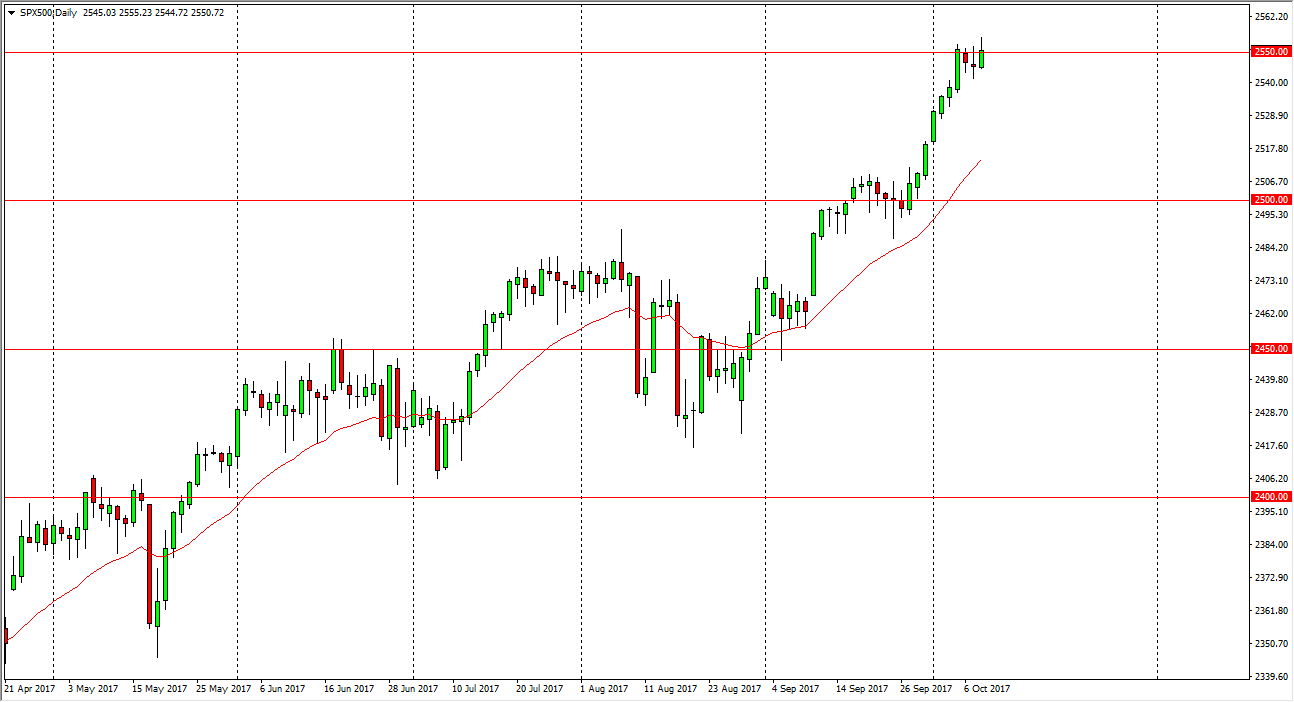

S&P 500

The S&P 500 rallied during the day on Tuesday, breaking above the 2550 handle. By doing so, looks likely that the market may continue to go higher, but we could also use a bit of a pull back in order to build up momentum to continue the longer-term uptrend. I believe that the 2500 level underneath is the floor in the market, and that it’s probably only a matter of time before the buyers return on every dip. I have no interest in shorting this market, but I also recognize that the 2550 level is psychologically important. With banks reporting this week, it’s likely that we will continue to see a lot of volatility in the S&P 500, but if they report strong earnings, the S&P 500 should continue to go much higher. Otherwise, the 2500 level underneath should be the “floor” in the uptrend.

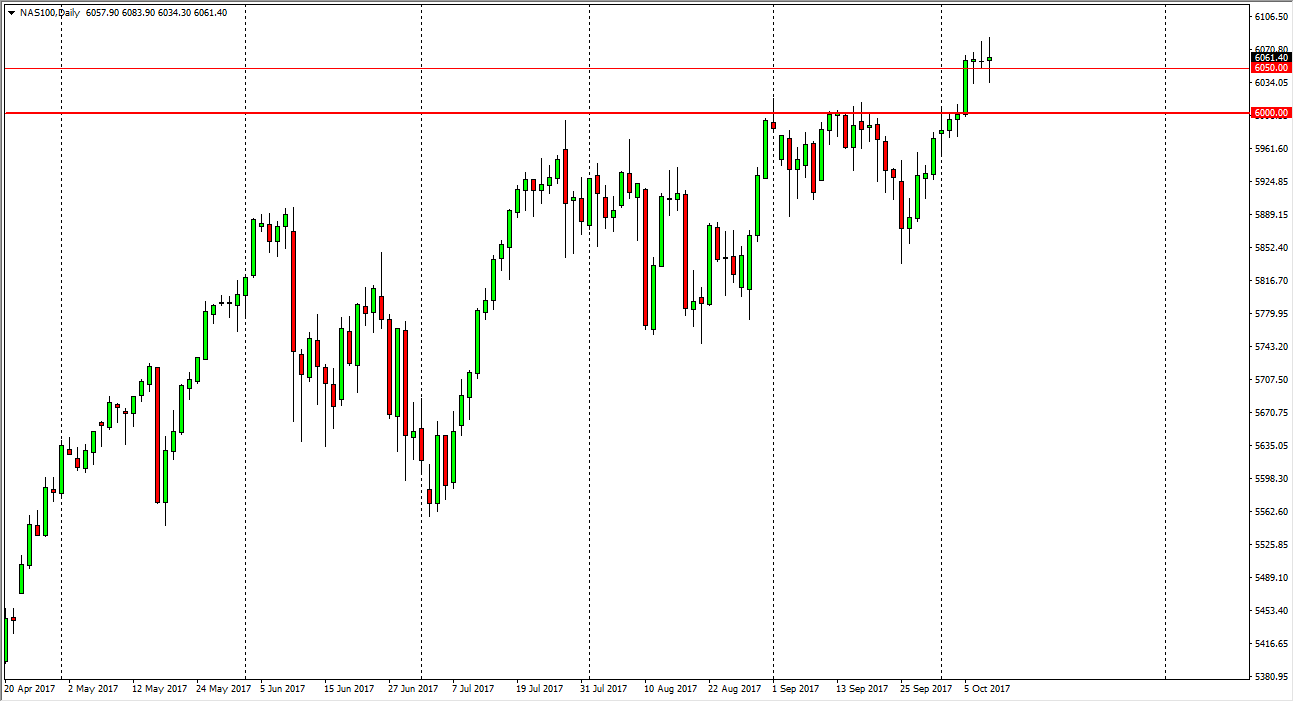

NASDAQ 100

The NASDAQ 100 was very volatile as well, going back and forth near the 6050 handle, as we continue to see a lot of volatility. The 6000 level underneath is the “floor” in the uptrend as far as I can see, as we have recently broken out above a massive barrier. I think now that any pullback that we get in the NASDAQ 100 should be a buying opportunity to go long. Given enough time, I think we go to the 6200 level, as that is what the ascending triangle that got broken out of measures to, and I believe that with money flowing into the stock markets the way it has been, there’s no reason that the NASDAQ 100 won’t continue to rally going forward.