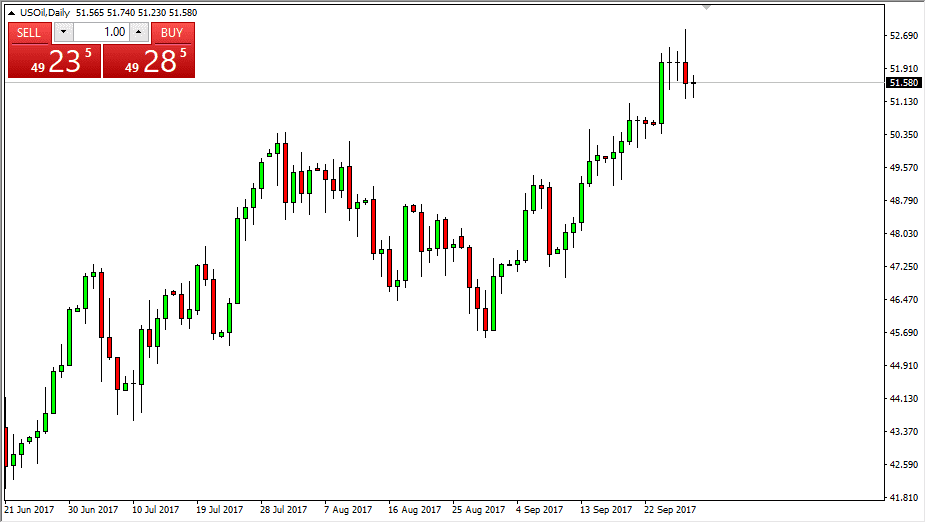

WTI Crude Oil

The WTI Crude Oil market initially pulled back on Friday, but turned around and form a hammer to show signs of resiliency. However, we have recently seen a significant selloff after the inventory announcement on Thursday. I think that the market is can we continue to be choppy in this general vicinity, with $51 offering a bit of support. I believe that there’s a bit of a “floor” near the $50 level, so I look at short-term pullbacks as potential short-term buying opportunities. I think clarity in this market is probably not coming anytime soon, as we continue to have a lot of noise. However, I suspect that the upward momentum is probably the easier direction to follow, although easy is a relative term.

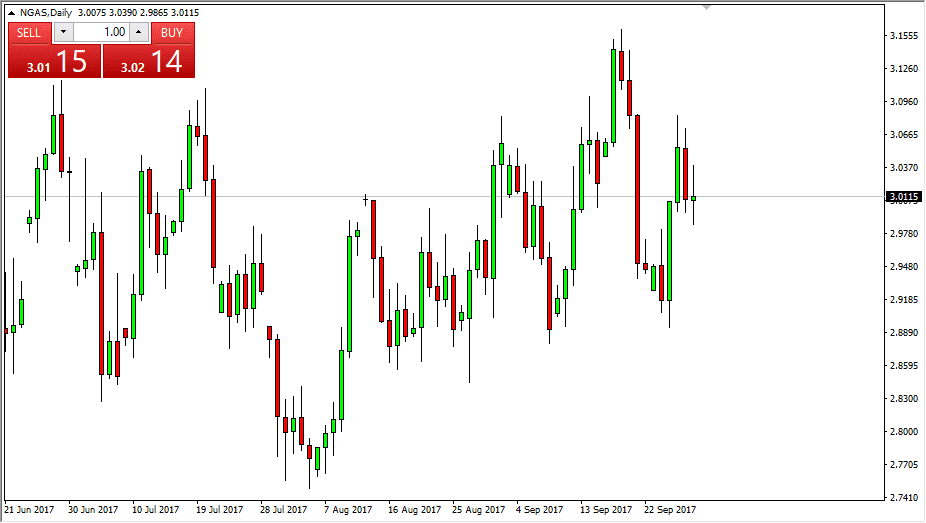

Natural Gas

Natural gas markets when back and forth during the day on Friday, essentially settling on no change. The market continues to bounce around the three dollars level, and I think this might be “fair value” currently. With this, I suspect that reversion to the mean will probably be how traders look at this market, with dips down to the $2.90 level possible, but probably attracting buyers. Meanwhile, a rally to the $3.10 level should offer enough resistance to turn things around and go looking towards the three dollars level as well. I believe that natural gas markets are stuck currently, as oversupply continues to be a major issue but we are starting to head into the time of year where demand picks up. A couple of hurricanes could not disrupt the infrastructure, so I suspect that it’s going to be difficult to sustain any longer-term rally going forward, as has been the case for several months.