USD/JPY

The US dollar fell during the session on Thursday, reaching towards the 112 level and finding support. We did bounce slightly, but I think that the market is simply trying to catch its breath in this area. This region should continue to show signs of life, and I think that eventually the buyers get involved. However, if we break down from here, then I think the 111 level becomes where the buyers get involved. Keep in mind that this market has gone parabolic recently, and now that we are sideways it’s likely that the market is trying to build up enough momentum to continue the move. The 114.50 level continues to be my target, and these dips continue to offer an opportunity. Ultimately, this is a market that continues to be choppy, but I believe bullish over the longer term.

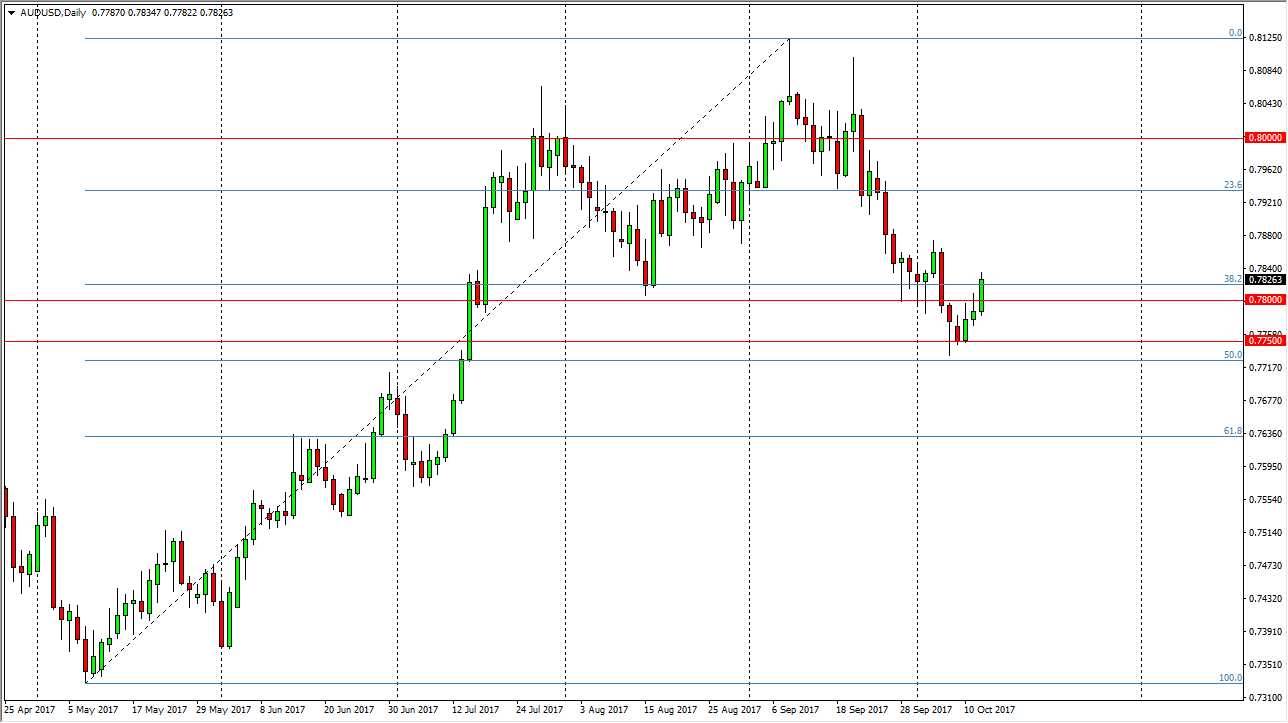

AUD/USD

The Australian dollar rallied significantly during the day on Thursday, breaking above the 0.78 level, and break above the top of a shooting star from the previous session. That is at least 2 reasons to think that the market is going to continue to go higher, and of gold can rally with any type of significance, that should put even more pressure on the Aussie dollar. I think that pullbacks will find support near the 0.7750 level, as this was the scene of a major breakout. Given enough time, we should go looking towards the 0.80 level above, which is important on longer-term charts. Breaking above there and cleanly doing so should send this market into more of a buy-and-hold situation. At that point, the market should go looking towards the 0.90 level, and perhaps even parity over the longer term. I believe in buying dips, and if we can stay above the 0.7750 level, the market should continue to find plenty of reason to go long.