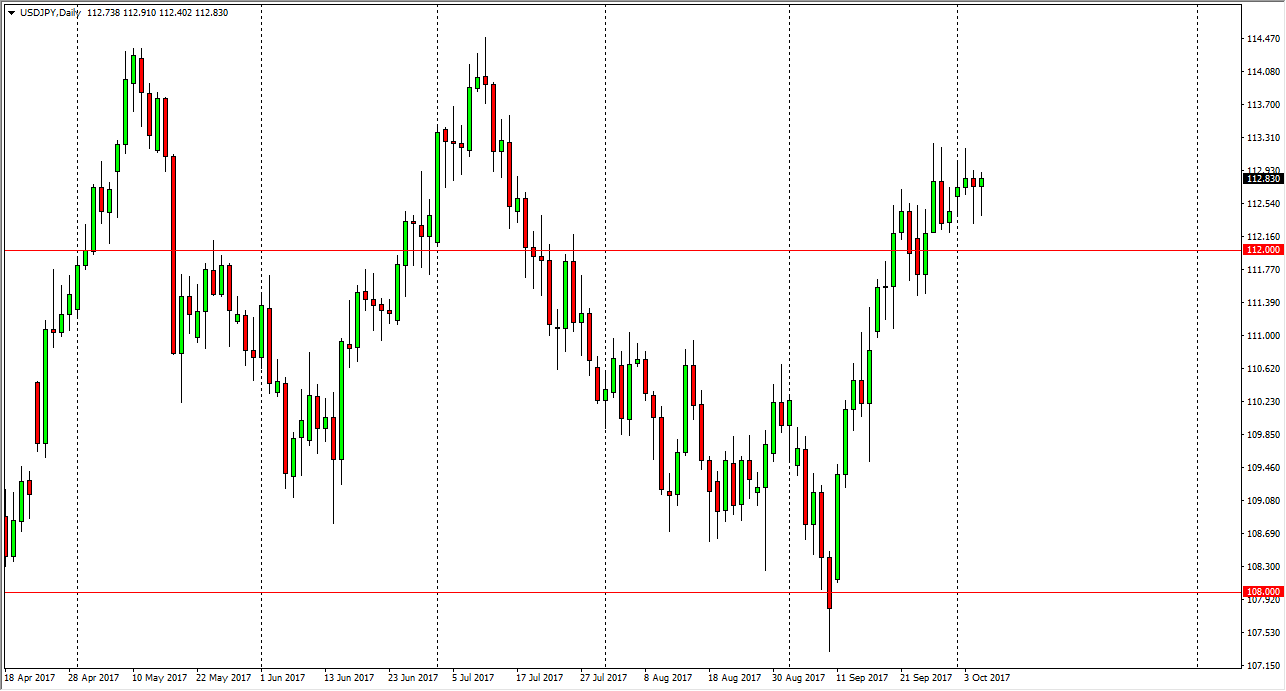

USD/JPY

The US dollar initially fell against the Japanese yen during the day on Thursday, but turned around to form a hammer. The hammer from Thursday was preceded by the hammer from Wednesday, and it looks likely that we will continue to go higher. The 112-level underneath should offer support, and I think we should then get to the 114.50 level after that. A break above there should send this market well above the 115 handle, as it would be a breakout of the larger consolidation area that we have been in for some time. Keep in mind that the market is heavily influenced by risk appetite in general, so you should pay attention to the stock markets as well. If they rise, it’s likely that the market will continue to go much higher.

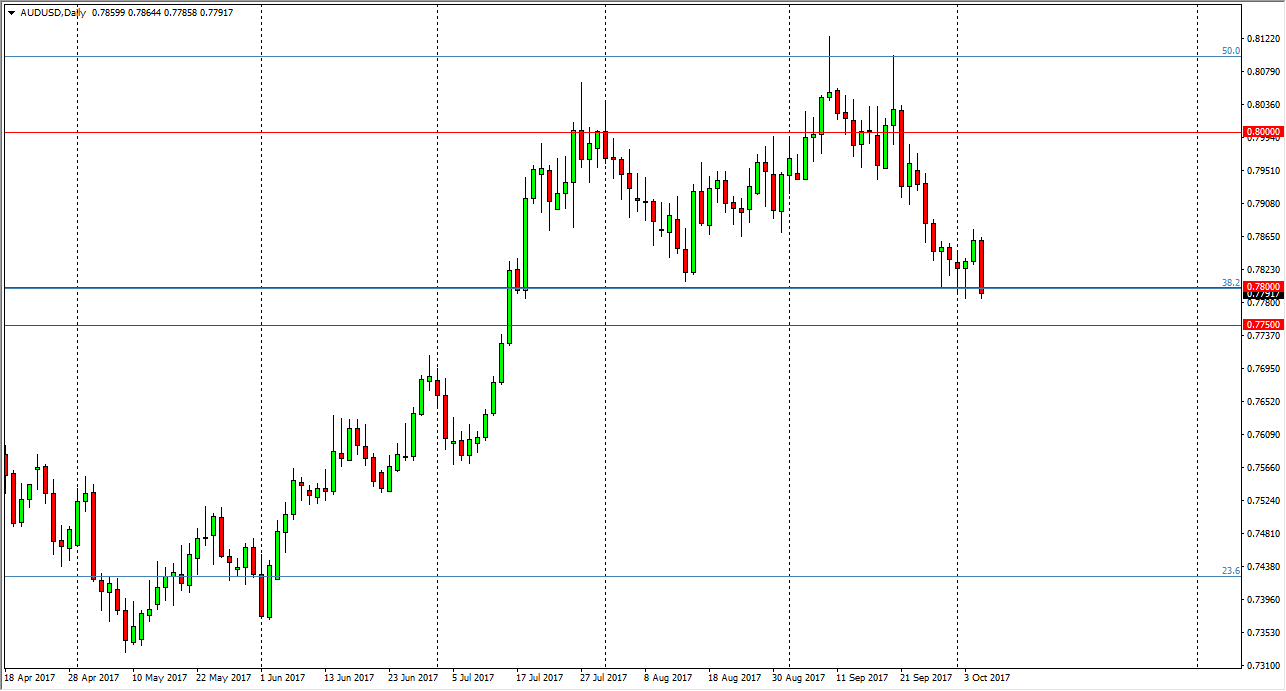

AUD/USD

The Australian dollar fell significantly during the day on Thursday, breaking below the 0.78 level. I think that there is a significant amount of support at the 0.7750 level, and if we break down below there I think the market falls apart. This candle was very negative looking, and I believe that the gold markets are dragging it down. If we can turn around and break to the upside, then I think the market goes to the 0.80 level after that. There is a massive amount of resistance near the 0.81 level, so if we were to somehow break above there, the market would become a “buy-and-hold” scenario. However, after seeing the breakdown during the session on Thursday, I am a bit concerned about the uptrend, and a move below the 0.7750 level should send this market down to at least the 0.76 level, if not the 0.75 level after that. If we did breakdown, it could be rather quick.