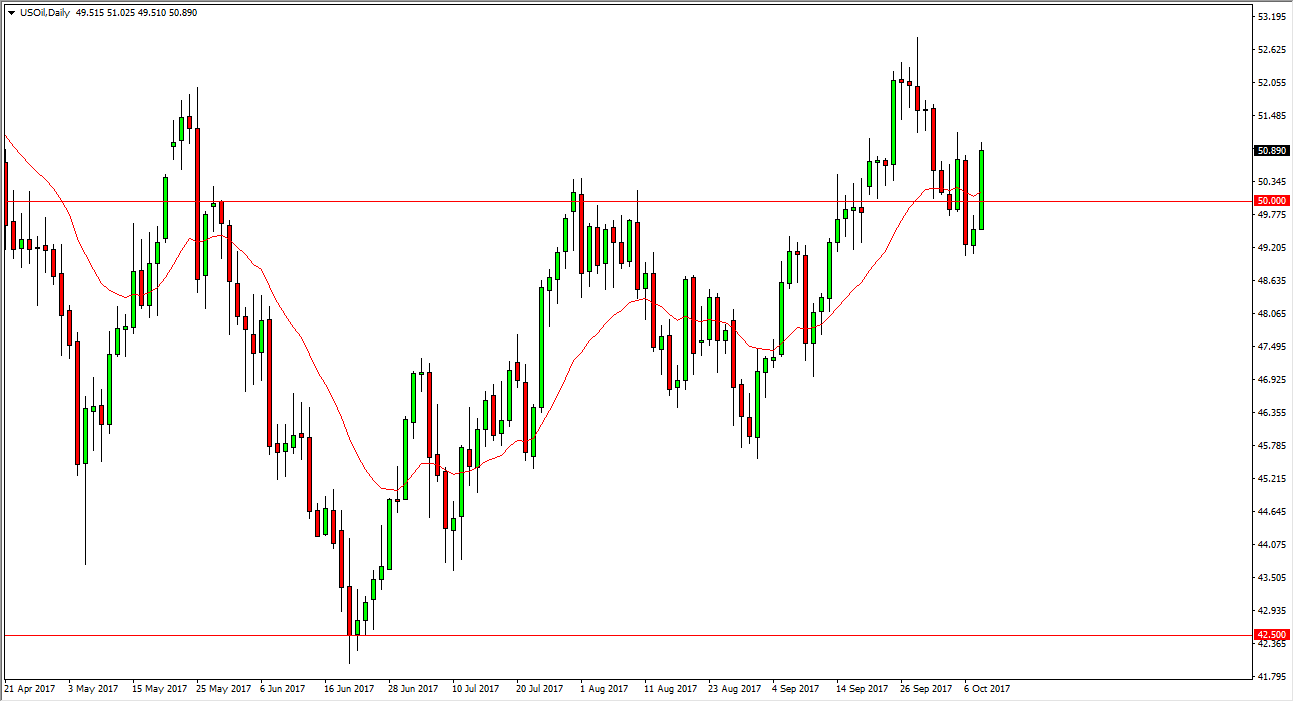

WTI Crude Oil

The WTI Crude Oil market rallied rather significantly during Tuesday’s trading session, breaking well above the $50 handle. However, we remain just below the $51 level, an area that I think will continue to be resistive. If we can break above there, then the market should go towards the $52.50 level. That’s an area where I would anticipate seeing quite a bit of resistance, and a break above there would be very bullish indeed, perhaps sending this market towards the $55 level. Alternately, if we break down below the $49 level, the market should continue to drop from here and go down to the $46 level. There is a lot of noise in this market, and I believe that we will see short-term traders go back and forth and slam around the market as oversupply continues to be an issue, just as OPEC meddling in the markets will be.

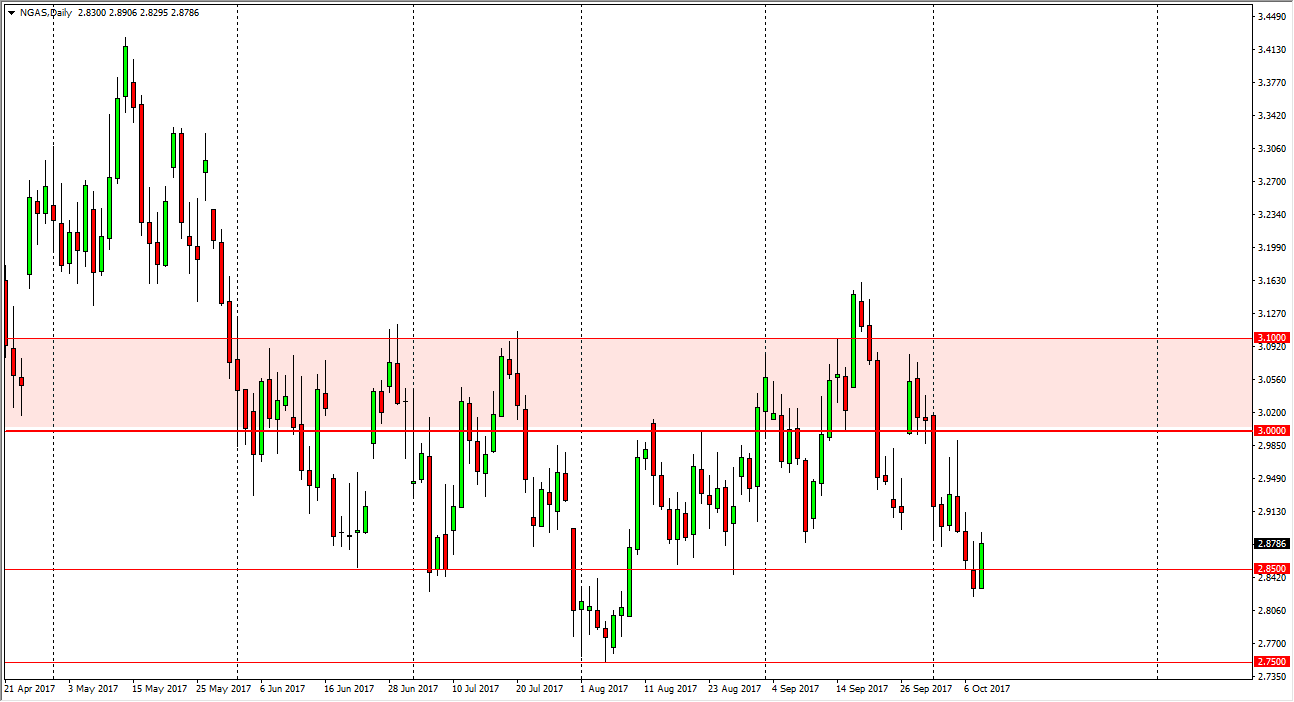

Natural Gas

Natural gas markets rallied during the day as well, reaching towards the $2.90 level. If we can break above there, I think there is plenty of resistance that extends all the way to at least the $3.10 level, and I believe that it’s only a matter of time before sellers get involved on these rallies. Signs of exhaustion should be a nice opportunity to get involved, as the oversupply of natural gas continues to be a major issue. With American natural gas producers becoming profitable above the $3 level, any rally that this market enjoys will be short-term at best. Because of this, I think that the markets will continue to see the most profitable traders sitting on the sidelines in shorting after each of these bounces. I believe that the $2.75 level underneath is the longer-term target, but it isn’t going to happen right away.