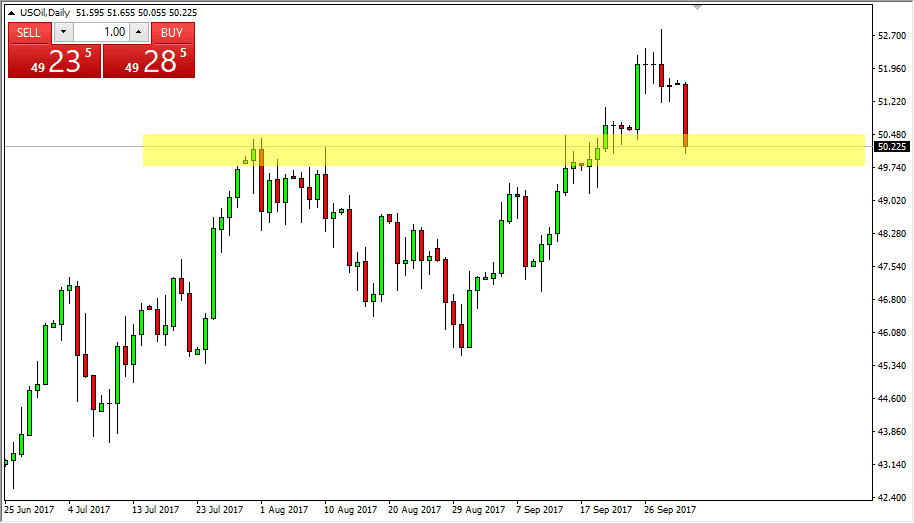

WTI Crude Oil

The WTI Crude Oil market fell significantly on Monday, reaching towards the $50 level. This is an area where I would anticipate seeing a bit of support though, so it would not surprise me at all to see buyers come back in. Ultimately, I think that the $50 level is essentially “fair value” currently, and therefore I think that a breakdown below there would be significant, but I would not be overly convinced the start selling until we break down below the $49 level. At that point, I think we could move as low as $45. In the meantime, I suspect that the buyers come back and try to push this market towards the $52 level. I would wait for some type of confirmation though, as the market has been very volatile.

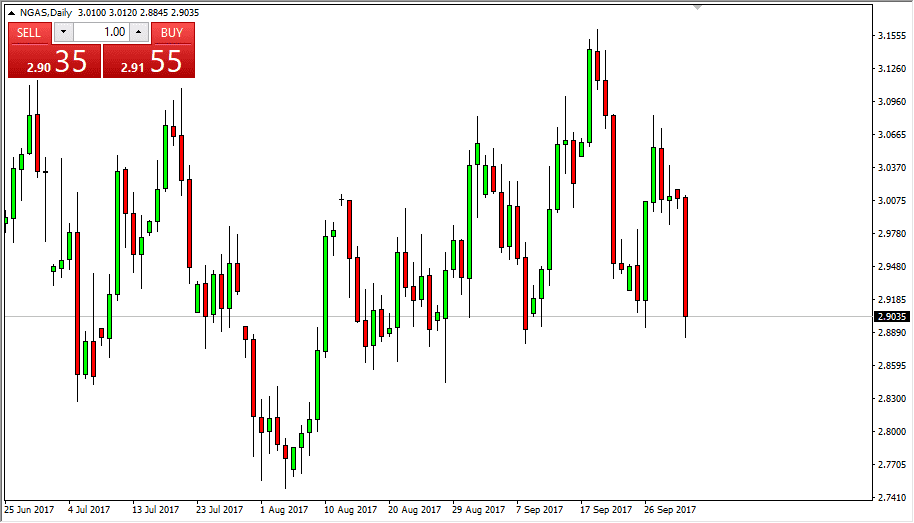

Natural Gas

Natural gas markets fell apart on Monday, reaching towards the $2.88 level again, as we have seen a bit of support in that general vicinity. Recently, this has been an extraordinarily volatile market, and considering we are going into the colder months in the United States, you would think that there would be enough pricing power to lift pricing in general, but we continue to see an overhang of supply above the three dollars handle. I think that continues to be the story here: supplier stepping into the market over three dollars as there has been seen in the past. I think that the fracking companies in the United States continue to see profits above three dollars, that could be difficult to sustain any rally above there for a significant amount of time. Selling the rally’s continues to be the way forward, but I do see a significant amount of support near the $2.75 level.