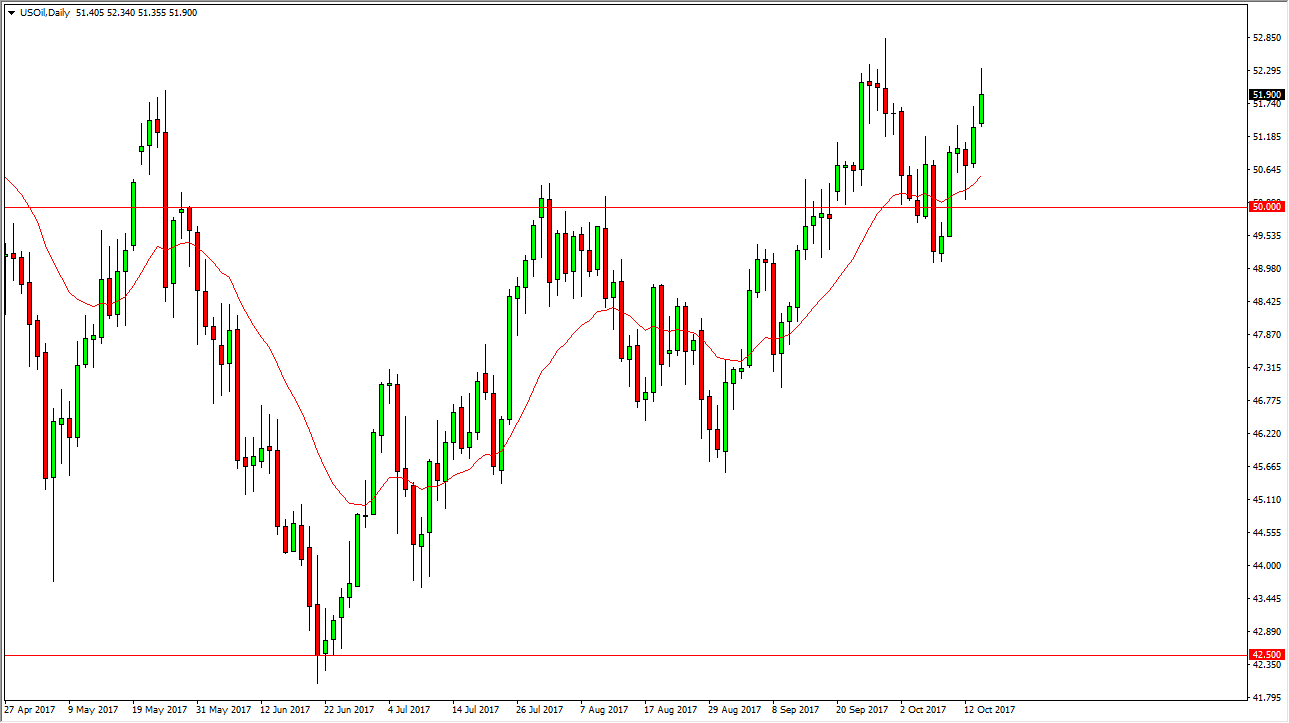

WTI Crude Oil

The WTI Crude Oil market continues to show strength, and now that the Iraqi Army has entered Kurdistan, there are a lot of concerns when it comes to the disruption of oil around the world. That being the case, we did see a bit of a rally, but I would point out the fact that we have failed to make a fresh, new high, and I think that there is more than enough resistance above to keep this market from going any higher. If we do breakout to the upside, the market will probably go looking towards the $55 level, which I think is the absolute top in the market. A pullback from here makes a lot of sense, but I think there is plenty of support down at the $50 level underneath. I think we continue to see choppiness, and therefore I’m ambivalent about trading this market.

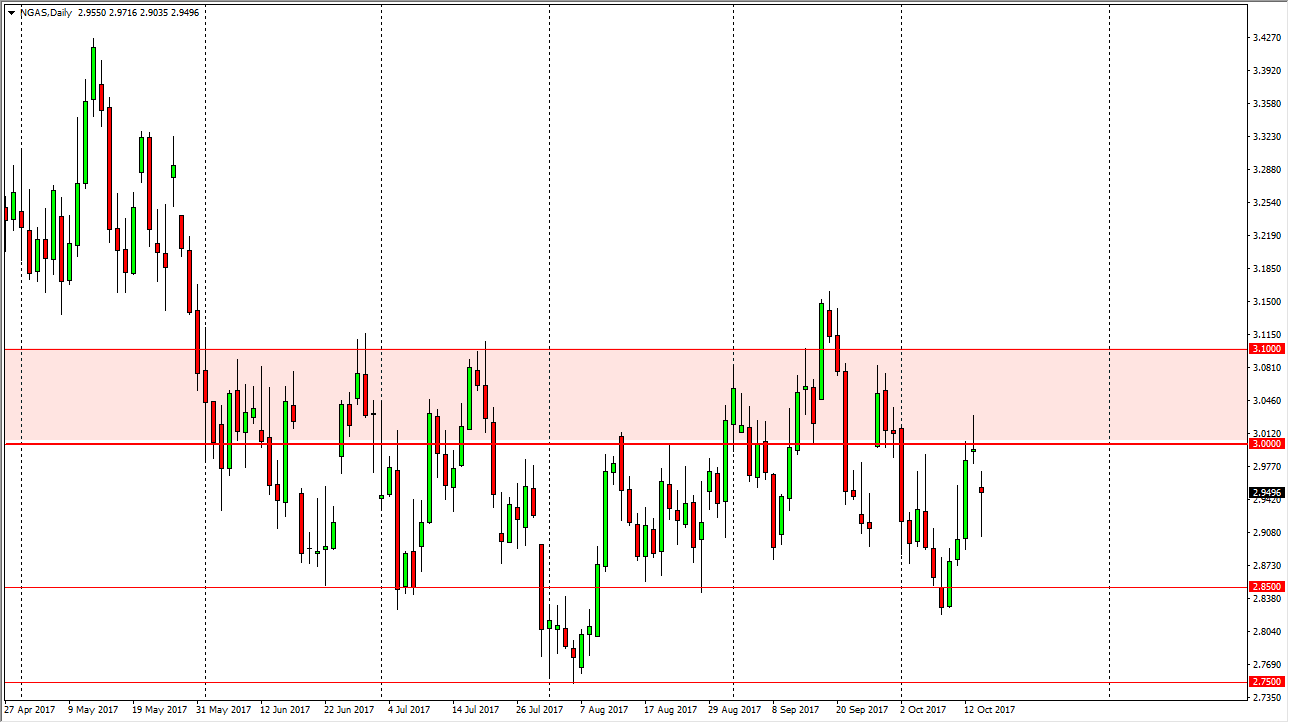

Natural Gas

Natural gas markets gapped lower at the open, broke down to the $2.90 level underneath, and then bounced. We ended up forming a massive hammer, and it now looks as if we are going to try to fill that gap. There is a lot of resistance just above, near the $3.00 level. That’s an area where I think that sellers will come back in, and on signs of exhaustion on short-term charts, I am more than willing to start selling again. I think that the market probably goes down to the $2.85 level underneath, and perhaps even lower. I have no interest in buying natural gas, we are far too oversupplied to consider doing that, and I think that the US fracking companies will continue to send massive amounts of supply into the market every time we go near the $3 handle.