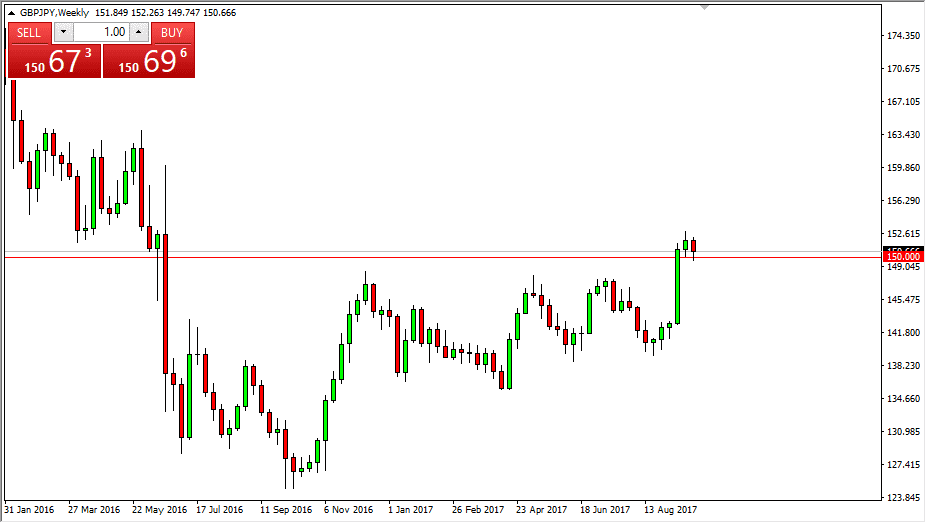

GBP/JPY

The British pound fell against the Japanese yen during the bulk of the week, but has found the 150 level to be supportive. I think that the support runs down to the 148.50 level, so I’m not interested in selling this market, and believe that the buyers will return sometime this week.

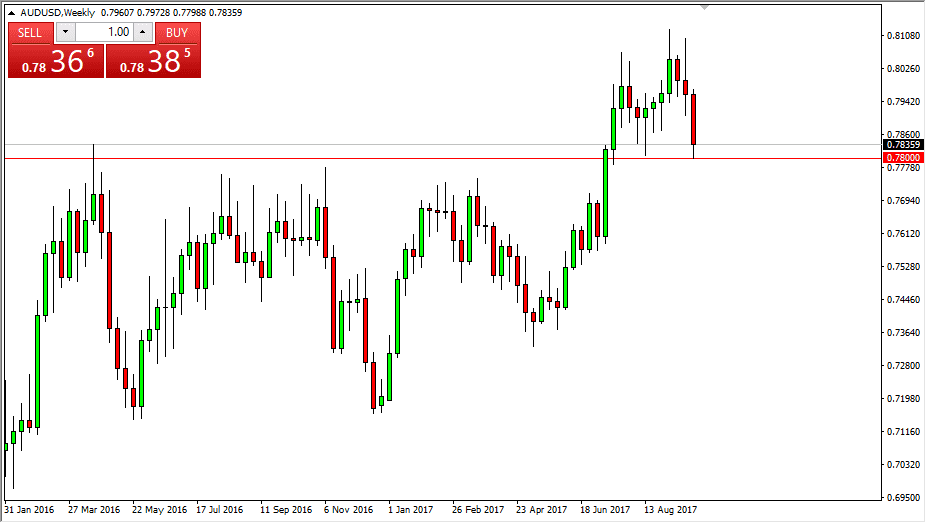

AUD/USD

The Australian dollar had a rough week, slamming into the 0.78 handle. However, this is the beginning of rather significant support that extends down to the 0.7750 level. Because of this, I expect that the buyers will probably return this week, and push back towards the 0.0 level, however I do not expect it to be broken right away.

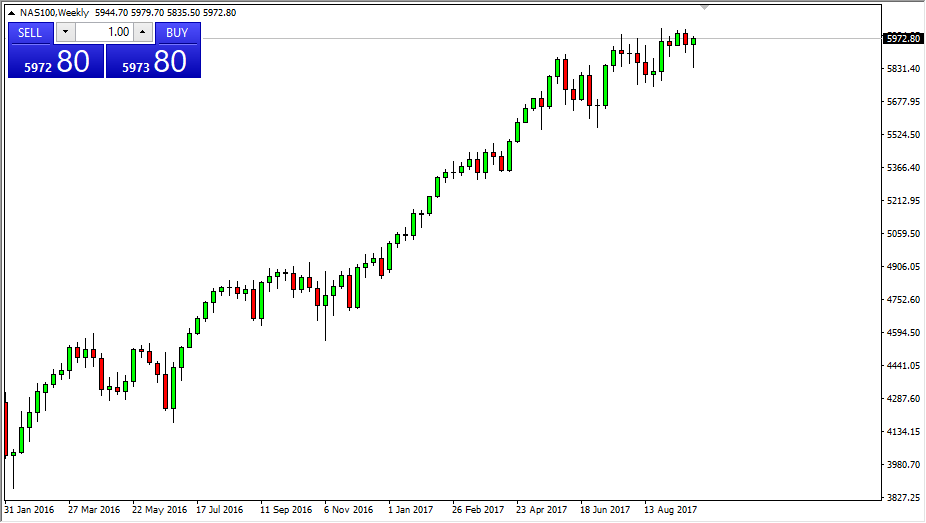

NASDAQ 100

The NASDAQ fell during the bulk of the week but turned around and form a nice-looking hammer, and suggests that we are going to continue to go higher. Because of this, I think this continues to be a “buy on the dips” market. I also believe that the 5800 level is now going to offer a bit of a “floor” in the market, and that we could probably go to the 6100 level rather quickly.

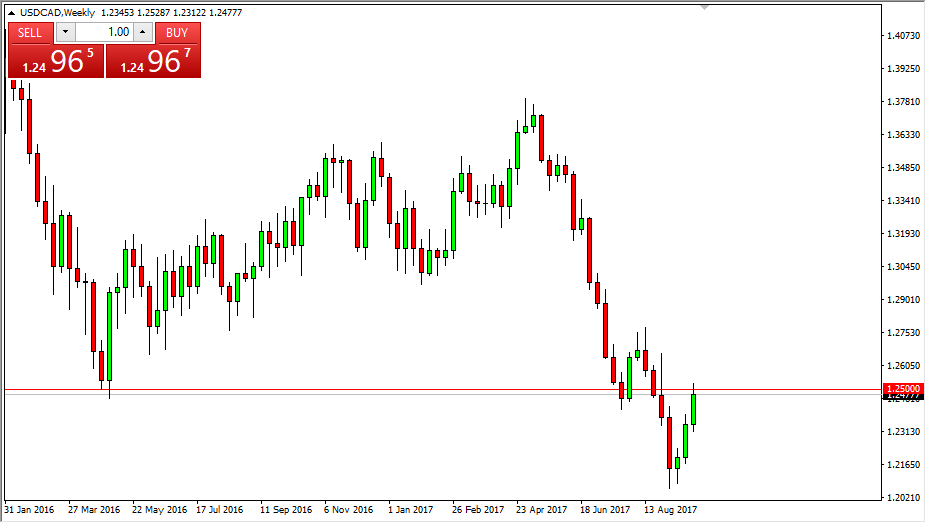

USD/CAD

The USD/CAD pair rallied again during the previous week, testing the 1.25 handle, however this is a number that should have a certain amount psychological resistance attached to it, and we are essentially in the same neighborhood of the previous uptrend line on the weekly chart. With that in mind, and the fact that we have sold also drastically, I would not be surprised at all to see this market roll over and start falling again. If it does, I anticipate a move towards the 1.22 level next. Alternately, if we can break above the 1.26 handle, I think the market goes much higher as it shows resiliency by doing so.