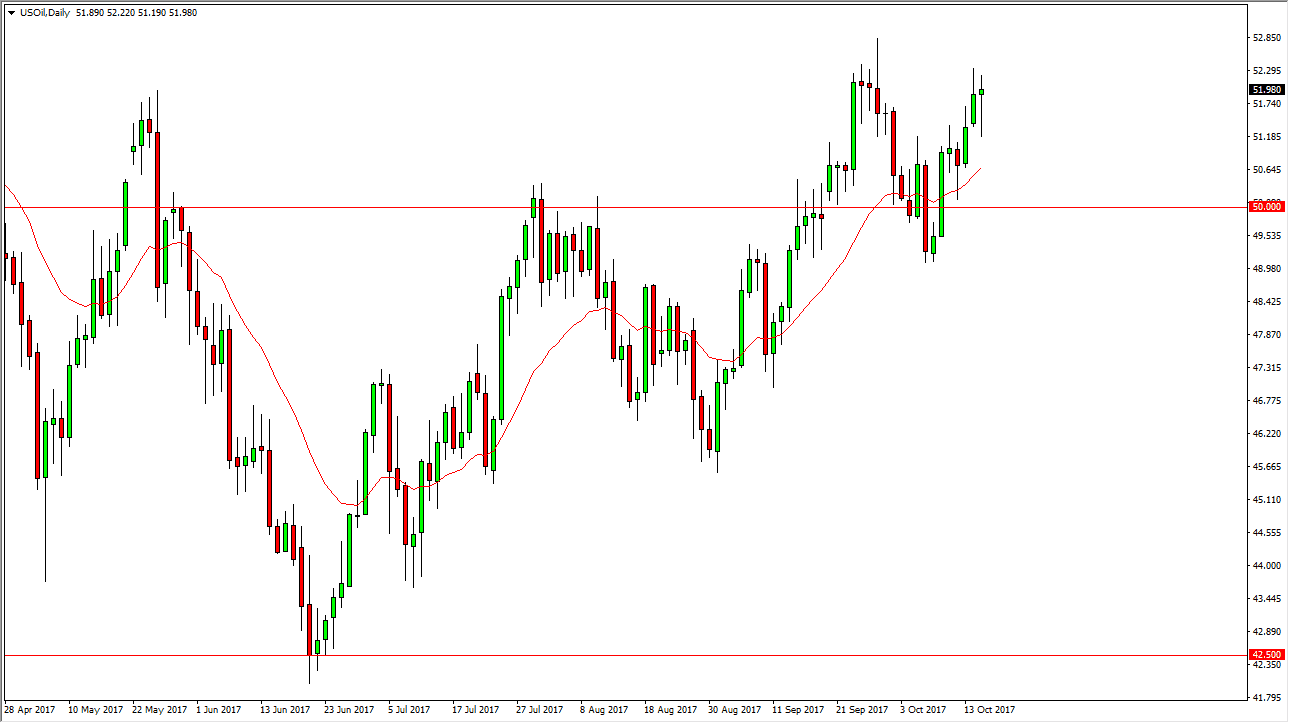

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Tuesday, reaching towards the $51 level. However, buyers came into the market later in the day, to form a hammer. The hammer suggests that we are going to go higher, and I also recognize that we have seen a bit of resistance just above. I think if we can clear the $53 level, we will eventually reach towards the $55 level above. I would be surprised if we break above there, as there is a massive oversupply of oil in the market. Yes, we are starting to see supply tighten a bit, but quite frankly, the Americans and Canadians will flood the market with supply at higher levels, as it becomes much more profitable going forward. If we were to break down below the $50 level, that would change everything and send this market much lower.

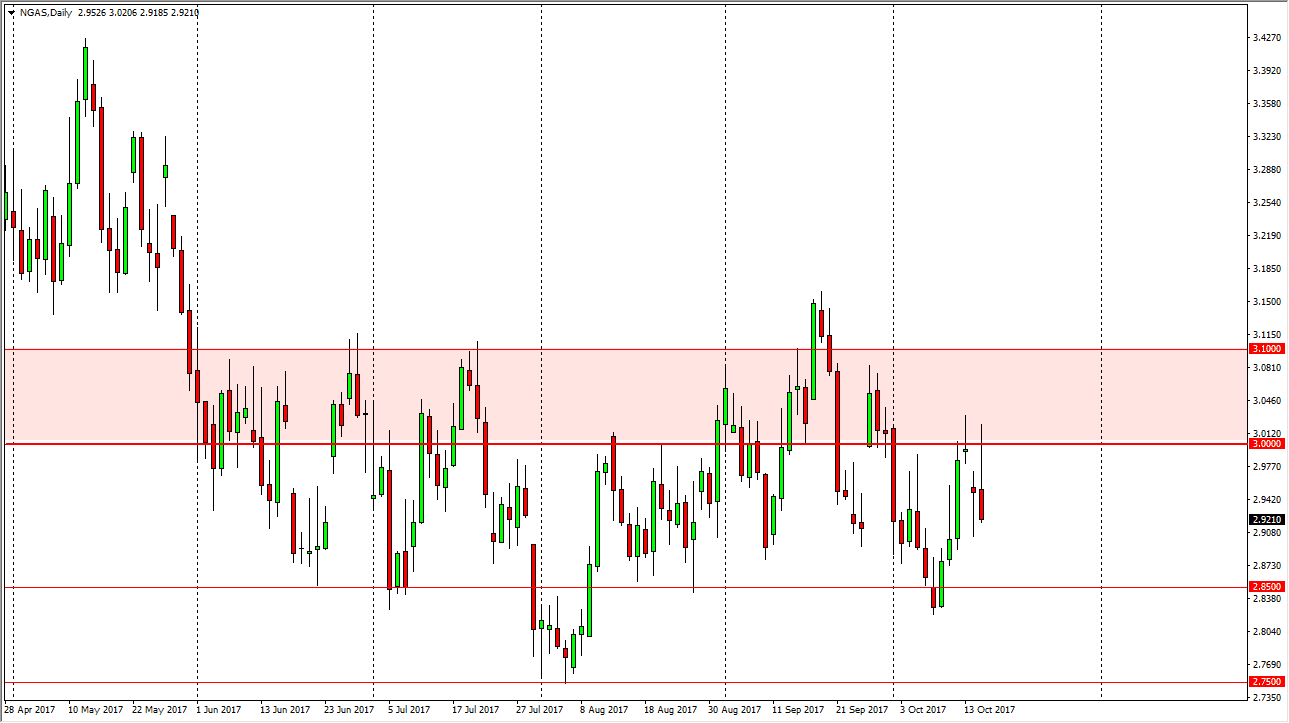

Natural Gas

The natural gas markets initially rallied significantly during the day on Tuesday, but found enough resistance above the $3 level to turn things around and break down to the $2.92 level. By doing so, we ended up forming a very ugly shooting star, and as a result I think that we are going to go looking towards the $2.85 level again. Short-term rallies continue to be selling opportunities, as the oversupply of natural gas will continue to weigh upon pricing power. I think that every time we rally, traders will be looking for exhaustion on short-term charts to get involved. I believe that if we were to break down below the $2.85 level, the market should then go to the $2.75 level next. I have no interest in buying this market anytime soon, as suppliers are willing to flood the market every time prices rise.