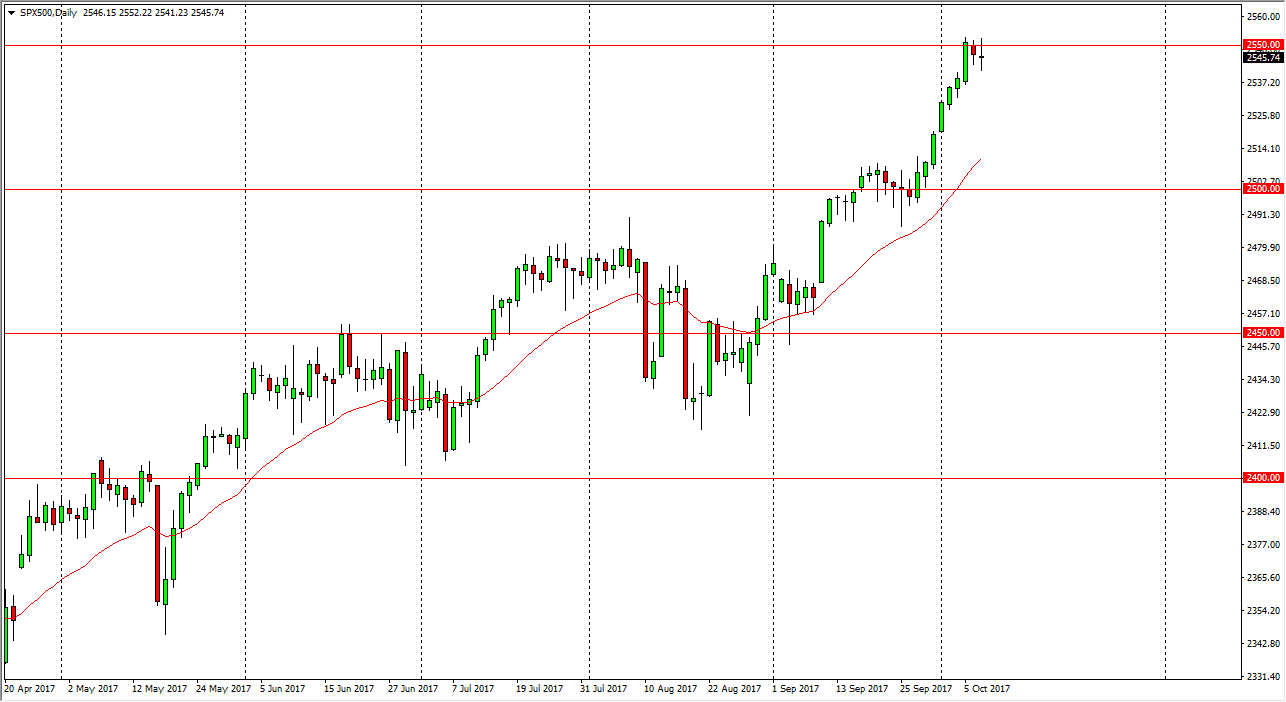

S&P 500

The S&P 500 went back and forth on Monday, as we struggled with the 2550 handle. That makes sense, because quite frankly we are overbought. I think that a pullback from here makes quite a bit of sense, and therefore although I’m not willing to sell this market, I think that the markets below will offer value that we can take advantage of. I believe that the 2500 level underneath will continue to be support, and I think that buying on the dips continues to be the best way to play this market, and therefore think a certain amount of patience will be needed to make profit here. If we broke above the 2550 handle, the market could go higher, but right now I prefer pullbacks over breakouts. Ultimately, I think that eventually we break out to higher levels, but we need to pull back to build up the necessary momentum.

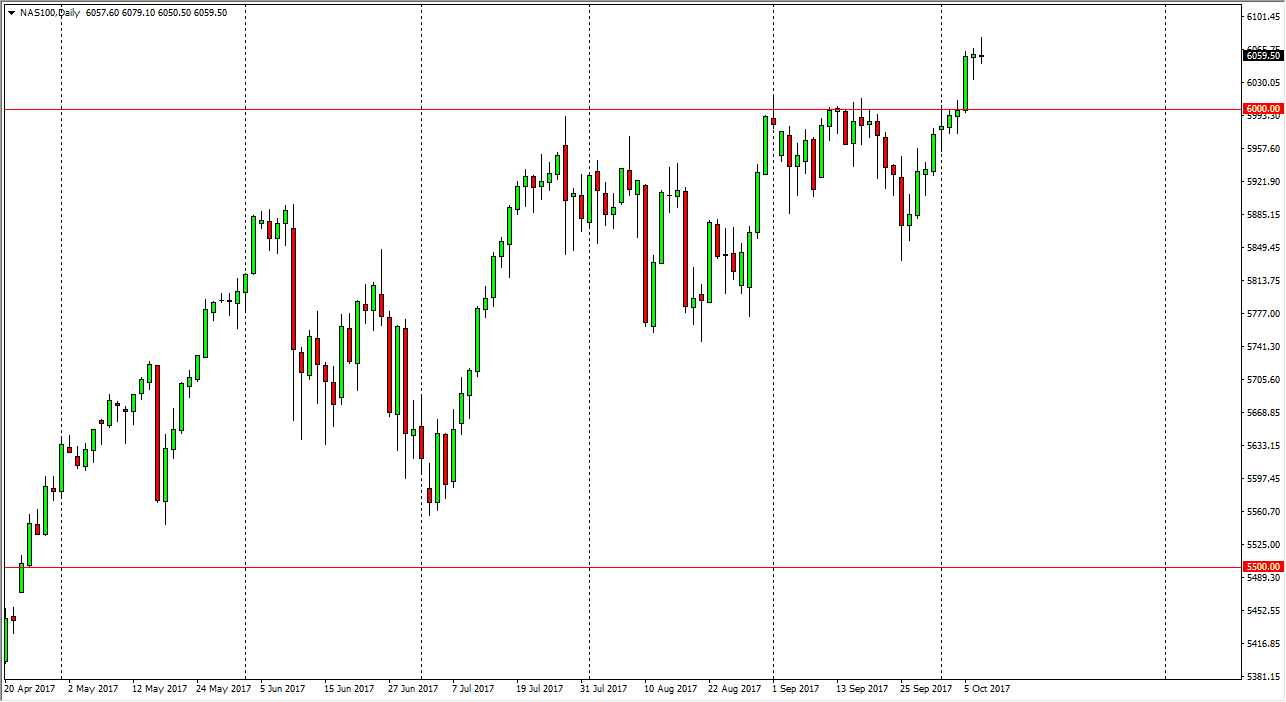

NASDAQ 100

The NASDAQ 100 initially one higher during the day on Monday, but turned around to form a shooting star. It was preceded by a hammer on Friday, and a very massively impulsive candle on Thursday. I think the 6000-level underneath should be supportive, as it was massively resistive in the past. I think that pullbacks coming back towards that area should offer value the people take advantage of. I think the given enough time; the market should then go to the 6100 level above. Ultimately, I think that the market then reaches towards the 6200 level after that. I have no interest in shorting this market, I think the buyers are most certainly in control, but we may be just a bit overbought in the short term, which of course gives us an opportunity to pick up value underneath.