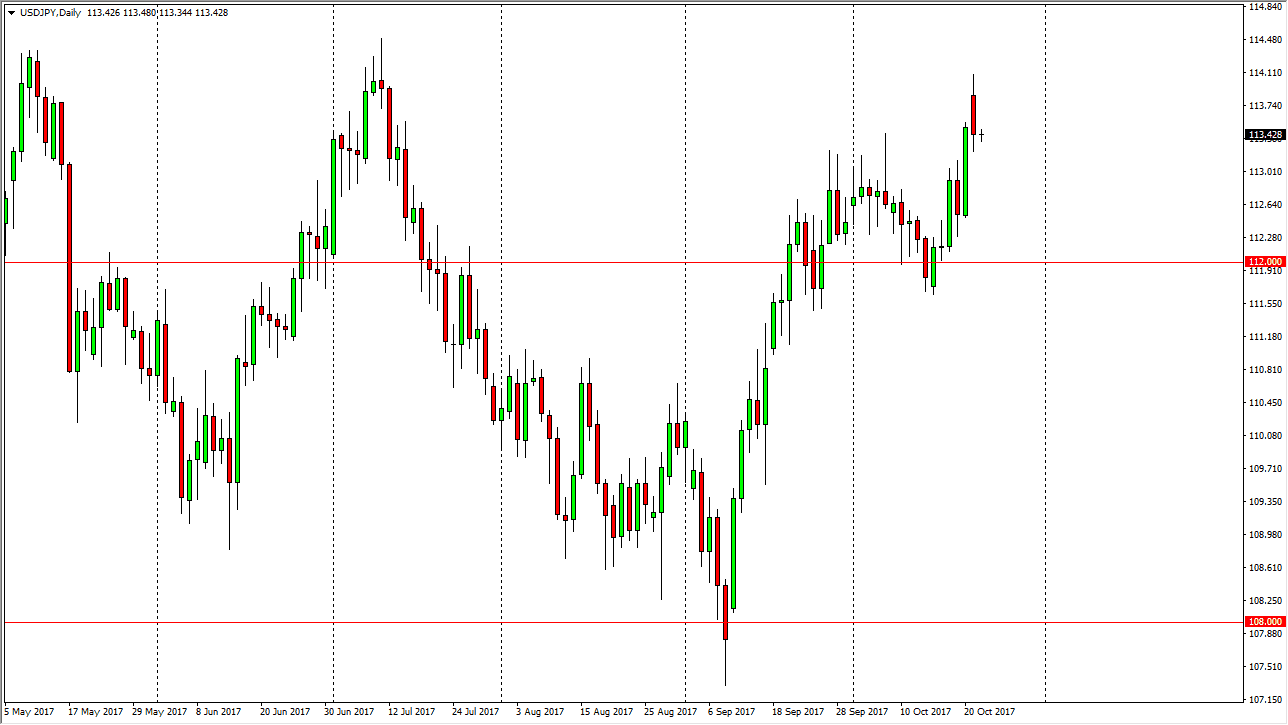

USD/JPY

The US dollar gapped higher against the Japanese yen at the open on Monday, as Abe got an overwhelming victory in the election. Because of this, it makes sense that the Japanese yen will continue to depreciate over the longer term, as a continues the loose monetary policy that we have been accustomed to. I think that a pullback from here makes a lot of sense, and I think it’s only a matter of time before the buyers come back in and start buying. The 114.50 level above is the resistance barrier from the longer-term consolidation that we been in for some time, and I think if we can break above the 114.50 level, we will eventually try to break out above the 115 handle, allowing longer-term traders to get involved. In the meantime, I think that short-term pullbacks are buying opportunities as the 112 level should be massively supportive.

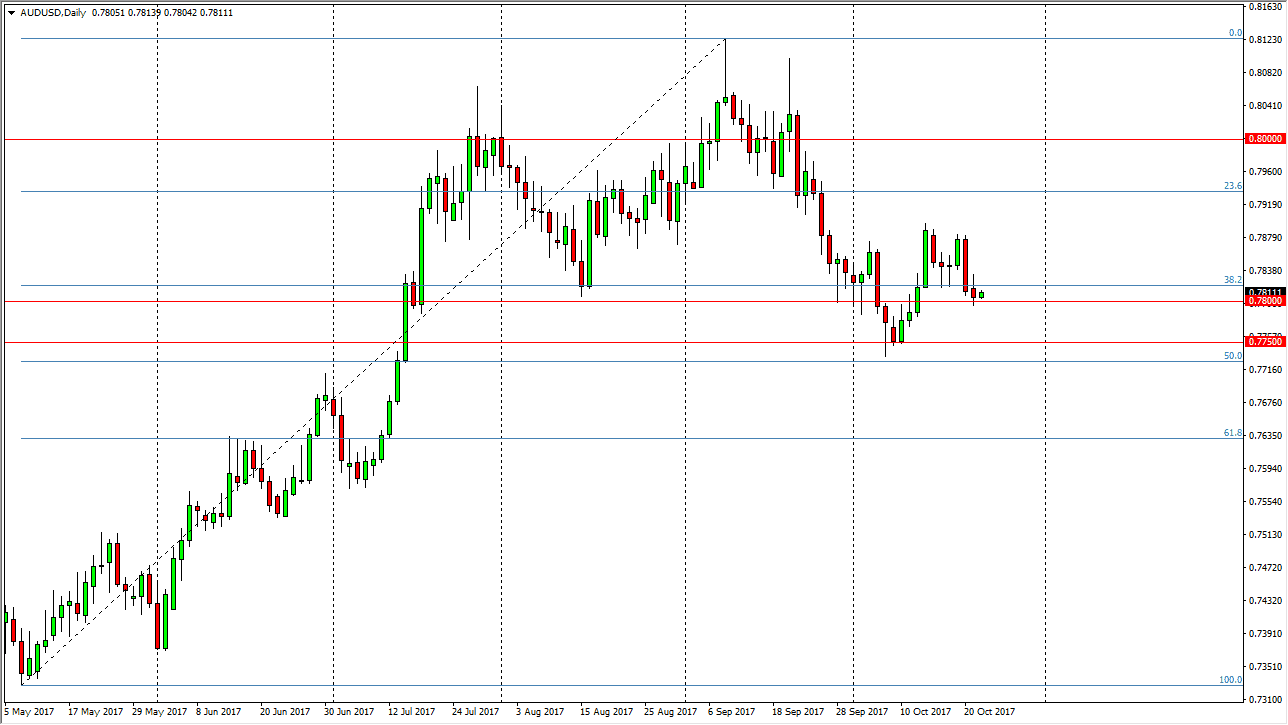

AUD/USD

The Australian dollar initially tried to rally, began back quite a bit of the gains to sit right on the 0.78 level. There’s a lot of support underneath the, extending down to the 0.7750 level. If we were to break down below there, the market should go much lower, perhaps turning the overall attitude around in the market. Alternately, if we can break above the highs from the session on Monday, the market should then go to the 0.79 level above, and perhaps reaching towards the 0.80 level after that. Gold markets have their usual influence on the Australian dollar, and I think we will have to pay attention to that commodity to see where we go next. The 2 should move in the same direction, but I do expect a significant amount of resistance near the 0.80 level above even if we do rally.