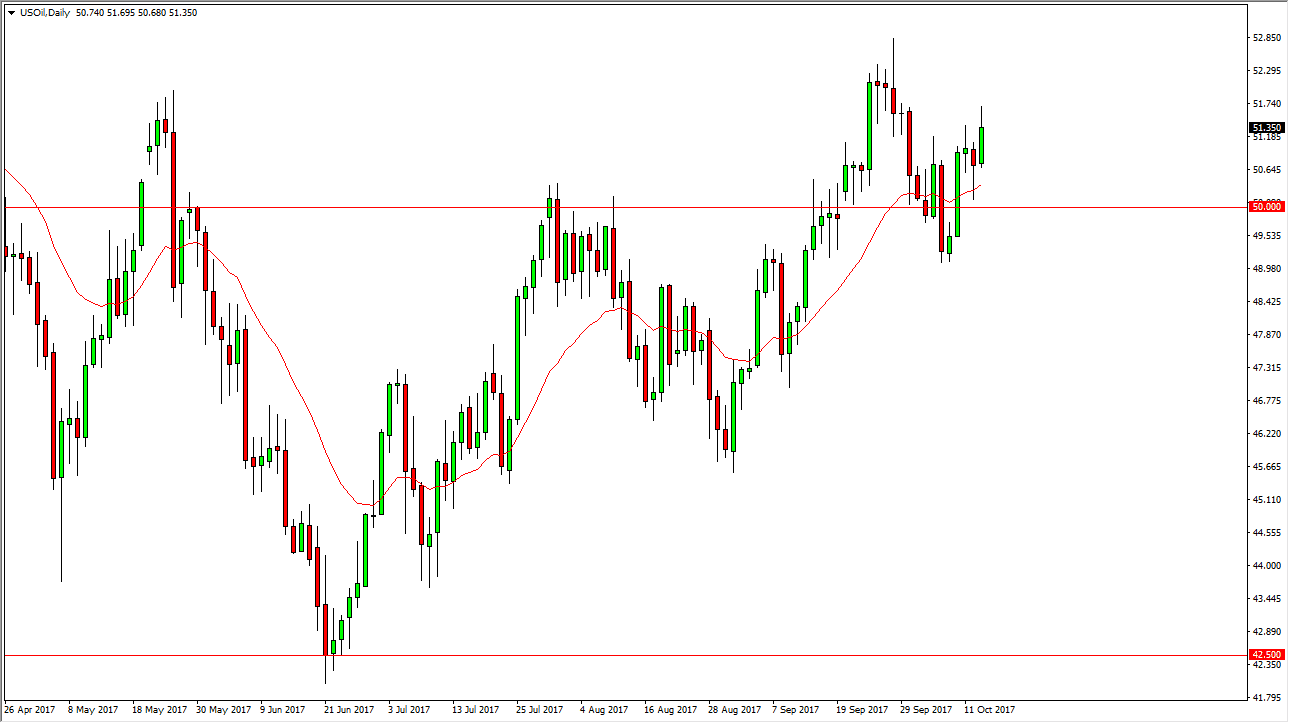

WTI Crude Oil

The WTI Crude Oil market rallied on Friday, breaking the top of the hammer that formed on Thursday, which of course bounced off the psychologically important $50 level. For me, the signals that we are ready to go higher. I think eventually we will go looking towards the $53 level, but I also recognize that this is a market that continues to see a lot of volatility. This makes sense of course, because quite frankly there are a lot of moving pieces when it comes to the oil markets. The US dollar course has its own influence, but at the same time we have Saudi Arabia and Russia suggesting that production cuts are going to be extended. As this brings pricing higher, that then makes it much more attractive for US producers to flood the market with supply. Expect a lot of choppiness with a general bullish attitude over the next couple of days.

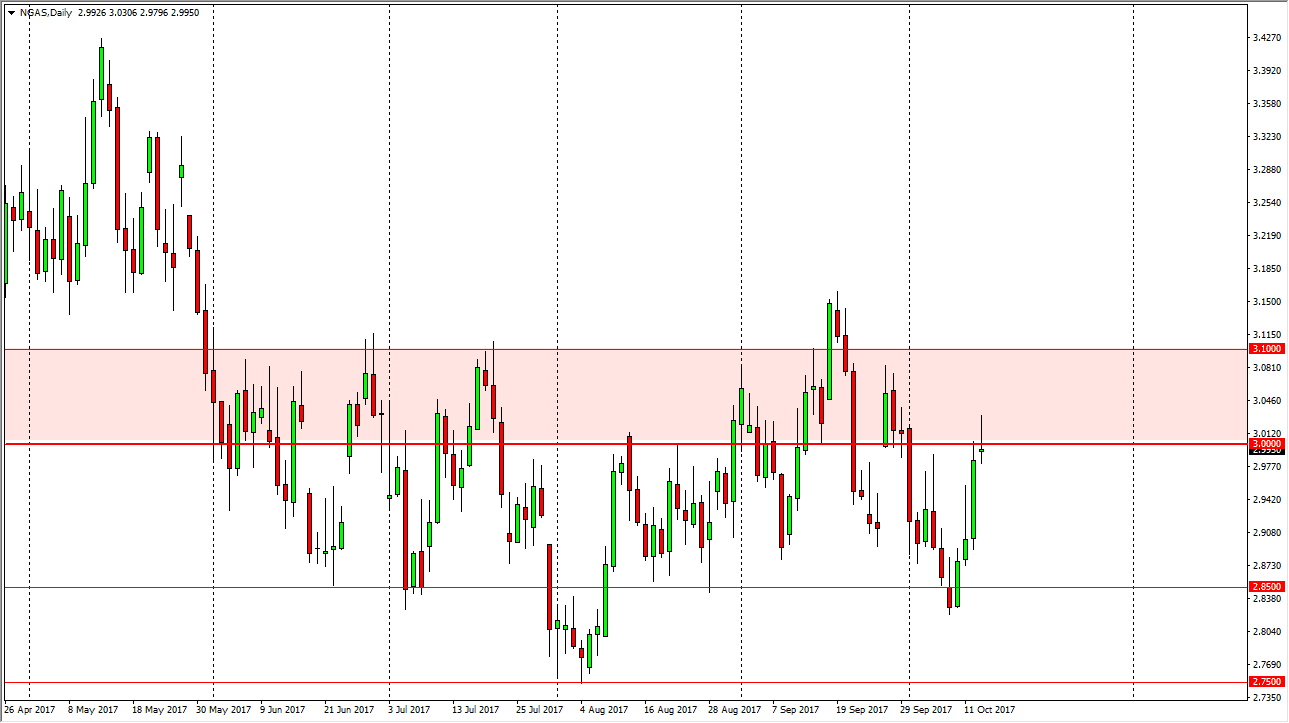

Natural Gas

Natural gas on the other hand is quite a bit different. This has been my favorite “whipping boy” for months now, and forming a shooting star at the psychologically important $3.00 level tells me that the market is going to try to roll over again. On a breakdown below the $2.90 level, I suspect that we will go looking towards the $2.85 level. The most obvious place for a stop loss is above the daily trading range, but even if we break above that level, I think that there is plenty of oversupply in the market and of course suppliers willing to dump that oversupply in the market above the $3 level to keep this market rather beaten-down. I don’t care what the temperatures are doing in the United States, the oversupply continues.