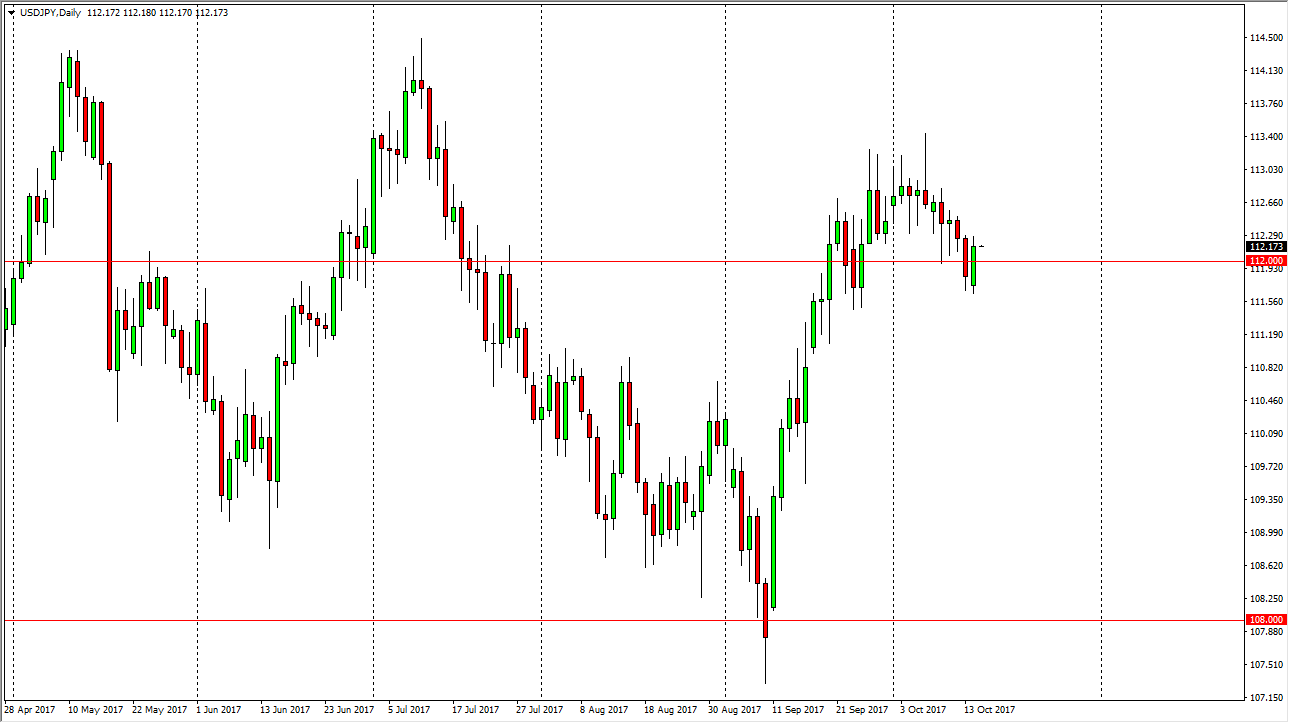

USD/JPY

The US dollar fell against the Japanese yen initially at the open on Monday, but then found enough footing to break above the 112 level. I believe that the market is trying to consolidate around this area so that we can continue to the upside, especially with the interest rates rising in the United States. I think that we will continue to see a significant amount of noise in this area, but given enough time we should go looking towards the 114.50 level above which is the top of the longer-term consolidation. It we do break down from here, I suspect that the 111-handle underneath will offer plenty of support, so either way am not interested in selling this market, but I do recognize that is going to be rather choppy in the short term.

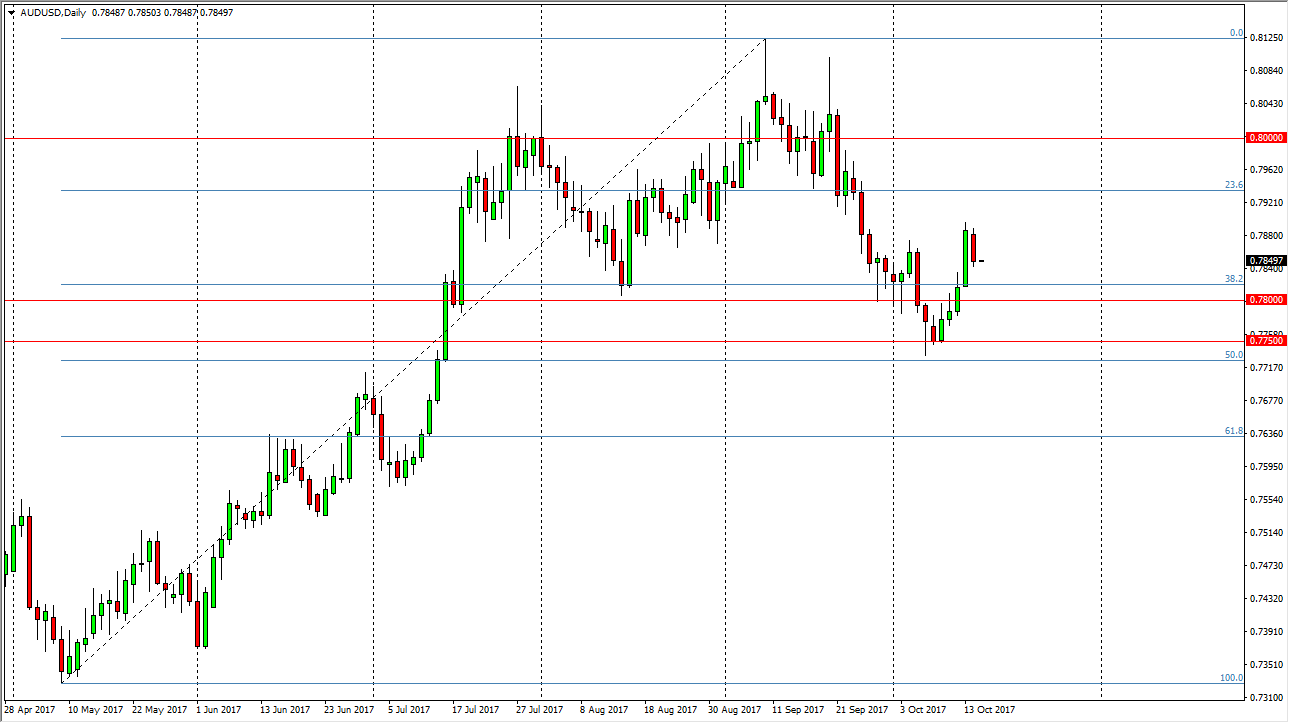

AUD/USD

On a day where gold fell below the $1300 level again, the Australian dollar sold off. That’s not a huge surprise, because quite frankly the 2 are highly correlated. However, I think there’s plenty of support below and I think that given enough time, the buyers will return. I look for the 0.78 level underneath to be massively supportive, and I do not think that the market is going to break down below there, but even if it did there is support extending down to at least the 0.7750 level. If gold starts to rally again, the Aussie will as well. I still think that the market is going to go looking towards the 0.0 level above, which has been the beginning of massive resistance. However, I think that once we break cleanly out of that area, we could continue to go towards the 0.90 level and then possibly even parity over the next several months.