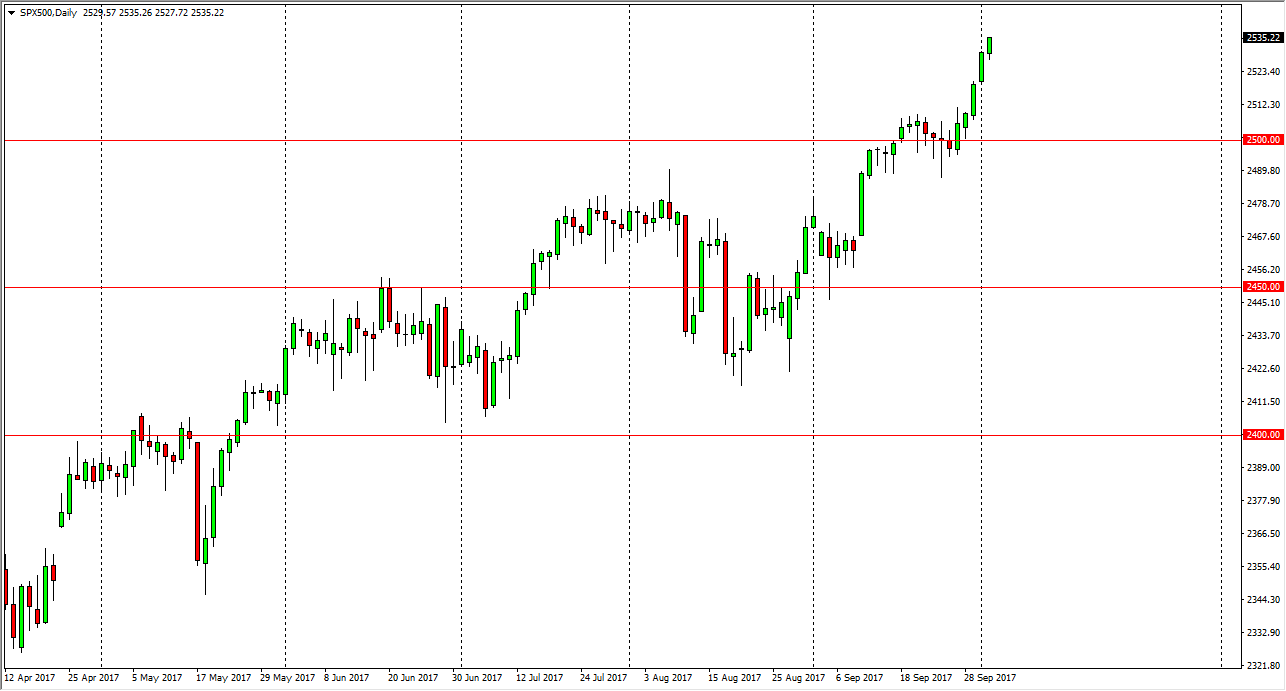

S&P 500

The S&P 500 rallied during the day on Tuesday, reaching towards the 2535 handle above. I believe that ultimately, we are going to go to the 2550 handle, and that pullback should be nice buying opportunities. The 2500 level underneath should continue to be the “floor” in the market as the uptrend has been very strong, and this bullish pressure looks likely to continue. I look at pullbacks as value, and that something that I want to take advantage of. Ultimately, I believe that the S&P 500 is going to go looking towards the 2550 level above, as it is the next psychologically important number. If we were to break down below the 2500 level, that would be extraordinarily negative, but I don’t see that happening anytime soon.

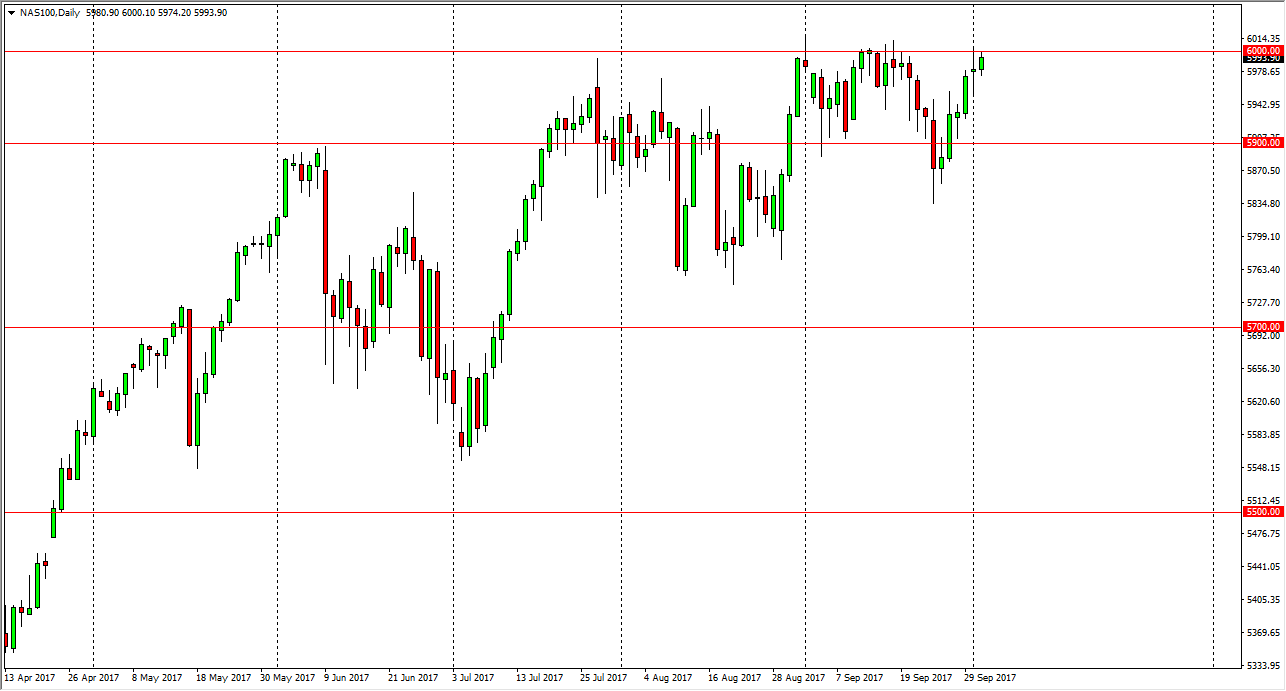

NASDAQ 100

The NASDAQ 100 continues to show volatility, as we tried to rally during the session but struggled at the 6000 handle. A break above the 6000 handle would be a very bullish move indeed, perhaps sending this market to much higher levels as it becomes more of a “buy-and-hold” scenario. I think pullbacks in the meantime are simple attempts to build up momentum to go higher. I think that the market will eventually continue to find people looking at pullbacks as value, and therefore I think that the algorithmic traders have already programmed “buy on the dips.”

If we can break above the 6000 handle, the market should then go to the 6200 level above. This is based upon the ascending triangle that has been forming, and therefore I think that the breakout is one that you can buy and hold on to for a while. I think short-term pullbacks after that breakout should be buying opportunities. I have no interest in shorting the NASDAQ 100, I believe the uptrend will eventually prevail.