Gold prices fell $8.55 an ounce on Monday as the U.S. dollar’s strength against other currencies weighed on the market. In economic news, the Institute for Supply Management (ISM) reported that its index of manufacturing activity climbed to 60.8 from 58.8 a month earlier. A heavy slate of key economic indicators will be released this week, including ADP non-farm employment change and ISM services PMI, but of course the highlight of the week will come on Friday when the Labor Department releases its employment report for September.

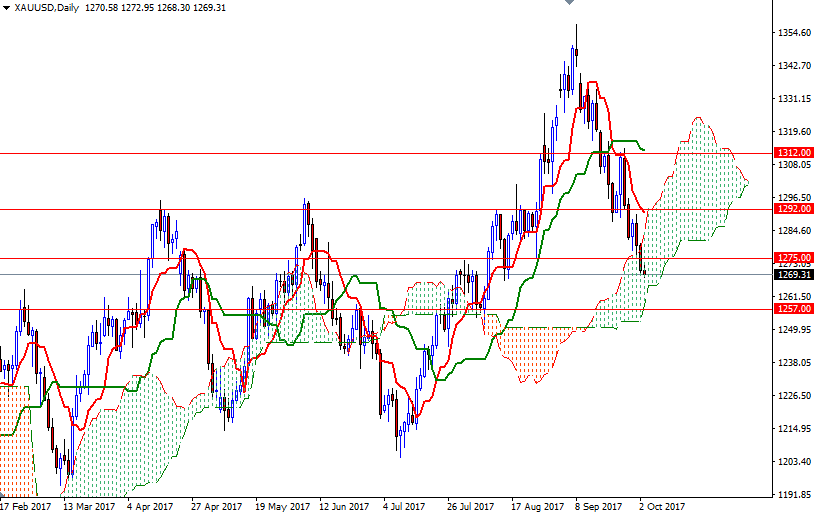

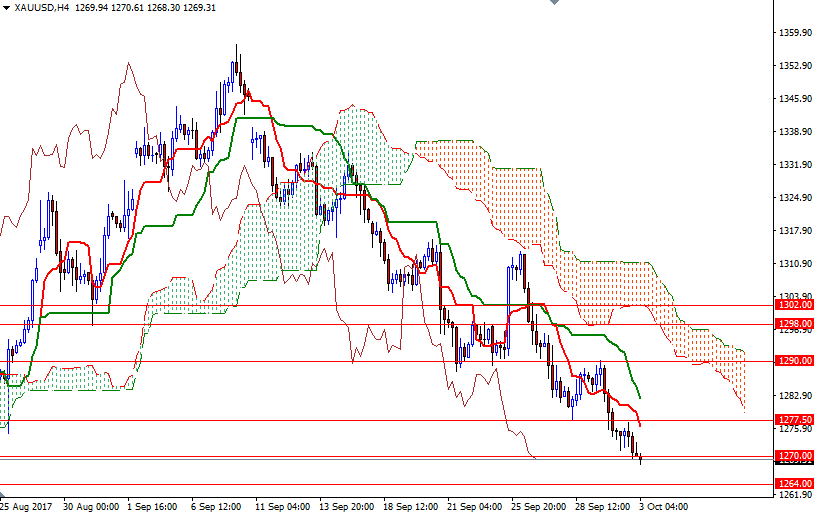

From a chart perspective, the short-term outlook remains bearish as the market continues to trade below the Ichimoku cloud on the 4-hourly chart. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned on both the daily and the 4-hourly time frames. In addition to that, the Chikou span (closing price plotted 26 periods behind, brown line) is moving below prices.

To the downside, the supports such as 1267 and 1264/3 stand out at first glance but since prices are moving within the borders of the daily cloud, it makes more sense to pay a bit more attention to this region rather than specific levels. If prices fall through 1264/3, the bears will be targeting 1257/4 and 1248. XAU/USD has to push its way through the 1277.50-1275 level in order to test the next barriers at 1284/2 and 1292/0. If the market can cleanly break above the 1292 level, we may see a push up to the top of the 4-hourly cloud.