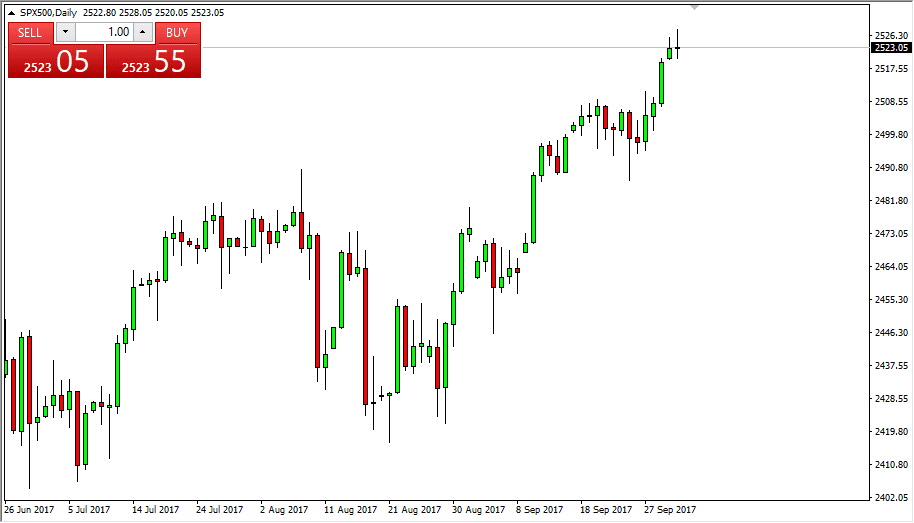

S&P 500

The S&P 500 initially trying to rally on Monday, but found enough resistance above that we turned around and form a somewhat exhaustive looking candle. That’s not a huge surprise though, because quite frankly we are a little overbought. I look at pullbacks as value, and look to short term charts for opportunities to start buying value. I think that the 2500 level underneath will continue to offer support, and somewhat of a “floor” in the market. Because of this, I don’t have any interest in shorting and I think that it is only a matter of time before traders come back into the marketplace and start buying again. After all, the S&P 500 has been extraordinarily strong over the last several weeks, and of course months.

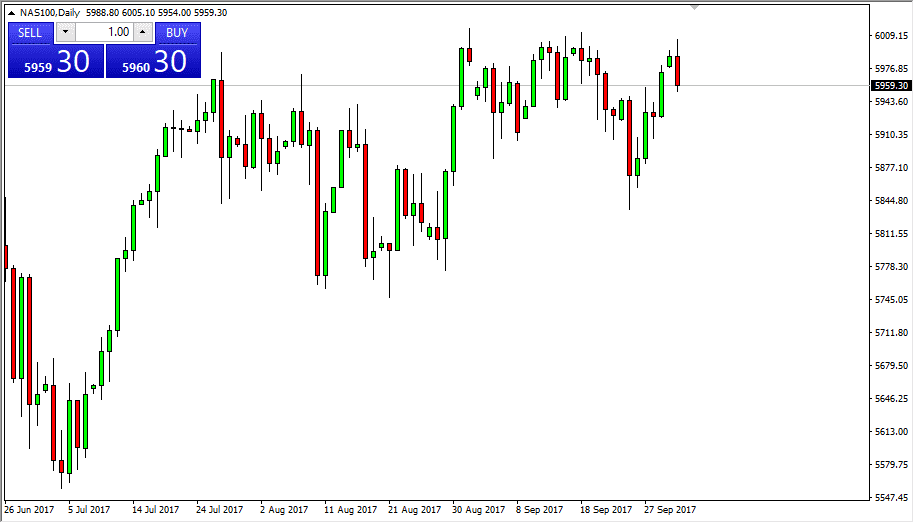

NASDAQ 100

The NASDAQ 100 try to break above the 6000 level that failed again, as that area has offered far too much in the way of resistance. By rolling over, I think were going to go looking for support at lower levels to try to build enough momentum to finally break out. I think that the 5900 level underneath is the “floor” in the market, and of course the NASDAQ 100 has been a bit of a laggard as stock traders in New York have been rolling out of technology and into industrials. While I think that eventually the buyers come back, I also recognize that there is probably more profit to be had in the S&P 500 as opposed to this index. I suspect continued volatility will be the case, but once we break above the 6000 handle, we could go much farther to the upside.