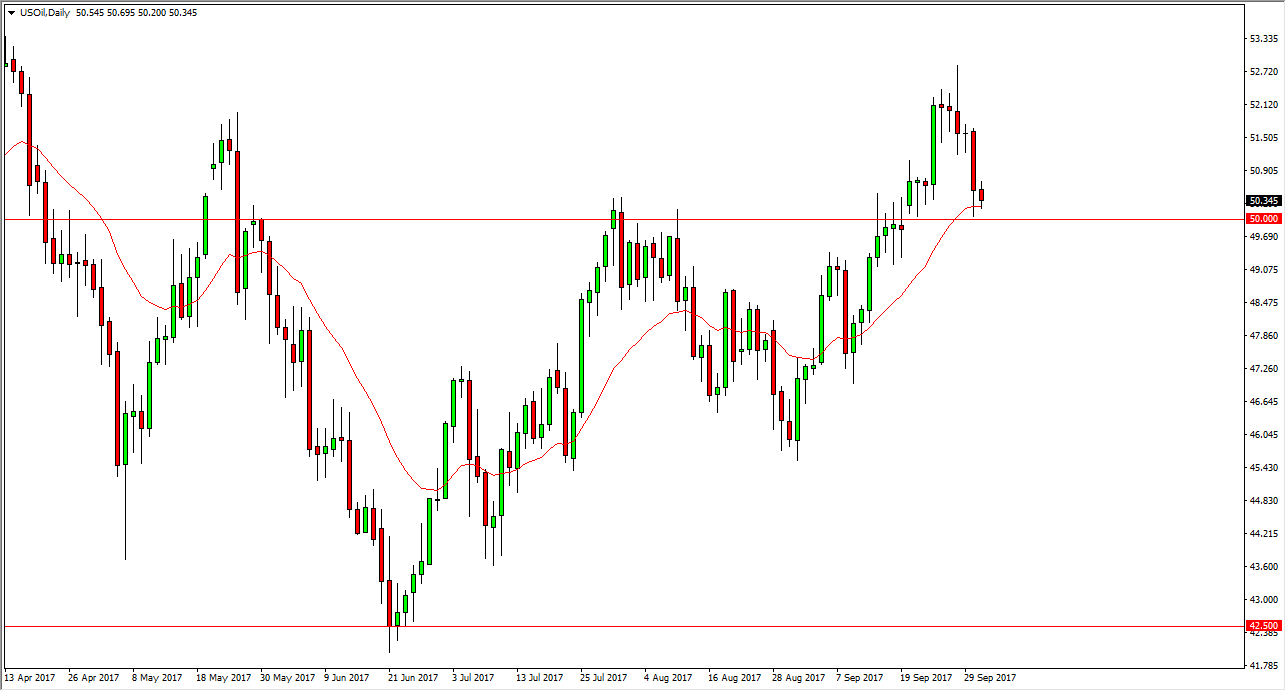

WTI Crude Oil

The WTI Crude Oil market fell during the day on Tuesday, testing the $50 level. The $50 level is massively important from a psychological standpoint, and of course structure will as well. I think that if we break down below the $49 level, we will have broken all support, and probably go falling towards the $46 level at that point. Alternately, if we bounce from here, the market probably goes back towards the $52.50 level. I believe that the market continues to struggle with over supply, as anytime the market rallies, rig counts will continue to grow. Ultimately, this is a market that continues to show a lot of choppiness, but as soon as we make a significant move, then I’m willing to put serious money to work.

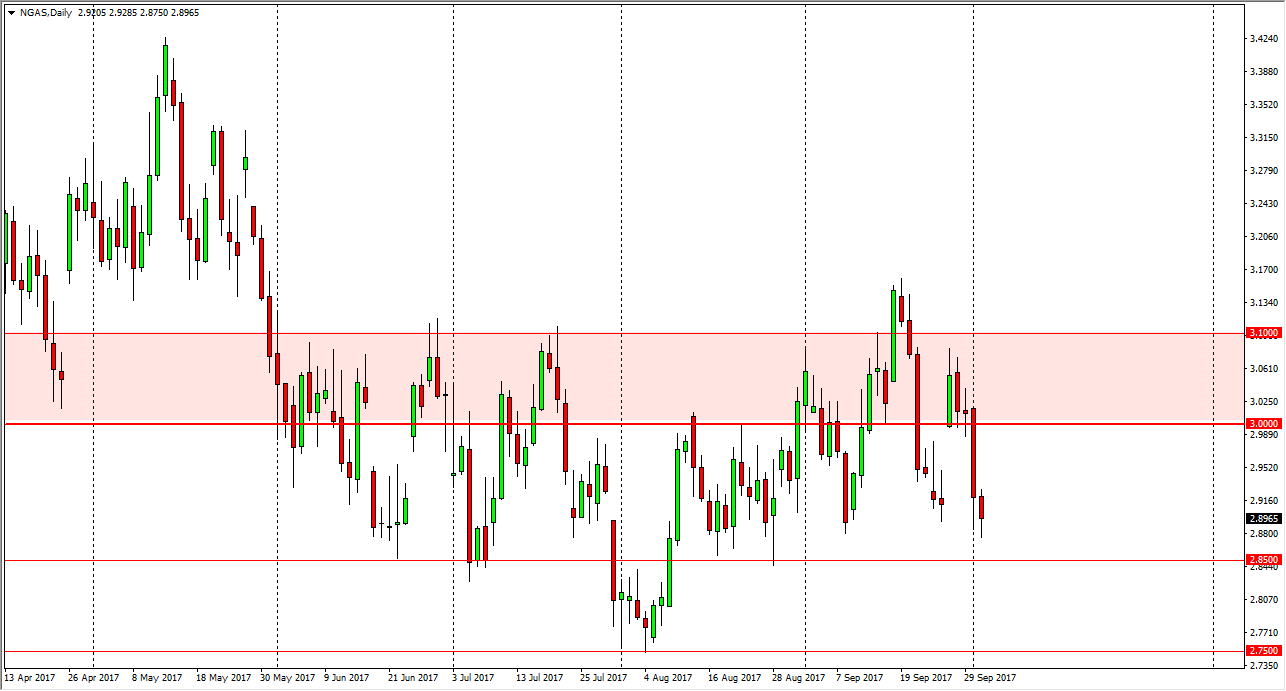

Natural Gas

Natural gas markets fell during the session on Tuesday, reaching towards the $2.88 level. I think there is significant support just below, so I’m waiting to see some type of rally to start selling again. The area above the $3 level should continue to be massive resistance, extending much higher. After all, fracking companies can sell natural gas at a profit above the $3 level, so I think the market continues to find massive amounts of supply above that area. The 2.85 level being broken to the downside would send this market down to the $2.75 level. Ultimately, this is a market that continues to show choppiness, and therefore think that the market is probably one that you are better off selling after rallies in this market and of course be patient enough to wait for rallies to sell after signs of exhaustion.