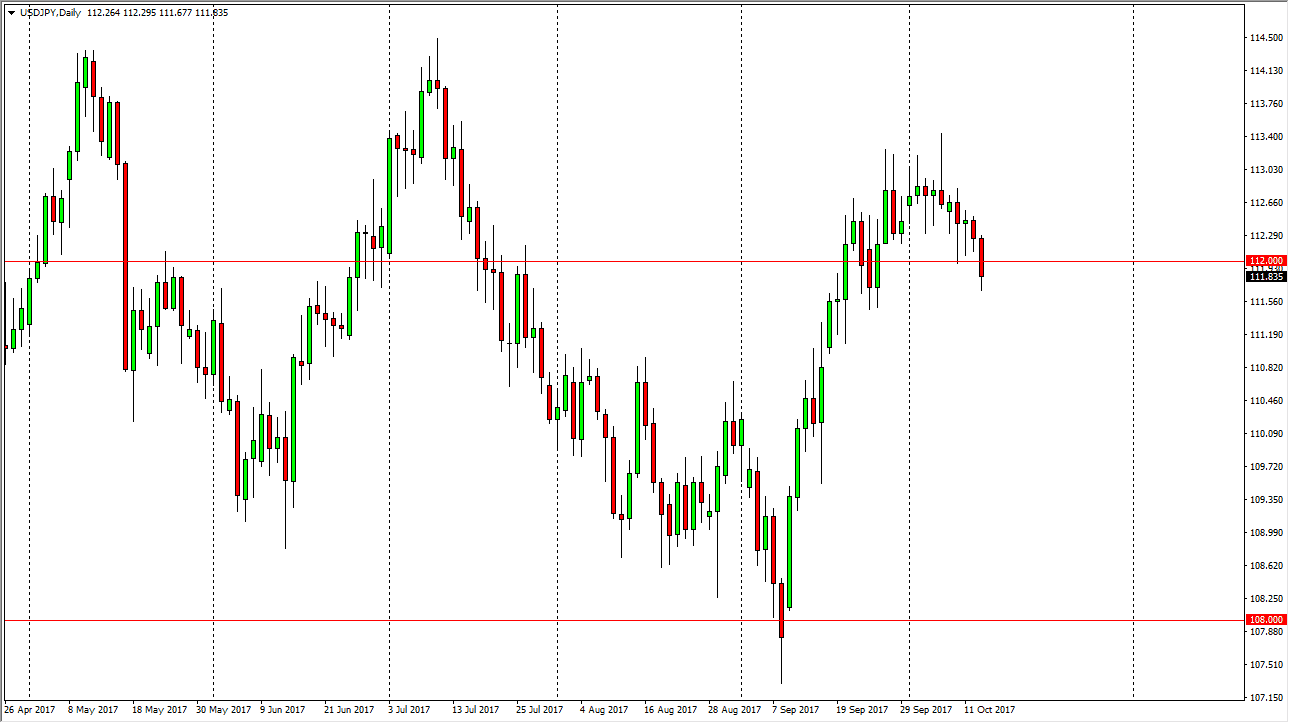

USD/JPY

The US dollar fell significantly during the day on Friday, slicing through the 112 level. This is an area that has attracted a lot of attention, and now that we have sliced through I think we may drift a little bit lower. I see support at the 111.50 level, and of course the 111 level. Given enough time, I think that the buyers come back and we should start reaching towards the 114.50 level above which is the top of the overall consolidation that we have been in. We have seen a significant move to the upside as of late, and rolling over here makes sense as we would probably be a bit exhausted. However, I have no interest in shorting, because I think there are more than enough reasons to think that eventually this pair rises.

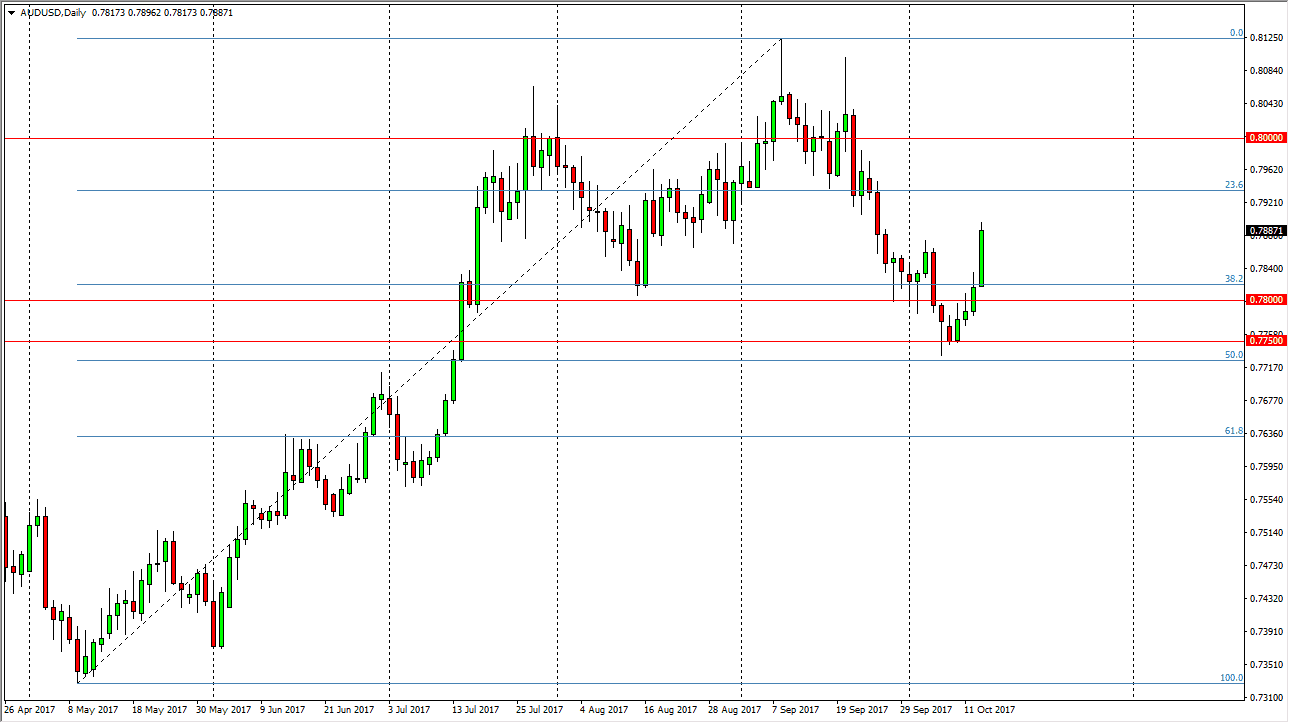

AUD/USD

The Australian dollar rallied significantly on Friday, breaking above the 0.75 zero level. By doing so, it looks as if we are going to continue to bounce from the 0.7750 level, which was essentially the 50% Fibonacci retracement of the recent surge higher. It was also the scene of massive resistance, and a retest of the overall breakout that we had found. That being the case, think we’re going to make a significant surge higher, and try to break above the 0.80 level. Once we clear the noise in that region, the market should be free to go to the 0.90 level, and then eventually parity. I believe pullbacks are buying opportunities, and it’s not until we break down below the 0.77 level that I would consider this market difficult to read. I think it’s going to be noisy, and I think it’s going to take several attempts, but eventually we should go much higher.