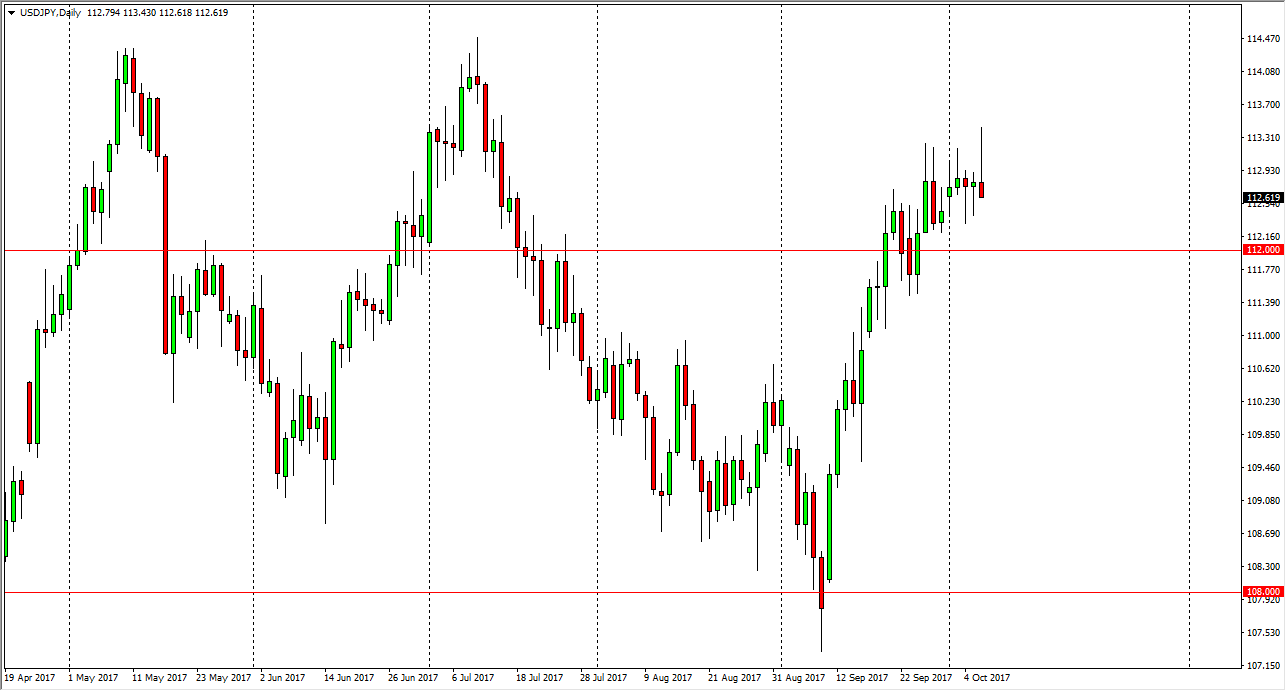

USD/JPY

The US dollar initially rallied against the Japanese yen on Friday, but turned right back around as we reached towards the 113.50 level. By forming the massive shooting star, looks like we may get a little bit of a pullback but quite frankly that’s probably going to be rather healthy as we have gone straight up for some time. More noise coming out of North Korea continues to make the markets a bit tentative, but I believe this pullback will end up being a buying opportunity. Because of this, I am not willing to sell this market, and I think it’s only a matter of time before the buyers get involved, with the 112-level looking rather supportive. I would not be concerned about the uptrend until we break below the 111 level. Longer-term, we are reaching towards the top of consolidation, which is the 114.50 level.

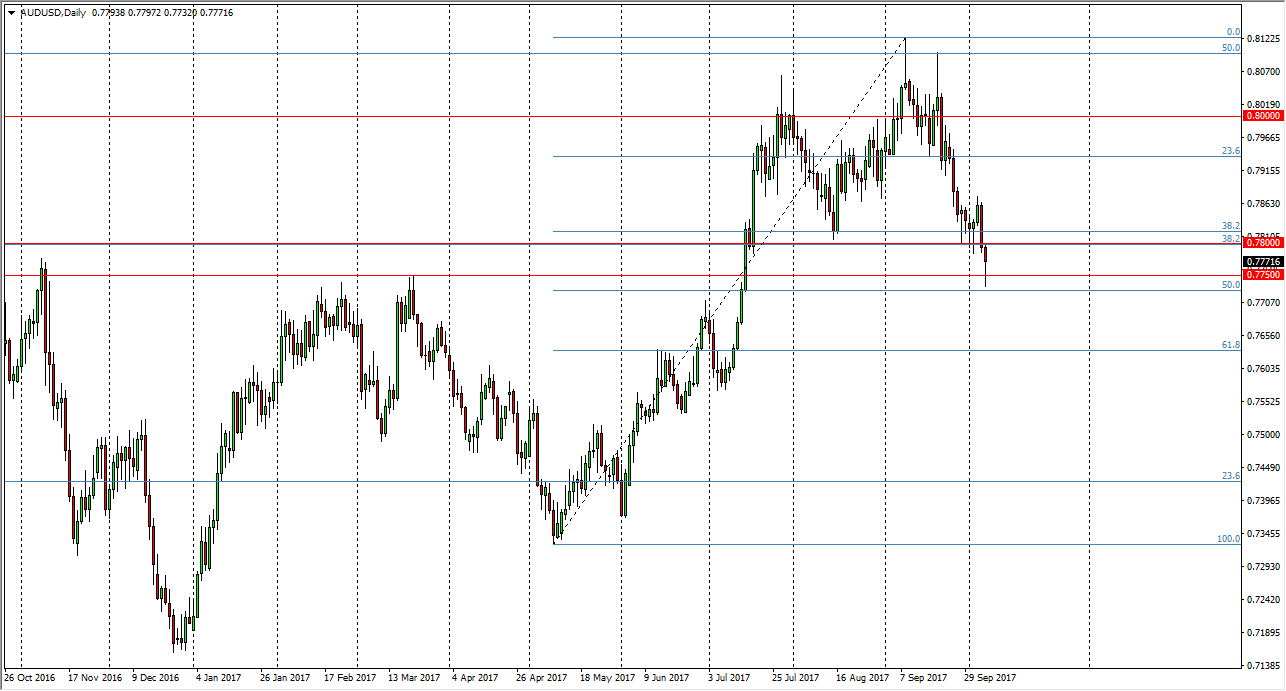

AUD/USD

The Australian dollar initially broke down during the session on Friday, and even broke below the vinyl 0.7750 handle. However, by the time the market close, we ended up forming a massive hammer based upon the 50% Fibonacci retracement level which is just below that handle. By forming a hammer, looks as if the market is going to try to rally, and if we can break above the 0.78 level, that is a classic technical analysis signal to start buying. Because of this, above that level I’m more than willing to start going long, as I believe the market will go looking towards the 0.80 level again. A breakdown below the bottom of the range for Friday would be very bearish, having this market looking for the 0.7650 level underneath, or the 61.8% Fibonacci retracement level which is at roughly the same place.