By: DailyForex

Gold prices rose $9.91 an ounce on Friday, up for the sixth straight session to $1303.29, as a softer dollar lured investors back into the market. The minutes from the U.S. Federal Reserve’s September meeting contained no big surprises. Fed members generally agree that a 0.25% December interest rate hike is warranted but they don’t have a clear consensus on the inflation outlook. The Labor Department reported its consumer price index increased 0.5% in September, slightly below expectations for a rise of 0.6%. World stock markets were mostly firmer last week. Major U.S. stock indexes ended the week at fresh records.

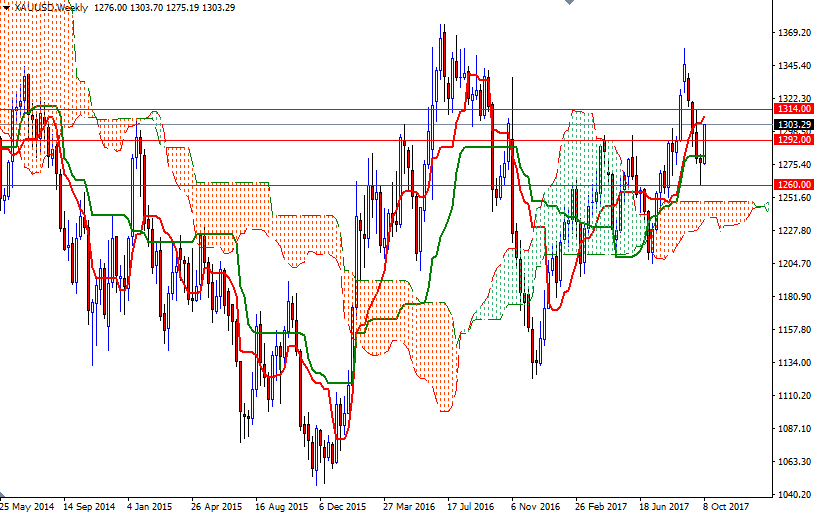

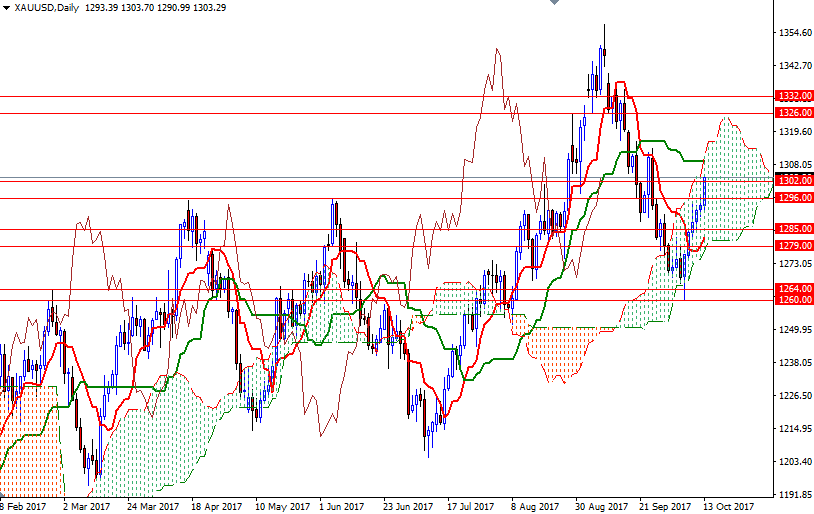

XAU/USD extended its gains after the broken 1292-1289 resistance flipped to support and pushed prices higher. Prices and the Chikou-span (closing price plotted 26 periods behind, brown line) are back above the Ichimoku cloud on the 4-hour chart. However, note that the market is still within the borders of the daily cloud and the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned.

With that in mind, it is likely the market will test 1296 (or even 1292-1289) if prices are unable to stay above 1302/0. Breaking below 1282 level could see a fall towards the 4-hourly cloud. In that case, 1285/3 and 1279/6 may be the next targets. To the upside, the initial barrier stands in 1309/7 but the bulls have to produce a daily close above 1316/4 to challenge 1320 and 1326/5. Once beyond there the bulls will be aiming for 1335/2.