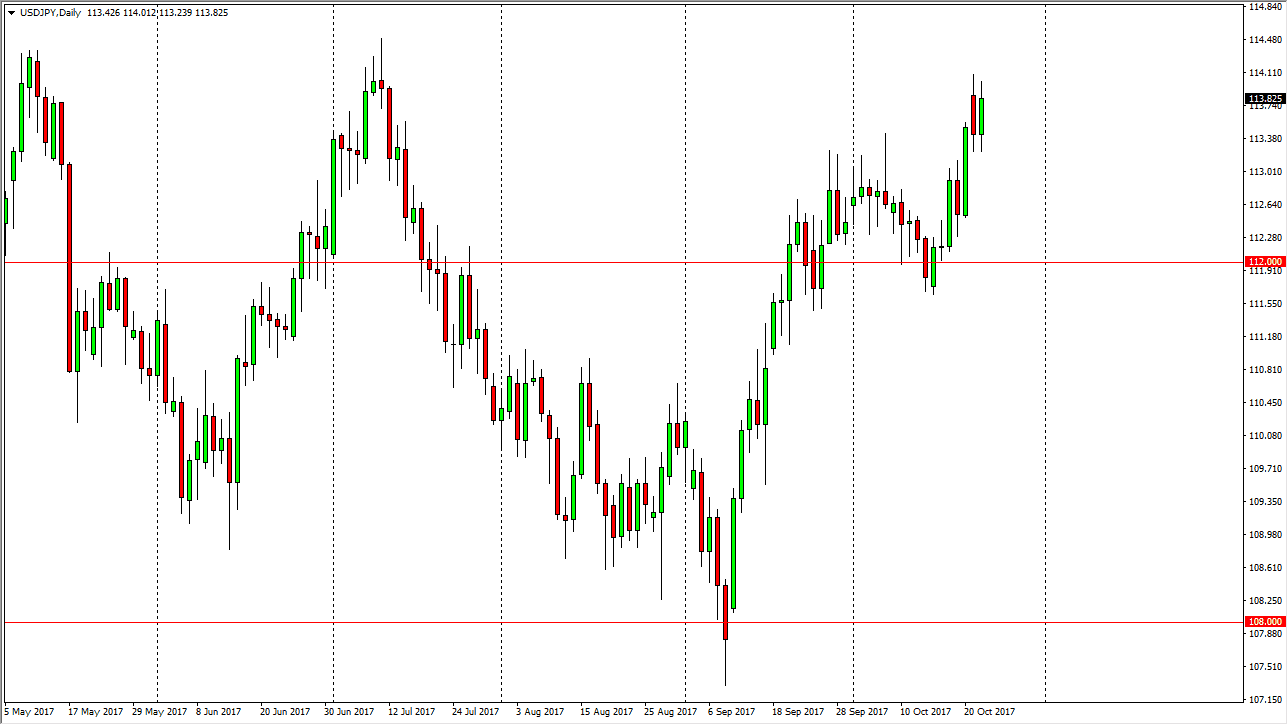

USD/JPY

The US dollar rallied against the Japanese yen on Tuesday, as we gained most of the losses from the previous session. It looks as if the 114 level is going to offer resistance, but I think if we can break above there we will then find even more resistance at the 114.50 level above. That extends to the 115 level beyond that, and is not until there that the longer-term traders will be able to hang on for the longer-term move. I believe at that point, you almost must get aggressive, as we should see a sudden burst of cash into the market. Ultimately, I think that’s what happens, but I would not be surprised at all to see short-term pullbacks with the 112-level offering support. Because of this, I’m a buyer of dips.

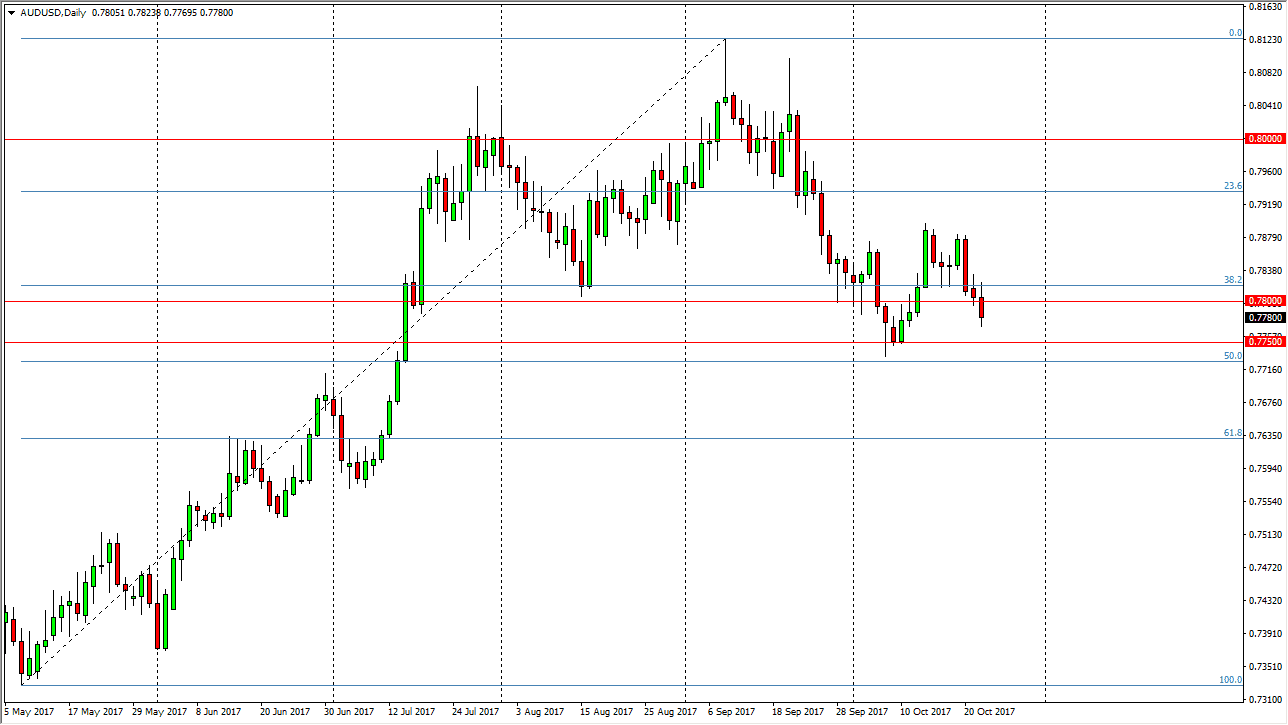

AUD/USD

The Australian dollar initially tried to rally, but as you can see failed to keep the gains. As we have now broken below the 0.78 level, I think that we are going to go looking for the 0.7750 level for support. If we can break down below there, the market probably continues to breakdown rather significantly. Alternately, if we can break above the 0.78 level again, that should be a nice buying opportunity, and give us an opportunity to ride the uptrend towards the 0.80 level which of course has been psychologically and structurally significant for decades. Gold markets might have an influence as per usual, just as the US dollar gaining has worked against the Aussie. Ultimately, this is a market that needs to make a significant decision rather soon, so I believe that in the next few days clarity should be coming to this pair, and all we will have to do is follow it.