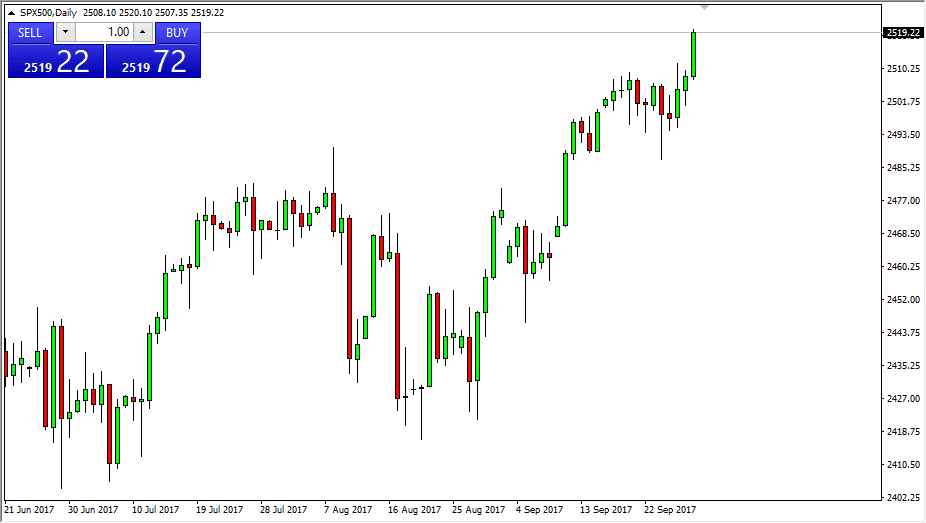

S&P 500

The S&P 500 broke higher on Friday, clearing the 2515 level handling. The market closed towards the top of the end of the range for the day, which of course is a very bullish sign as well, sending this market looking for higher levels before it is all said and done. I believe the pullback should find plenty of support below, especially near the 2500 level, possibly even the 2510 level. Because of this, I look at this is a market that is a “buy on the dips” scenario. I believe that we will go looking towards the 2525 level next, and then possibly the 2550 level. I have no interest in shorting the S&P 500, as it looks ready to leave the rest of American indices much higher.

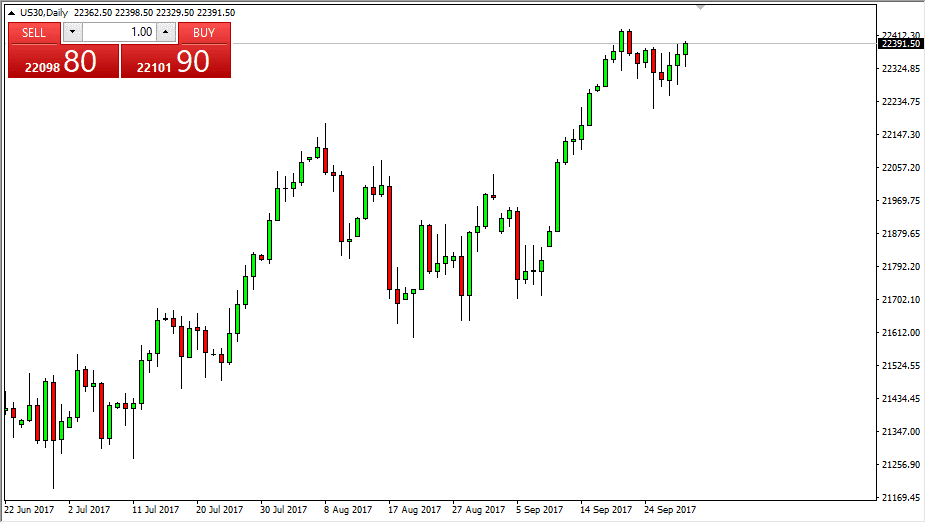

Dow Jones 30

Initially, the Dow Jones pulled back on Friday, but found more than enough support near the 22,325 level to turn around and start rallying again. Because of this, the market looks likely to continue to the upside. I think if we can get just a bit more bullish pressure, we should be able to reach the 22,500 level without too many issues. A break above there should send this market much higher, perhaps looking towards the 22,750 level, followed very shortly by 23,000. I believe that the Dow Jones will continue to do quite well as there has been a bit of a sector rotation out of technology and into industrials in America, and I think that should be a trend that continues. I have no interest in selling, I believe that the 22,300 level will now act as a floor in the market that looks ready to go much higher. Stock markets in general look healthy, there is no reason to fight this overall trend.