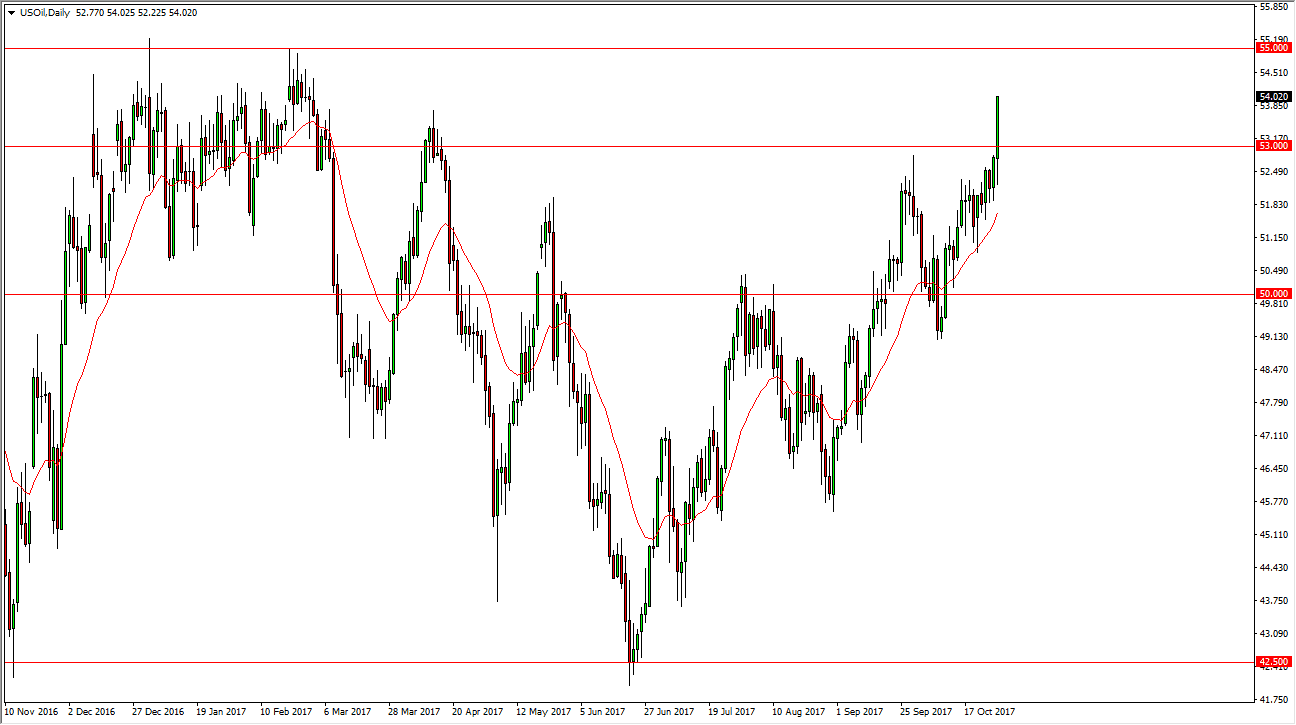

WTI Crude Oil

The WTI Crude Oil market initially fell during the Friday session, but then broke significantly above the $53 level. By doing so, it looks as if the market is ready to test the $55 level above, which has been massively resistive in the past. The market certainly looks as if it is going to go there, but the question is can we get above it? I think that if we do, the market probably then heads towards the $60 level. However, eventually the American start flooding the markets with crude oil as higher prices makes the sellers much more interested in offering more supply. Also, the GDP number was stronger than anticipated in the United States, so it’s likely that part of this may have been due to the idea of more demand.

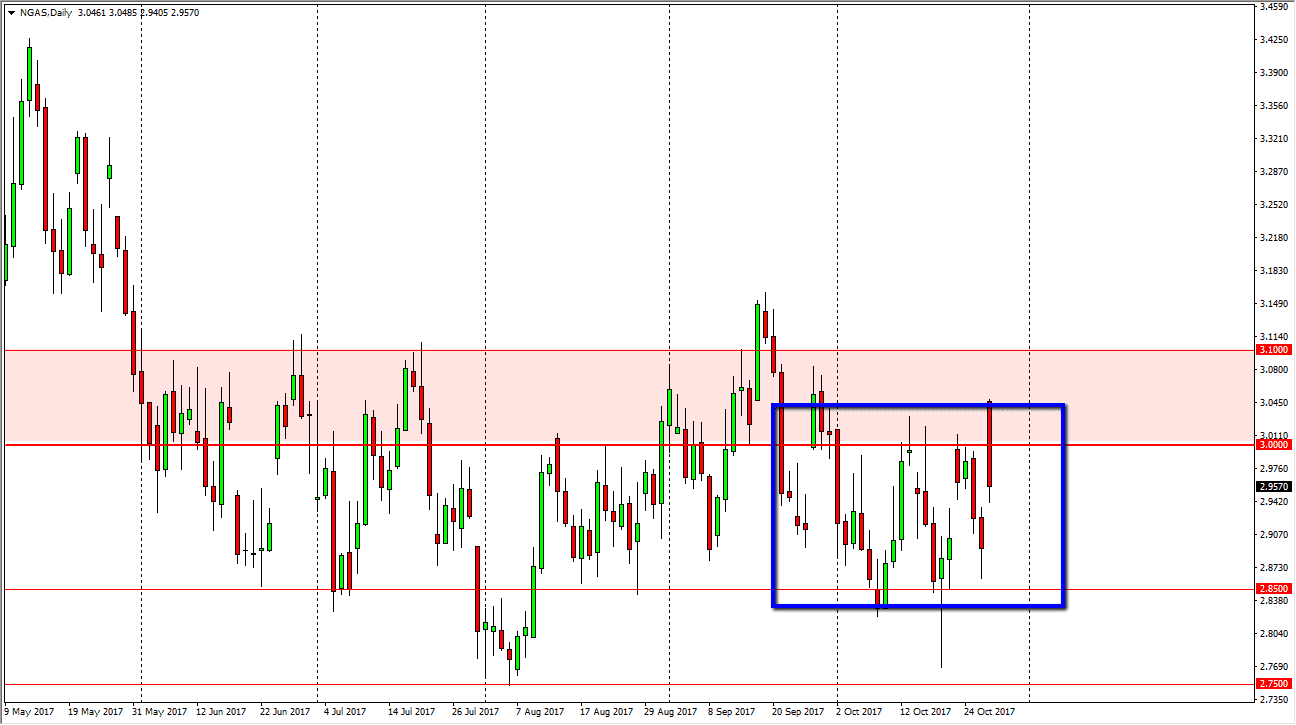

Natural Gas

Natural gas markets rallied at the open, gapping almost $0.10 initially, but then spent the rest of the day falling. This is a market that continues to be very choppy and back and forth, and even with this massive gap, I would be the first to point out that it’s not the first time it’s happened. Because of this, I don’t think anything has changed, and I am not impressed until we can get above the $3.15 level above. If we do, then I believe the market was much higher, but until then I think it’s just more of the same, we are simply going back and forth trying to figure out where we are going to be going next. The $2.85 level underneath continues to be massively supportive. I think short-term best for trading is probably going to be the best way to trade.