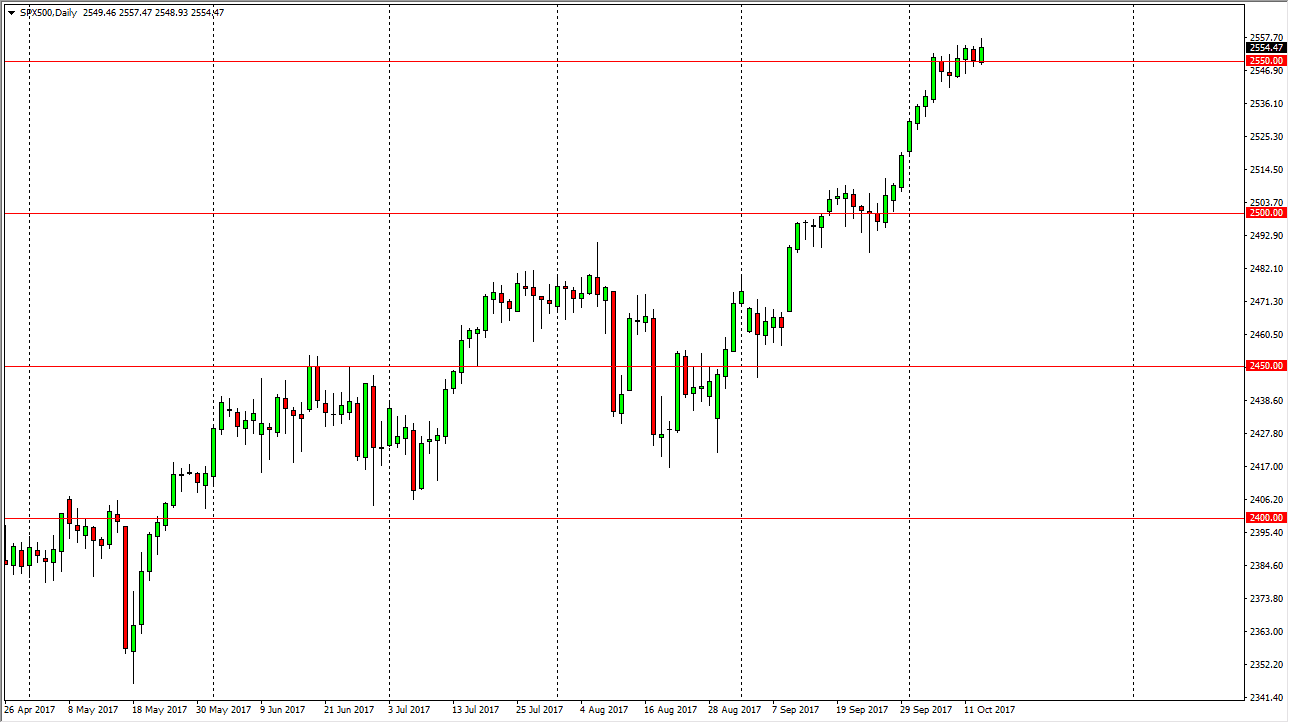

S&P 500

The S&P 500 continues to show resiliency, as we rallied during the day on Friday. The 2550 level looks to be offering support, and with earnings season kicking off this week, we had seen money flowing into the index anyway. I think that eventually we will break out to the upside, but I’m the first person to admit that we are bit parabolic at this point. We need sideways action at the very least, if not a pullback. Because of this, I would be very cautious, but I certainly wouldn’t be shorting a market that has shown so much promise as of late. With interest rates rising, it should continue to offer bullish pressure to the financials, which has a significant effect on how the S&P 500 performs. I believe that the 2500 level underneath will continue to be massively supportive.

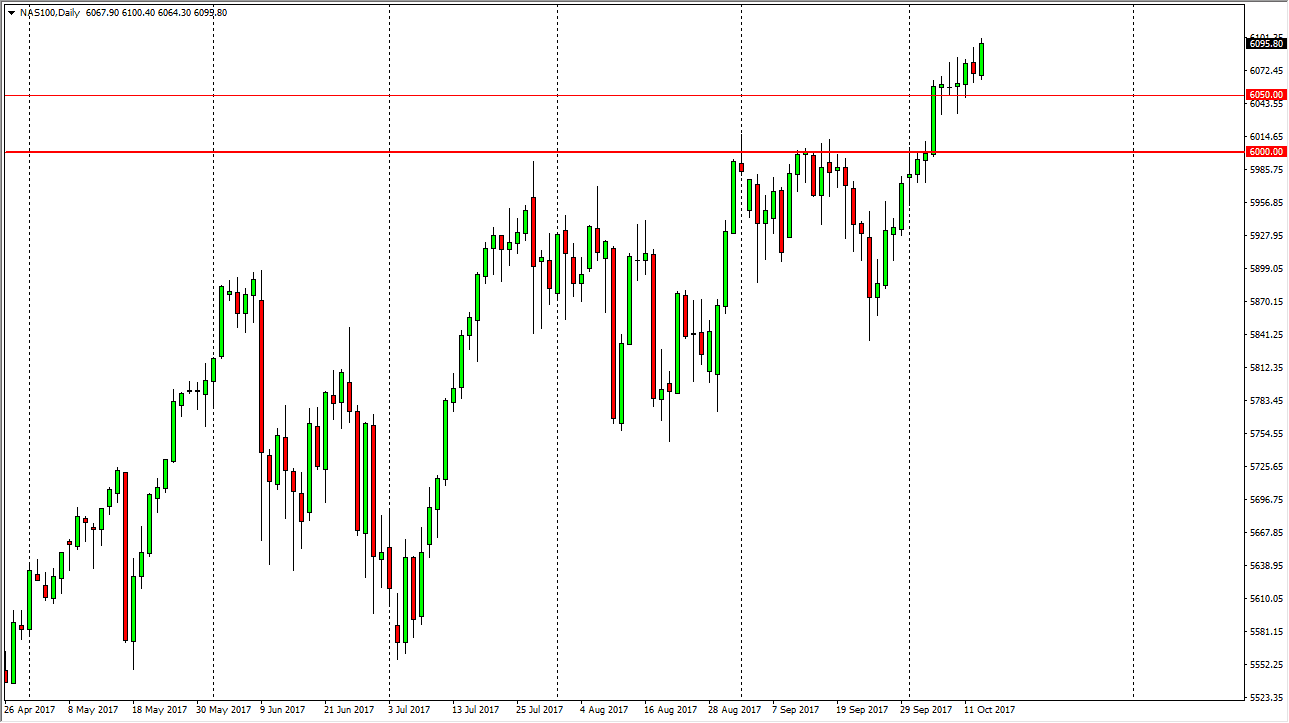

NASDAQ 100

If the S&P 500 looks bullish, the NASDAQ 100 looks absolutely spectacular. We had a very strong Friday session, breaking towards the 6100 level, an area that will offer a little bit of psychological resistance, but at the end of the day is minor at best. I like buying pullbacks, as technology continues to lead the way overall and should continue to be strong in America. I believe that the 6000 level underneath is the massive floor that keeps the uptrend intact. Longer-term, I fully anticipate a move to the 6200 level, and then eventually the 6500 level. I have no interest in selling, and believe that dips will be used as value propositions by most traders who are involved in the NASDAQ itself.