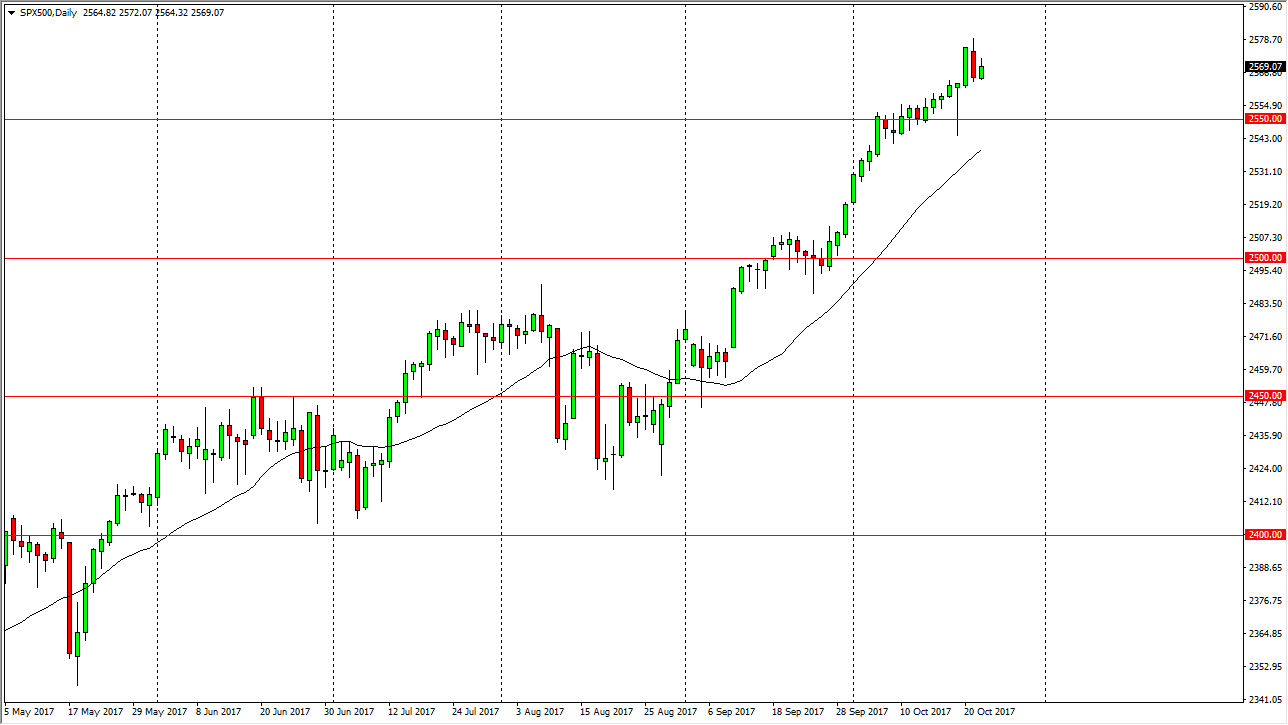

S&P 500

The S&P 500 rose slightly during the trading session on Tuesday, as we continue to bumble around above the 2550 handle. I think that the market should continue to be bullish overall, but I anticipate that we may get a bit of a pullback. That pullback should be a buying opportunity though, and I have no interest in selling this market. The 50-day exponential moving average sits just below the overall trend recently, and I think that the market will probably go looking towards the 2600 level. That is an area that will probably have a bit of psychological resistance attached to it, but longer-term I think we will manage to break above there after we make several attempts and build up enough momentum. Breaking above that level should send this more into a “buy-and-hold” situation.

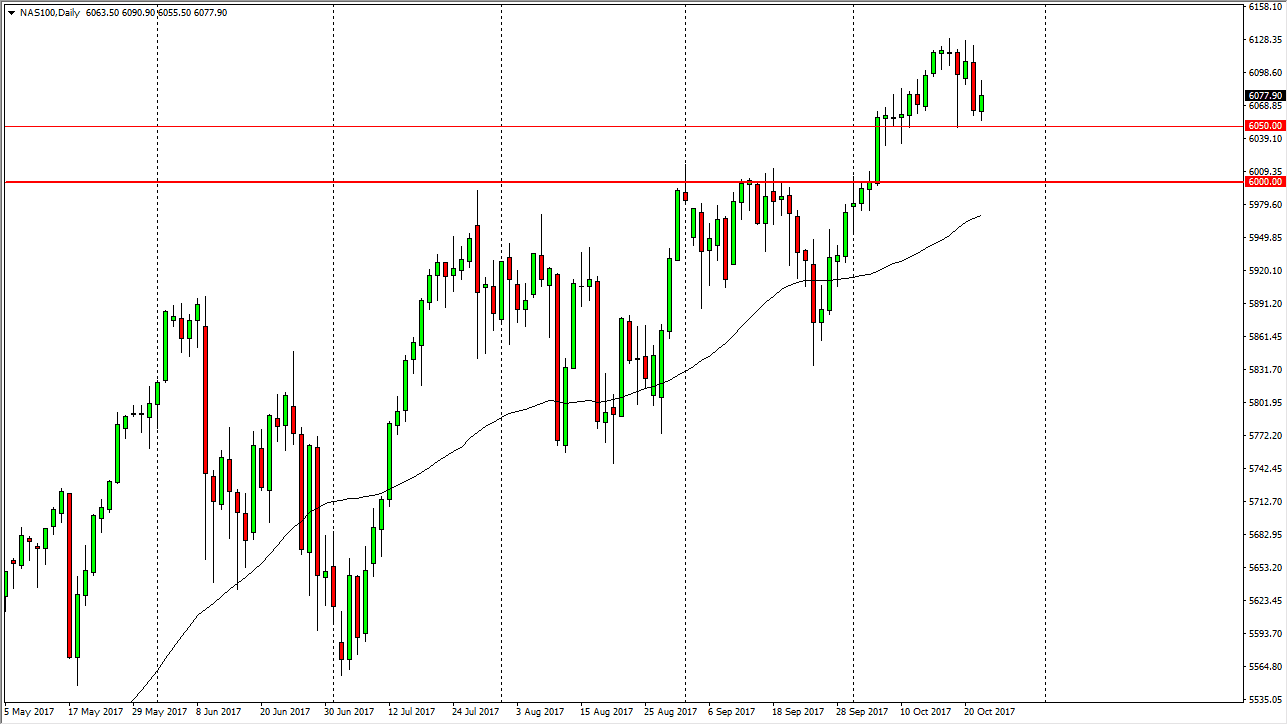

NASDAQ 100

The NASDAQ 100 rallied a bit during the day on Tuesday, showing significant support at the 6050 level. I think that the market has plenty of support extending down to the 6000 handle though, so at this point I have no interest in shorting, and the lower we go, the more likely I am to start buying. That is of course if we can stay above the 6000 handle, but a breakdown below there would be rather negative. When I look at the chart, I can make an argument for an ascending triangle being broken to the upside, and that measures for a move to the 6200 level. There is nothing on this chart that changes my attitude, and I still believe that the 6200 level is where we are targeting. It is the middle of earnings season, so we could get a bit of volatility but those should be minor in the big scheme of things.