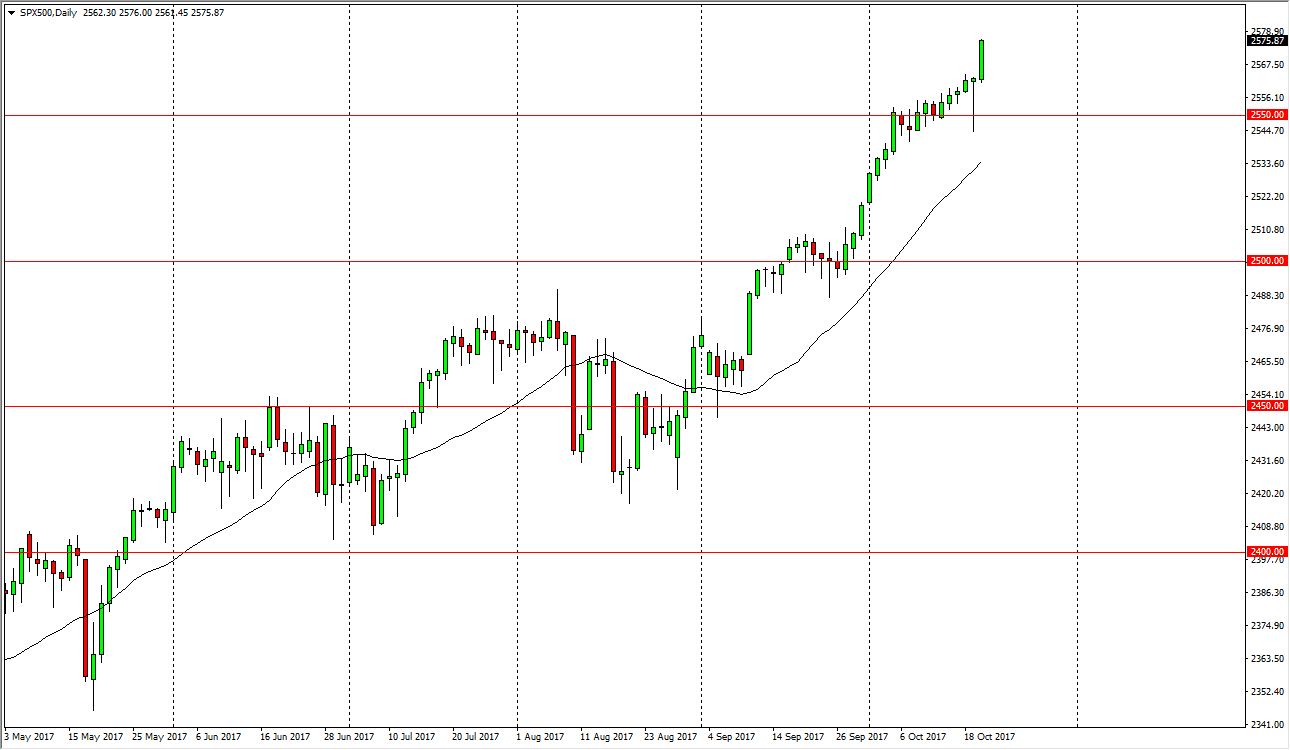

S&P 500

The S&P 500 exploded to the upside during the day on Friday as it was announced that tax deals may be happening in Washington DC. We had proceeded the trading session by forming a hammer on Thursday, so technically speaking, this was expected to happen. I think that there is plenty of support underneath though, so that’s probably just as important if not more important right now. The 2550 level is the floor, and I think it should go looking towards the 2600 level. We are bit overextended though, so expect pullbacks. Those pullbacks should offer value that you can take advantage of, and certainly I would have no interest in shorting this market as it has been extraordinarily bullish, and as we are in the middle of earnings season, and will more than likely continue to be.

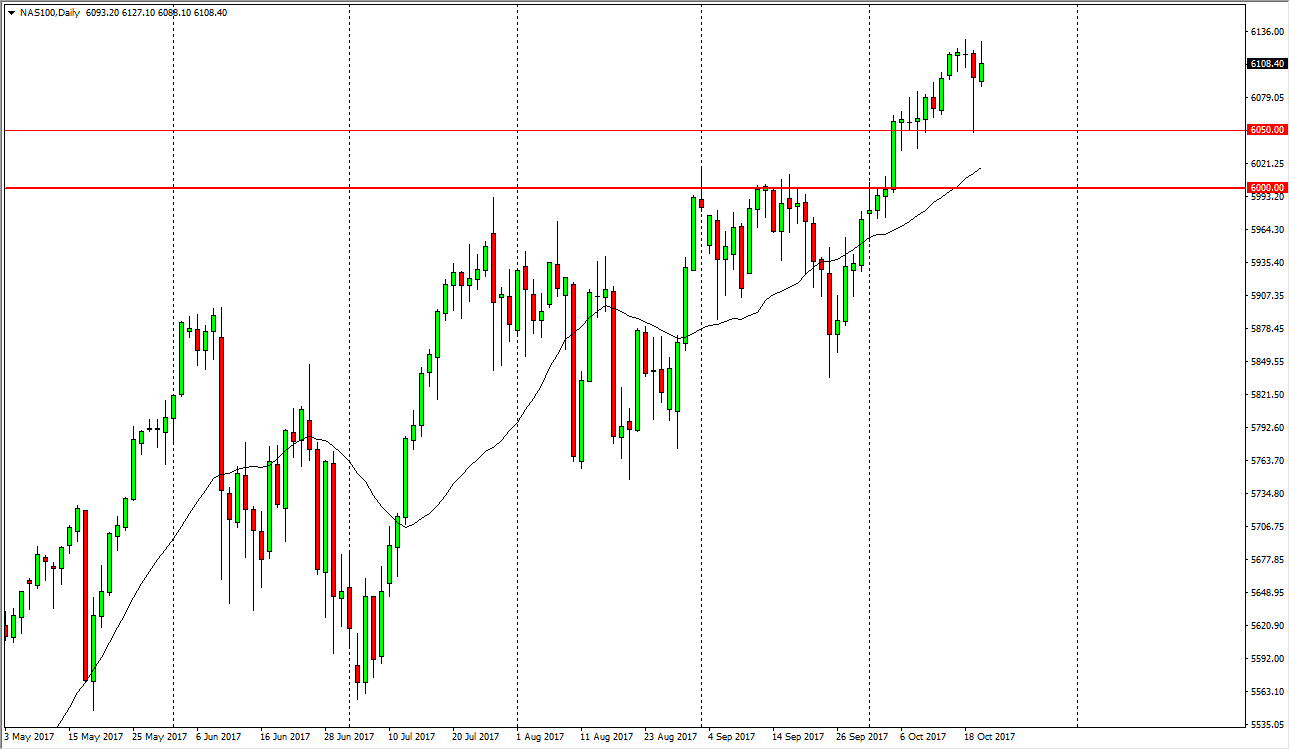

NASDAQ 100

The NASDAQ 100 tried to rally during the session on Friday, but turned around to form a shooting star like candle. The hammer from the Thursday session of course was supportive, but I think given enough time we should break out to the upside although we are certainly consolidating. The 6050-level underneath should be the floor, and if not, I think the 6000 level is. Longer-term, I believe that the market continues to go towards the 6200 level, and I think that the longer-term uptrend should continue to be the way we are going forward. I have no interest in shorting, I think that the buyers are much convicted than the sellers. Any time we pull back, I think that it’s ultimately value the people will take advantage of. The NASDAQ 100 has been a bit slower than the other indices that I follow, it may have to play catch-up.