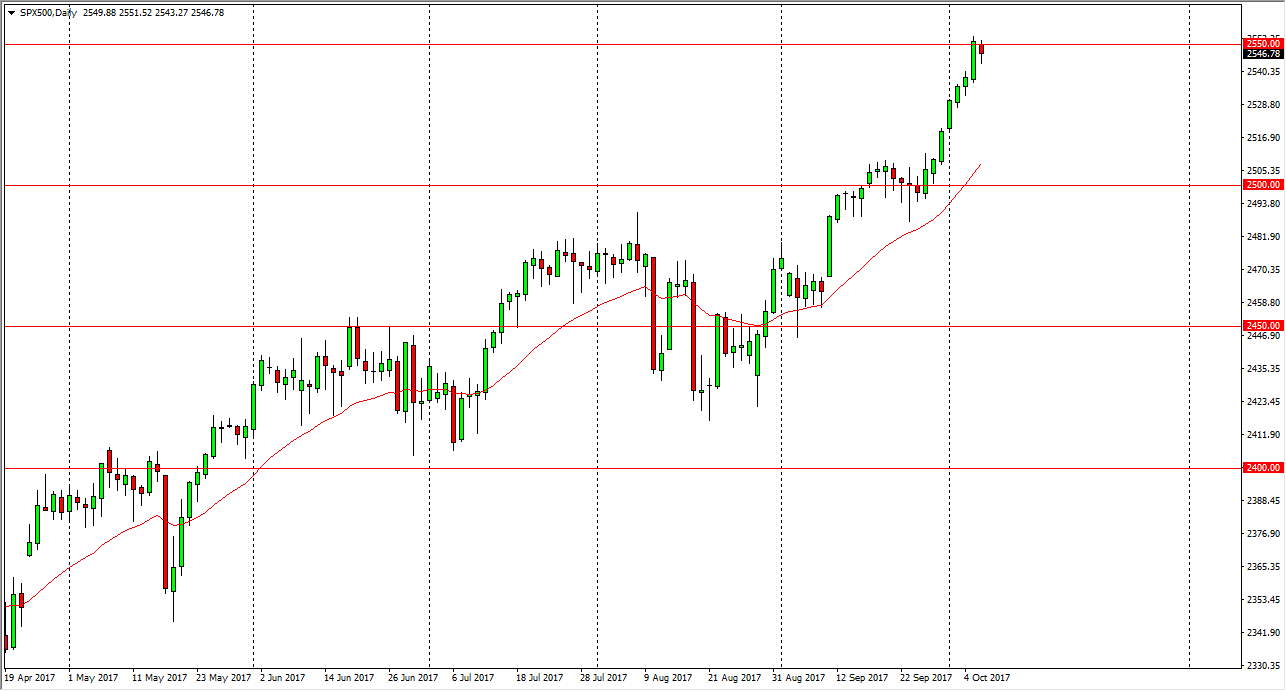

S&P 500

The S&P 500 fell during the Friday session, as the 2550 level offered a bit too much resistance. However, towards the end of the day we started to see buyers jump back in, and it looks like the market is trying to break out above the 2550 level over the longer term. I think that the rotation of stocks continues to favor the S&P 500 and with financials reporting this coming week, it’s likely that we will continue to see pullbacks as buying opportunities in a market that has been very strong. I believe that the 2500 level underneath is the “floor” in the uptrend, and although it has been a bit overextended, I think by being patient and waiting for value underneath, traders will continue to benefit. However, if we were to break above the 2550 level, at that point I suspect that you have to jump in.

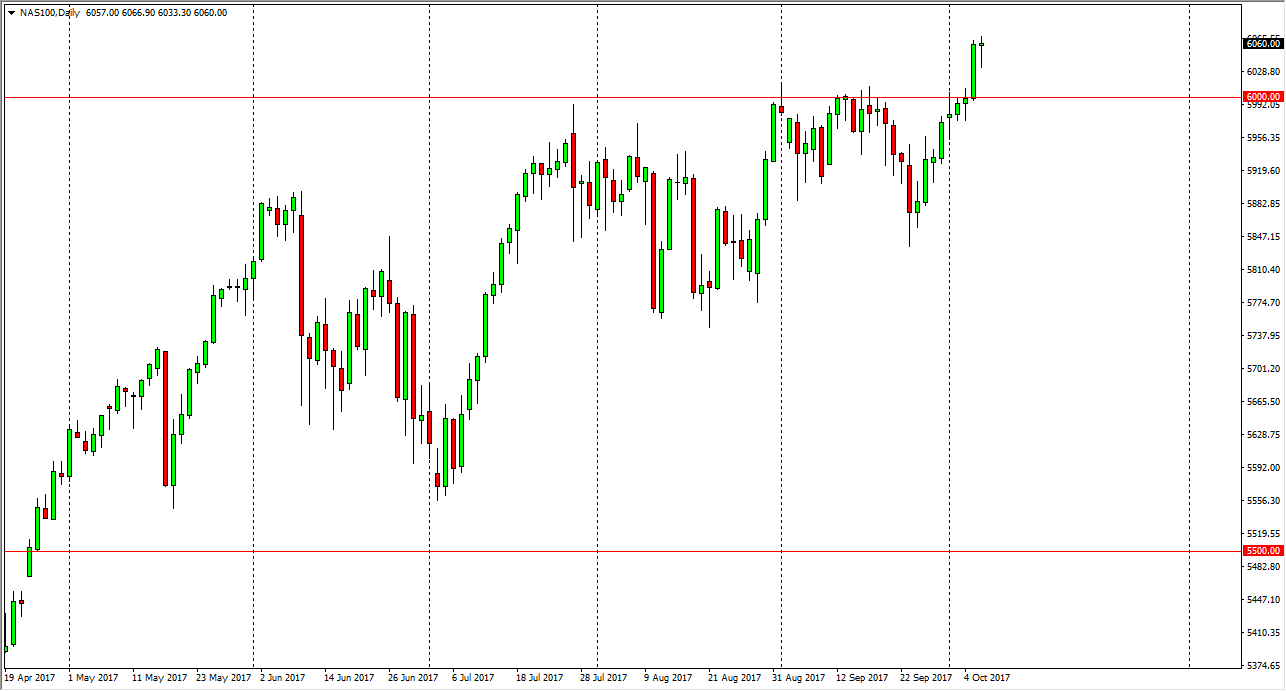

NASDAQ 100

The NASDAQ 100 initially fell during the day on Friday, but turned around to form a massive hammer. Because of this, I believe it’s likely that the NASDAQ 100 continues to go much higher, and the 6000 level should now offer a bit of a floor in what is a brutal uptrend. I have no interest in shorting this market, as technology has done so well. Given enough time, based upon the consolidation area that we have just broken out of which to me looks a lot like an ascending triangle, I think we will probably go looking towards the 6200 level. I believe that the 6000 level should offer a floor for the uptrend. I suspect that buyers will continue to be attracted to this market. If we were to break down below the 6000 level, that would be a very negative sign.