rallied on Thursday, showing extreme amounts of strength initially, using the $50 level as support. The $51 level was a bit too resistive though, so we sold off a bit. However, we broke above the shooting star from the Wednesday session, so that is a bullish sign. I think we continue to see volatility in this market, and I think that we will go looking towards the $52.50 level. Alternately, if we can break down below the $49 level, the market should breakdown and reach towards the $46 level. There is a lot of volatility just waiting to happen in this market though, so keep that in mind. With the jobs number coming out today, it’s likely that we will continue to see volatility in the US dollar, and that will translate into volatility in this market.

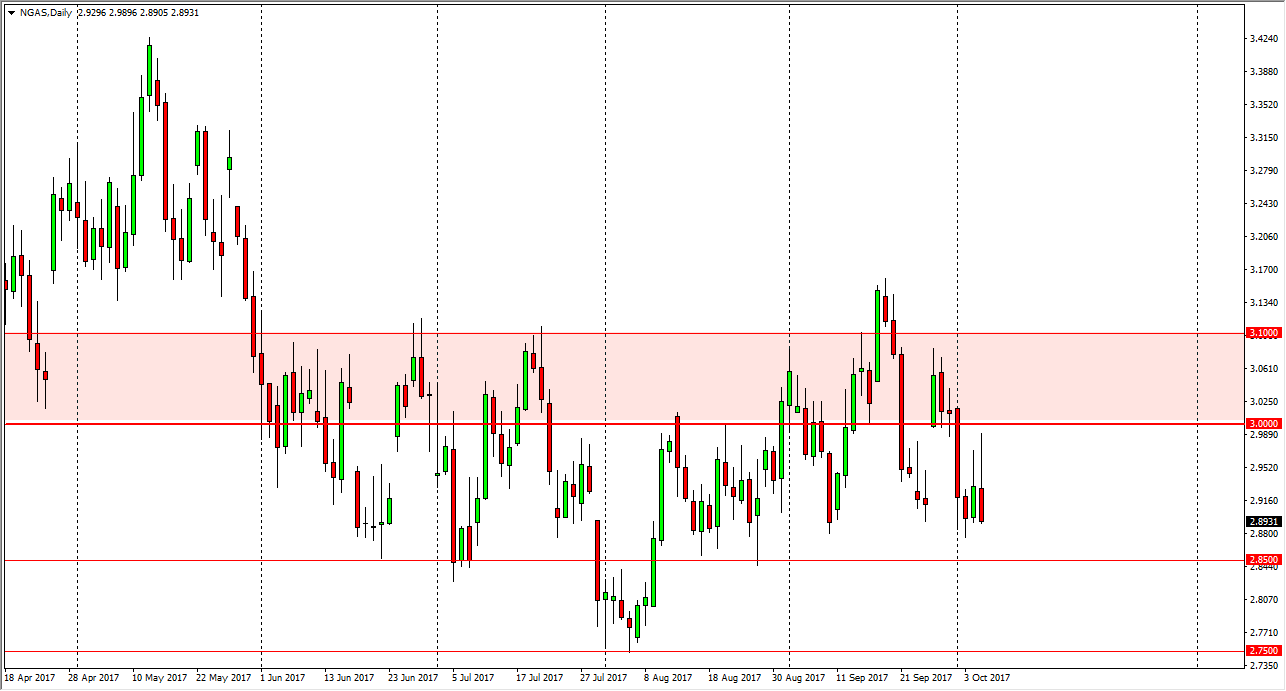

Natural Gas

Natural gas markets initially rally during the day, reaching towards the $3.00 level. However, we found resistance there yet again, as US companies that use fracking to find natural gas become profitable and that level. Because of this, we have a serious overhang and the natural gas markets, and I think that every time we get near that area, selling is probably the one thing you can do. Given enough time, we should go to the $2.85 level, which has been supportive. Even if we broke above the $3 level, I think it’s only a matter of time before there would be resistance just waiting to happen, turning the market right back around. I think that the massive amount of supply is going to continue to be an issue, and therefore I think that the market should be one that if you are patient enough, you should have selling opportunities present themselves quite often.