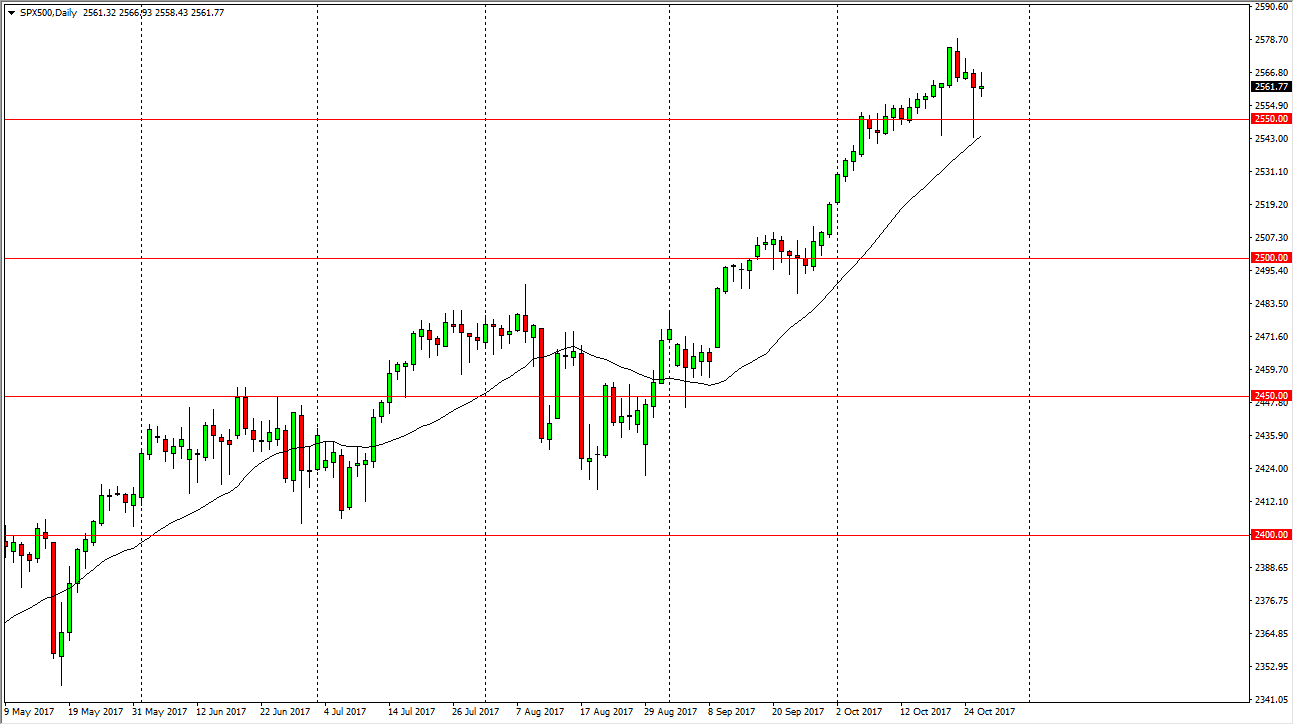

S&P 500

The S&P 500 had a lackluster session on Thursday, as we continue to grind above the 2550 handle. I believe that the market should continue to consolidate in general, as we have gotten ahead of ourselves. We are in the middle of earnings season, so that of course can change things, but also, we have the US dollar strengthening rather rapidly during the day after Mario Draghi suggested that quantitative easing was going to go much longer. Ultimately, this is a market that is in a bullish uptrend, but these pullbacks do occur occasionally. Pullbacks are value as far as I can see, and it’s not until we break down below the 2500 level that I would be concerned about the uptrend. Quite frankly, we’ve gotten ahead of ourselves, so it makes sense that we continue to tread water in this region.

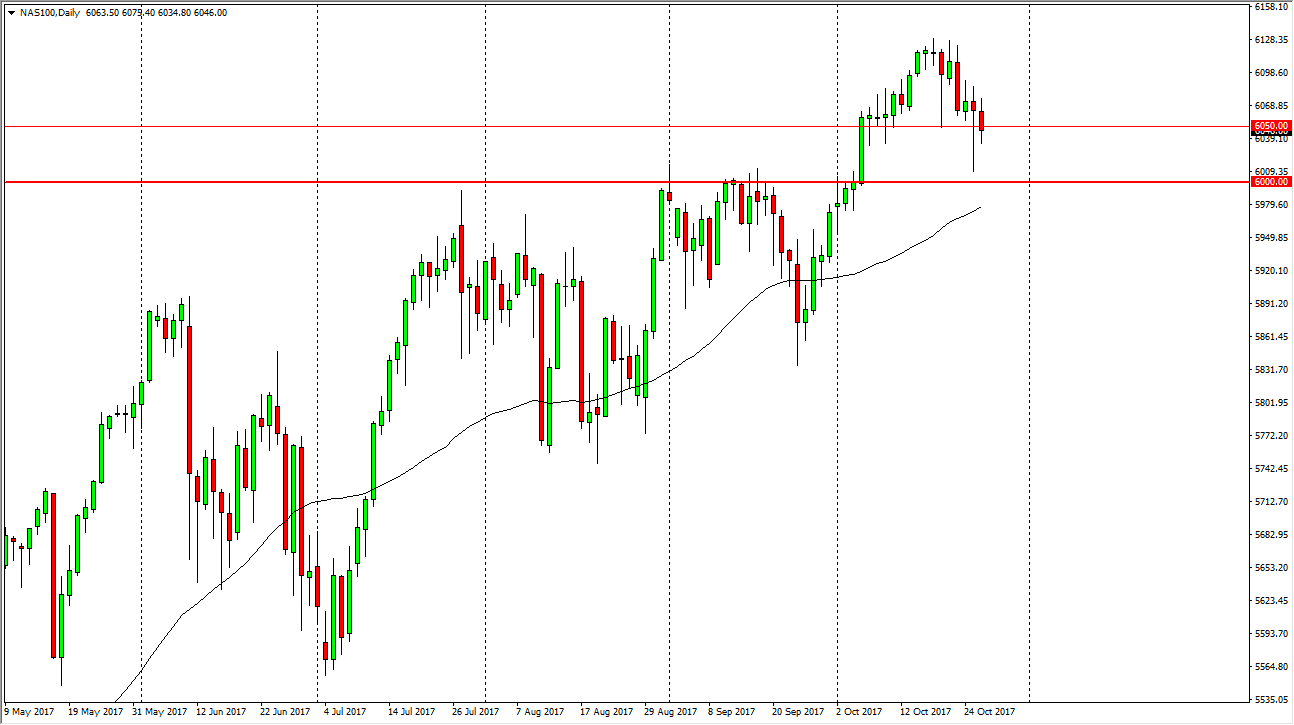

NASDAQ 100

The NASDAQ 100 had a slightly negative session as we continue to dance around the 6050 handle. The 6000 level below is massively supportive though, so I think that even if we do drop down to that area, there should be plenty of buyers in that region to lift the market. A bounce from the 6000 level makes a lot of sense, because it was the scene of massive resistance previously, which was the top of an ascending triangle. Now that we have broken that level and tested it for support, I think eventually we will go to the 6200 handle. Earnings season will of course dictate how quickly we get there, but technically speaking, this is a market that looks like it’s in an uptrend, and ready to continue that move. If we broke down below the 5980 level, at that point I would rethink the entire situation.