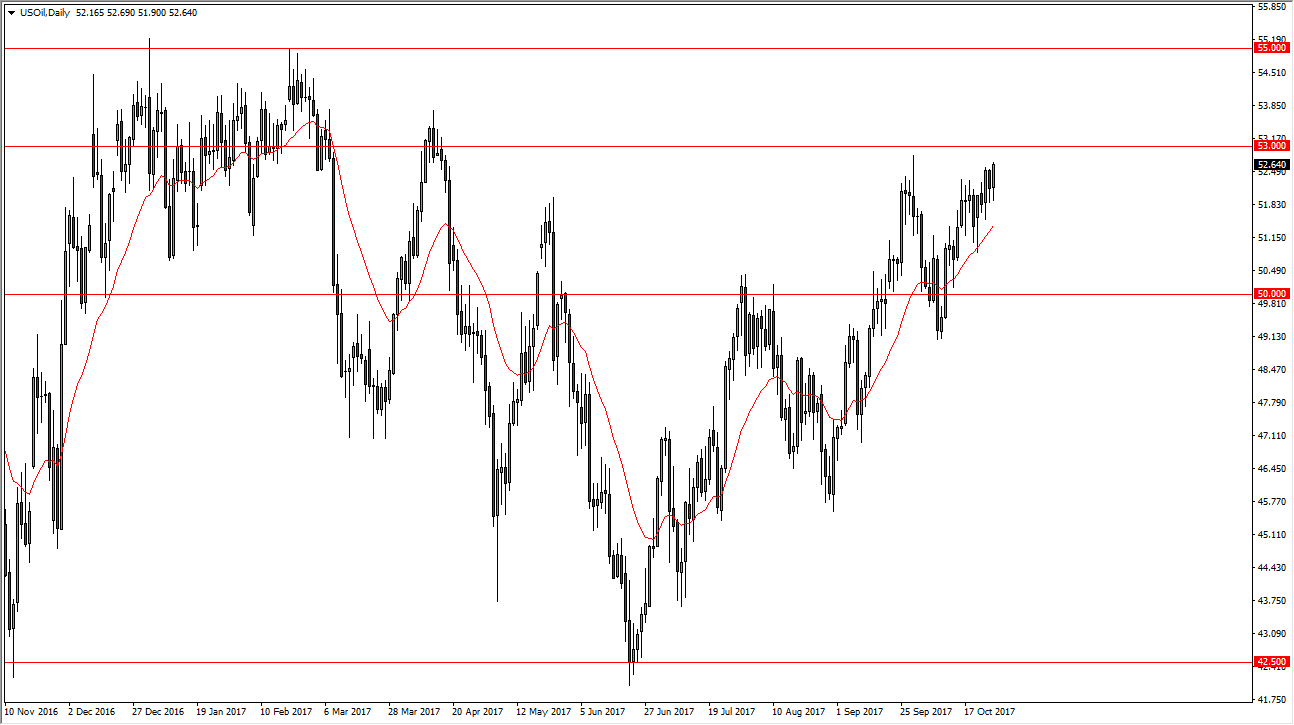

WTI Crude Oil

The WTI Crude Oil market initially fell on Thursday, but found enough support underneath to rally again. It looks as if the $53.00 level is going to offer resistance, but eventually I think we can break above there. Short-term pullbacks continue to be buying opportunities on short-term charts, but I think it’s going to take a significant amount of momentum to finally break out. I believe that once we do break above the $53 level, the market is probably going to try to reach the $55 level. This is a very noisy market, as there is a lot of confusion as to where we go next. There is consensus that OPEC will do something to cut production, but at the same time if oil starts to rally too much, the Americans flood the market with supplied. Because of this, I think you will continue to see upward pressure, but it will be tempered in general.

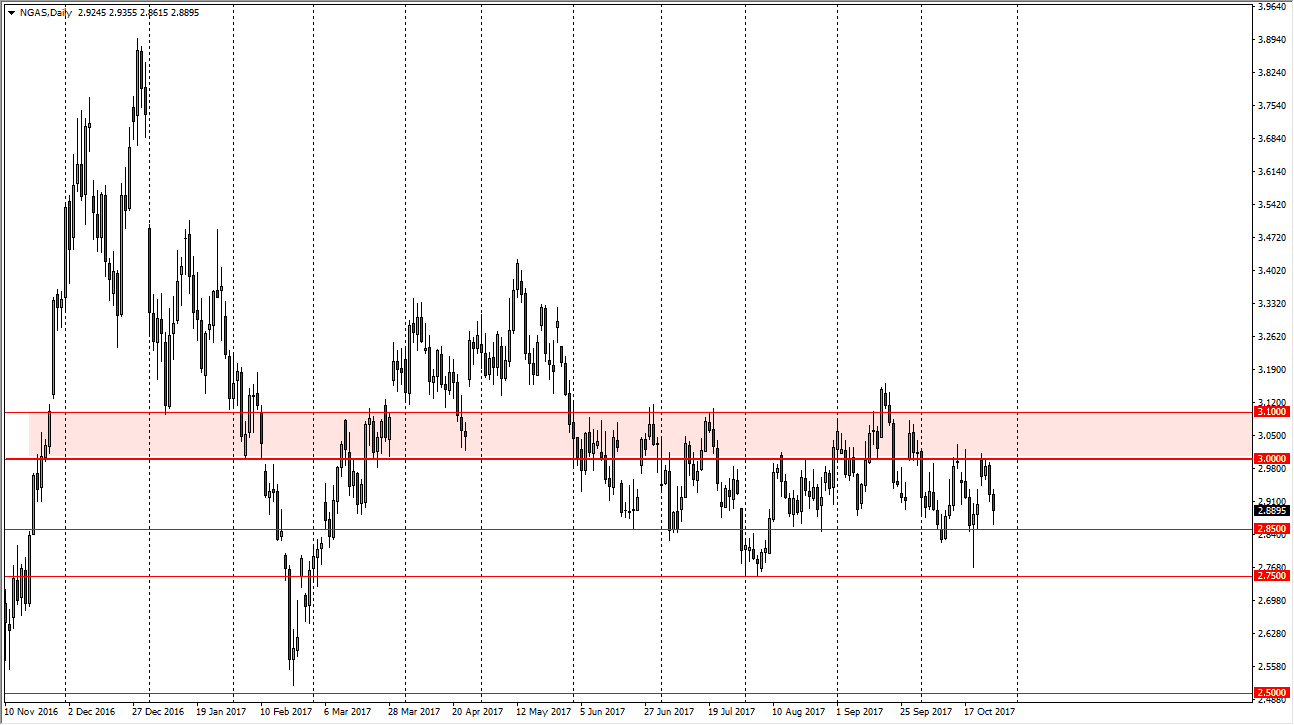

Natural Gas

The natural gas markets fell significantly during the day on Thursday, testing the $2.85 level underneath for support. We found enough support to turn things around and form a bit of a hammer. Ultimately, this is a market that’s likely to turn around and rally towards the $3.00 level above. That area has been massively resistive in the past, mainly due to the massive amount of oversupply in the market and the fact that every time we get to the $3.00 level above, US fracking company start dumping supply into the markets, as they become profitable again. I don’t know that we can break down below the $2.85 level, but if we do, I think that the $2.75 level will also be massively supportive. I am a seller on rallies.