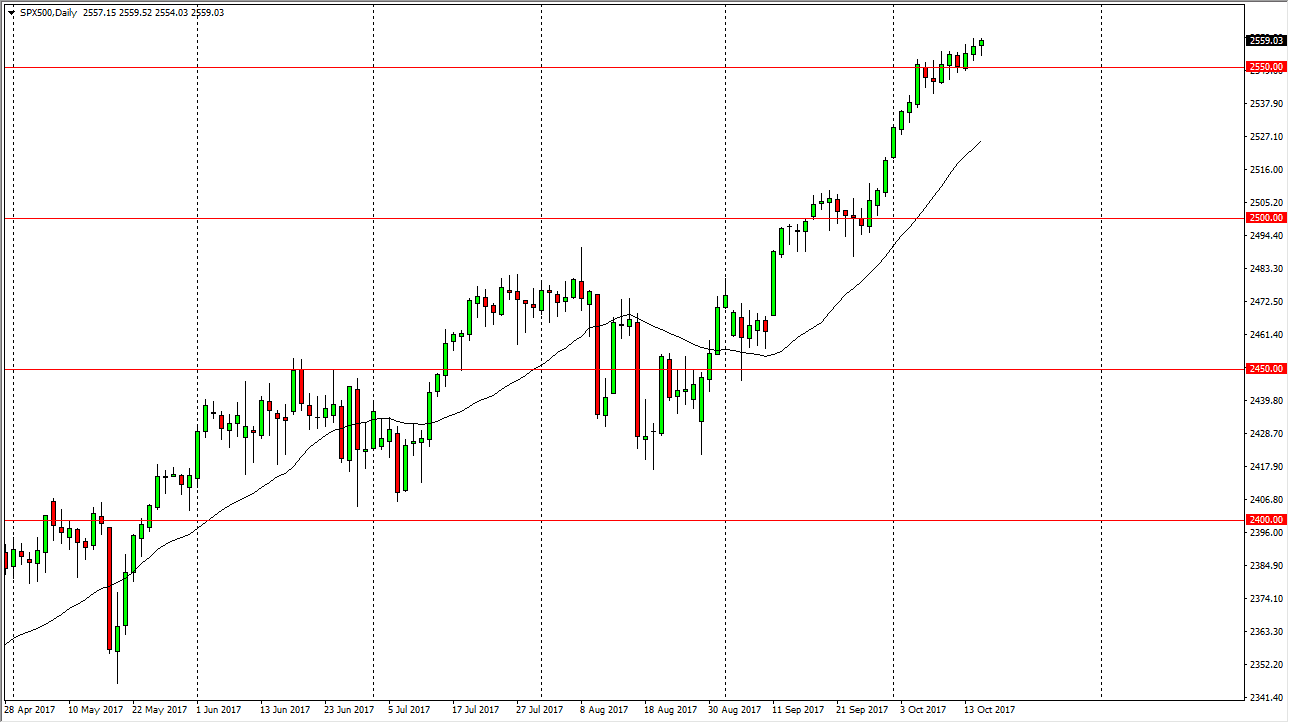

S&P 500

The S&P 500 initially fell during the day on Tuesday, but found enough support to turn around and form a hammer again. It looks as if the earnings season is going higher, as so far most estimates have been rather healthy. The 2550 level looks to be very supportive, but I also recognize that we have been a bit overbought for a while. I think pullbacks are coming, but I also think that the pullbacks that are coming are going to be buying opportunities. I have no interest in shorting this market, and believe that the bottom of the uptrend is probably closer to the 2500 level. Given enough time, the market should then go looking towards the 2600 level, and I believe the longer-term traders are continuing to buy these dips as they appear. I have no interest in shorting this market, even though I recognize that a pullback is necessary.

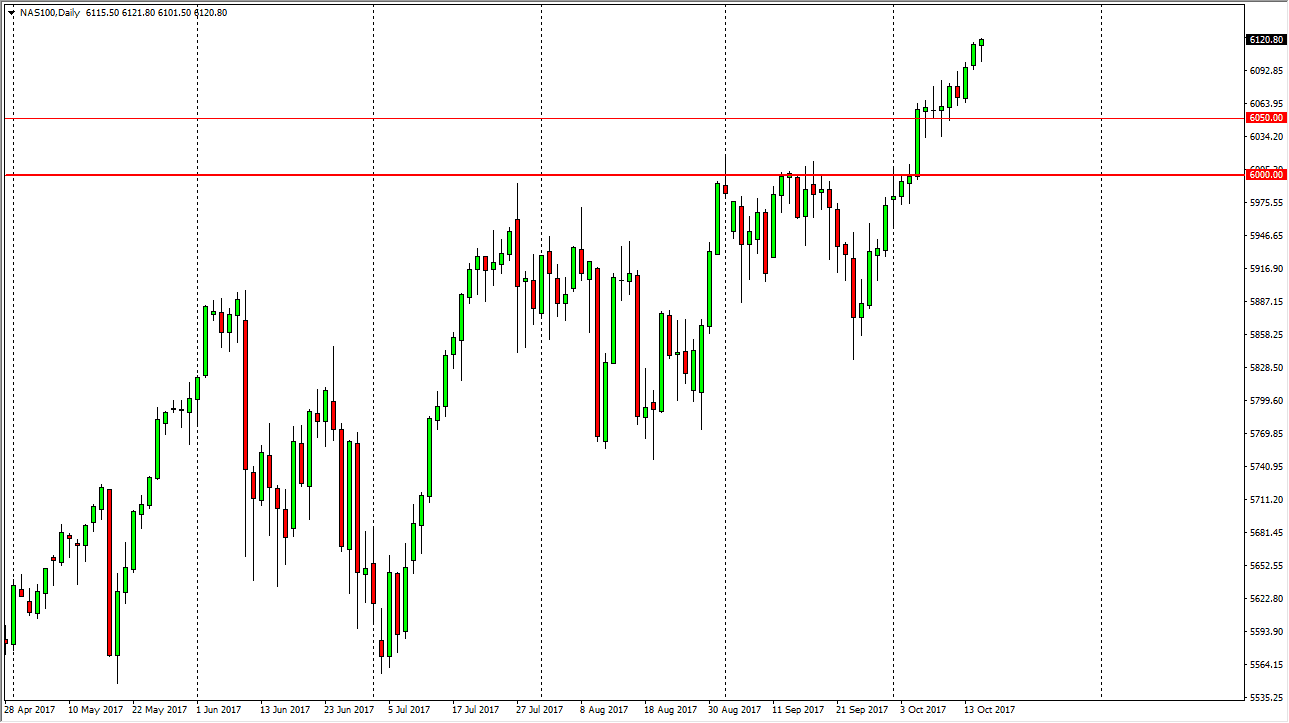

NASDAQ 100

The NASDAQ 100 initially fell during the day on Tuesday, but found enough support to turn around and form a hammer. The hammer is a very bullish sign, and that being the case it looks very likely that we will continue to go higher over the longer term, but I do recognize that we are bit overbought. I think that pullbacks offer value, and that the NASDAQ 100 will continue to lead the rest of the US indices higher longer term. We have been a bit parabolic as of late, and that does have me concerned. We are in the middle of earnings season, so that can cause significant volatility, and I think that’s which are going to see, people buying dips as they represent value.