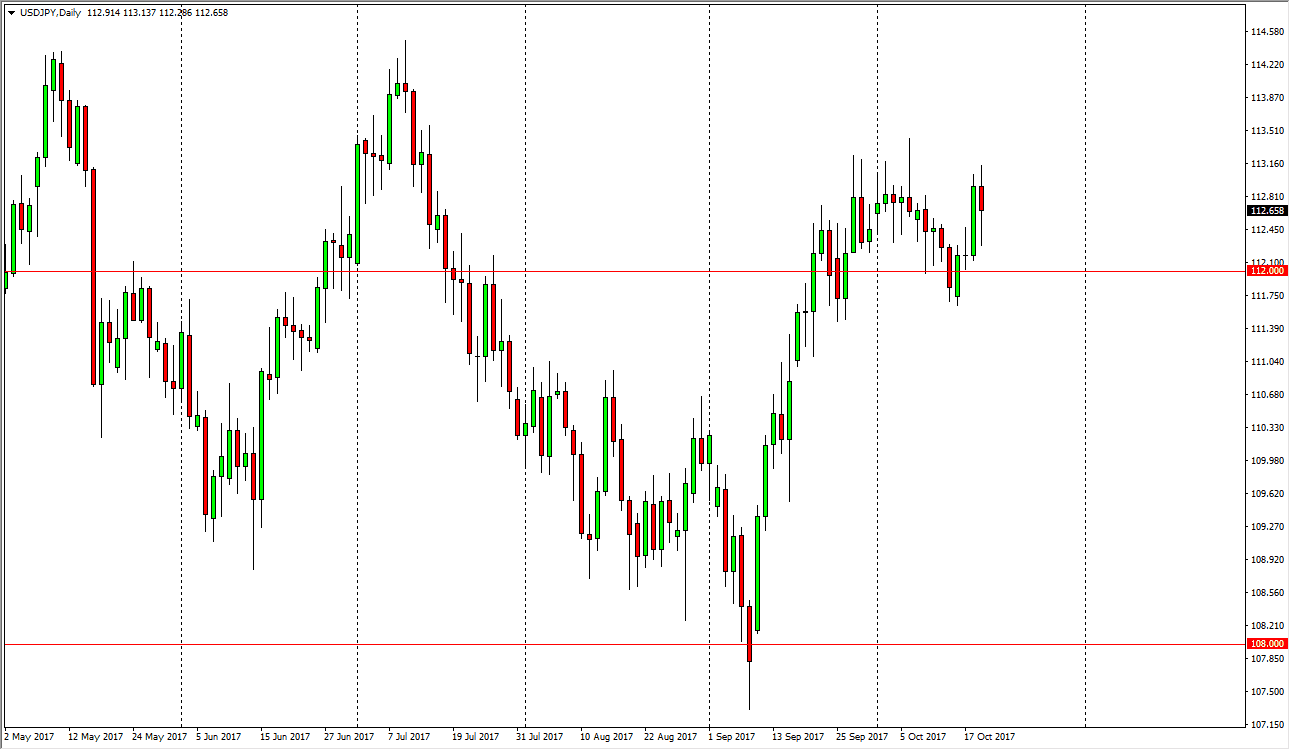

USD/JPY

The US dollar fell significantly during the session on Thursday, reaching towards the 112 level. This level offered enough support to turn things around to form a hammer though, so it looks as if the market is going to continue to be volatile, yet supported underneath. Keep in mind that the overall risk appetite of the global markets tends to have an effect on the USD/JPY pair, and therefore it’s likely that if stock markets rally, this pair should do the same. If we can break above the 113.50 level, then I think we go to the 114.50 level above. Ultimately, I think that pullbacks offer value, up to and including the 111-level underneath. Because of this, I believe that the market should continue to offer buying opportunities going forward, and eventually will break above the 115 handle above, offering a “buy-and-hold” situation.

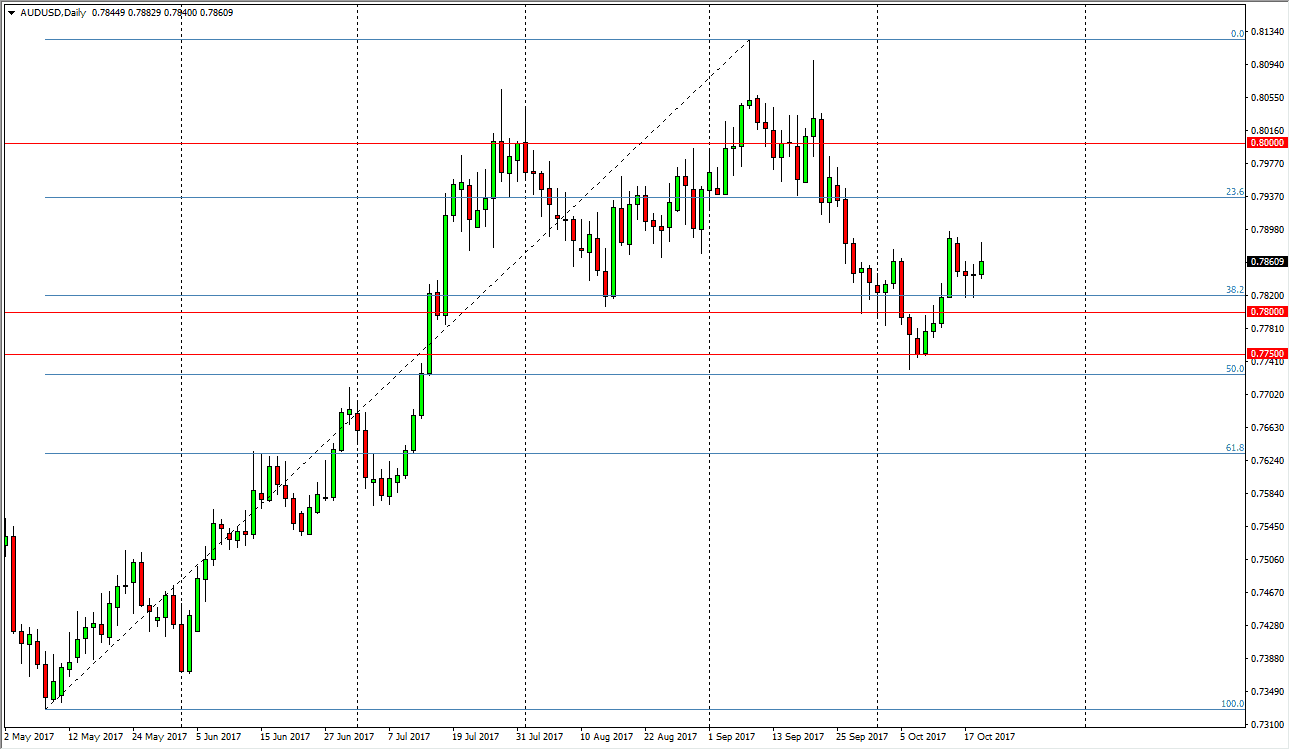

AUD/USD

The Australian dollar rallied during the session on Thursday, reaching towards the highs from last week. However, we pulled back, showing signs of hesitation. I think that the market continues to find support at the 0.78 level though, so I’m still a buyer. I think that the shooting star that we formed for the day being preceded by the couple of hammers tells me that the market is a bit confused at the moment. However, I think that given enough time we will find plenty of buyers underneath. Ultimately, I think that if the market breaks above the top of the range from last week, the market then goes looking for the 0.80 level above. Because of this, I am a buyer of dips, and I realize that if we get any help at all from the gold market, the Aussie will continue to go much higher.