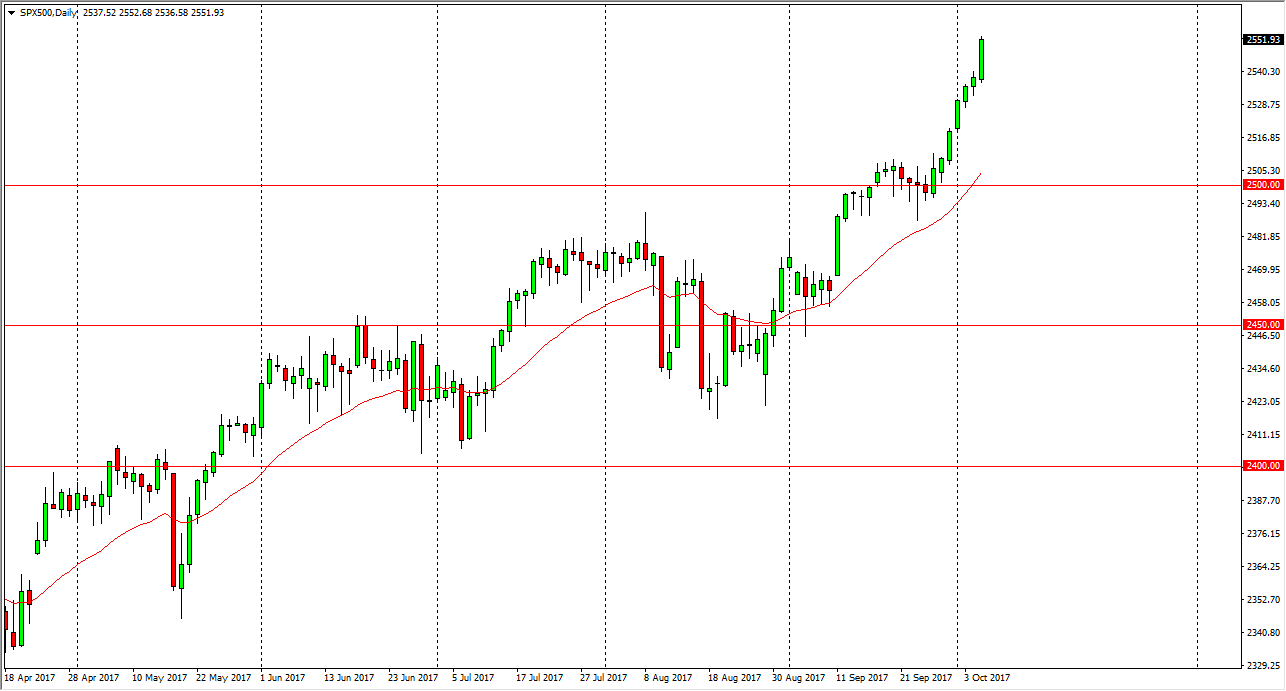

S&P 500

The S&P 500 broke out to the upside and reached towards the 2550 level during the Thursday session. With the jobs number coming out today, it’s likely that we will see choppiness. However, I also believe the pullbacks at this point would probably end up being a buying opportunity unless of course the jobs number is absolutely horrible. We’ve had a couple of hurricanes last month, so quite frankly I think that the market will probably shrug off any bad news, because they will certainly use the hurricane as an excuse for a less than exciting number. Ultimately, the market should continue to go much higher, and I think that pullbacks offer value regardless. The S&P 500 continues to look extraordinarily bullish and I think that the 2500 level underneath is the “floor.”

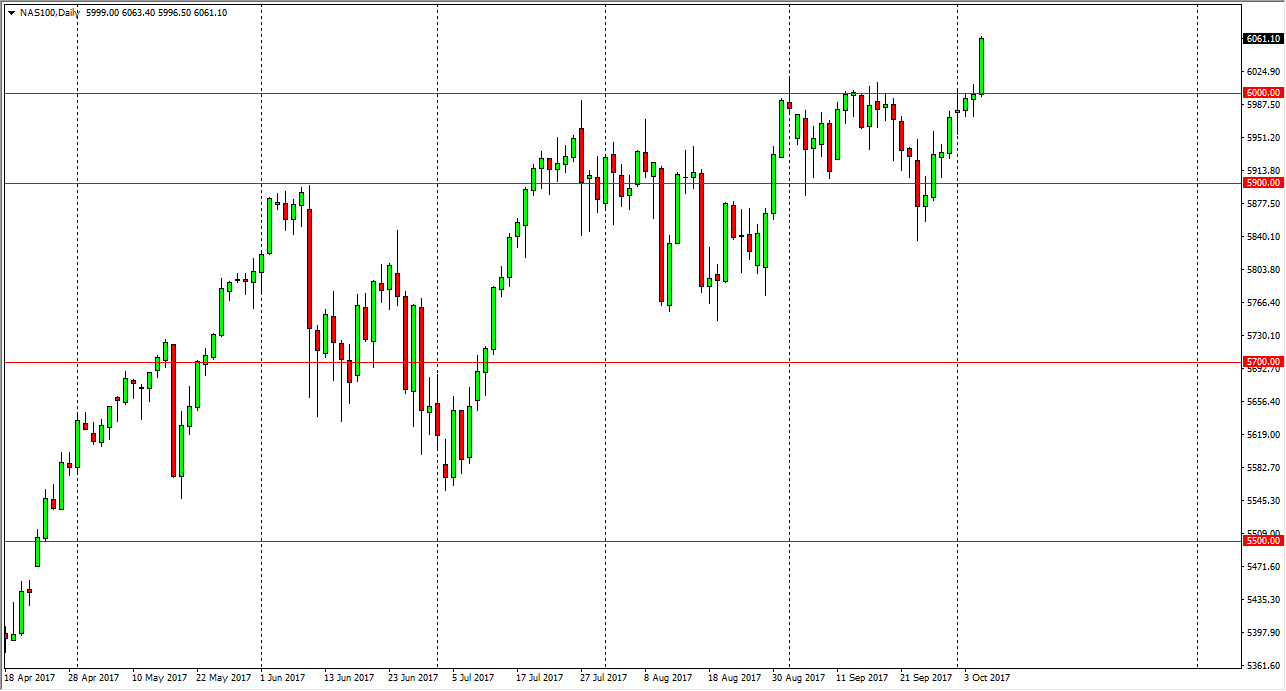

NASDAQ 100

The NASDAQ 100 finally broke out above the 6000 handle, an area that offered a lot of resistance in the past, and I believe that now that we have we have cleared this level, we should continue to see buyers going forward. The NASDAQ 100 was the initial cause of rallies, and now it looks like we are going to continue the uptrend, as we have tried so hard to break out, and the momentum has certainly picked up again. I think that pullbacks will find plenty of support at 6000, which was previously resistive, and it should now be support. Based upon the ascending triangle that we were trying to form, I think that the target will be 6200. If we get a stronger than anticipated jobs number, that could turbocharge the next move higher, and therefore I have no interest in shorting as I think it will be dangerous to do. Longer-term, I believe we go much higher.