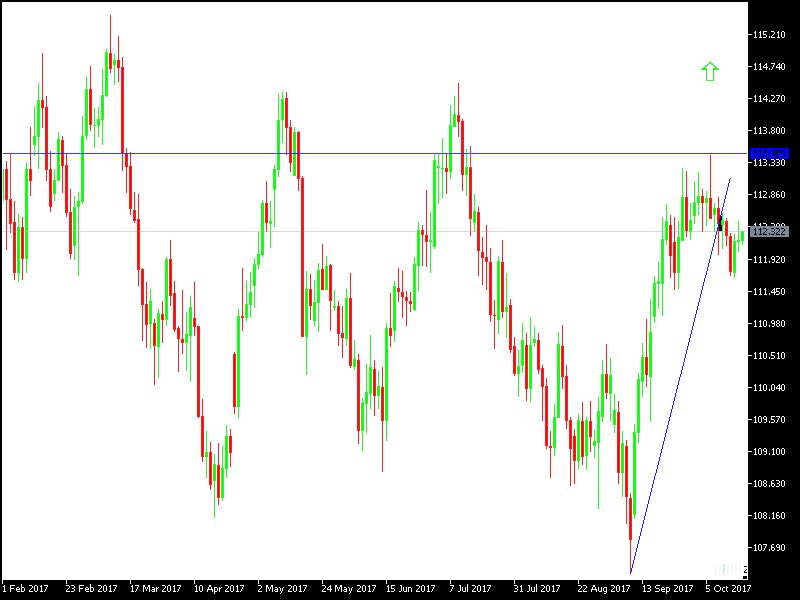

Since the USD/JPY lost the peak of 113.43, the bearish pressure increased on the pair, and remained stable for two weeks in tight ranges between 111.65 and 112.50, waiting for new catalysts to move in any direction. The pair will be leaning to drop in case it is stable below 112, and the other way around if it is above 114. USD/JPY is trying to avoid breaking below 112 to avoid bearish pressure towards lower levels. The pair faced bearish movement at the beginning of this week supported by the pressure on the USD due to weak inflation data. This is along the renewed geopolitical fears, with imminent missile tests from North Korea and continues US threats of stronger sanctions or even a limited military action. Expectations are less confident of higher interest rates in December after weaker than expected inflation data, which still supports higher rates.

The minutes of last Fed meeting showed a split among the Fed members regarding the path of higher interest rates in light of the current inflation data, which increased the pressure on the USD, and the dollar index went down to 92.82 DXY, before bouncing up to 93.52 today. In addition to what was mentioned in the minutes, the pair was under large bearish pressure with the announcement of weak job data from the US, which pushed the pair down again. Destructive hurricanes which hit the US had negative effects on the results, the job creation data retreated for the first time in 7 years, but had positive information about wage average which were higher than expected. The USD strength is still supported by the Trump administration tax plan, which the market has been waiting for since the elections.

Technically: If the pair managed to move upward through 112, then it will have strong bullish momentum to move to higher levels like 113, 113.75 and 114.20. On the bearish side, the nearest support levels are currently at 111.60, 111.00 and 110.00, and the latest threatens the pair’s bullish move.

On the economic data front: Economic agenda for today has no important Japanese data. As for the US, there will be a release of the housing data and comments from Fed members. The pair will closely monitor the renewed global geopolitical fears with North Korean issue on the stage again, as well as anything to do with Trump’s policies.