The GBP/JPY was under bearish pressure below 148 level, which supports the bearish corrective move of this pair. The renewed worries regarding BREXIT negotiations, and the contrast inflation data from the UK, increased the bearish pressure on the pair. If the GBP/JPY manages to break through support at 147.70, then it will be more bearish towards 145.00 level.

Yesterday the pair was monitoring important inflation data and today it is monitoring job and wages average data, while tomorrow there will be retail sales data release.The data has strong influence on the sterling performance.

The GBP/JPY will continue in a bearish trend as long as it’s trading below the psychologically important level of 150.00 for a number of sessions, in light of a risk evasion trend and towards save heaves led by the Yen, with renewed fears of imminent confrontation between the US and North Korea. The pressure on the Pound increased recently in light of the difficult BREXIT negotiations, and the UK Prime Minister went again to the EU to revive the negotiations process in a situation that suites all parties. This was after comments of an EU official that the negotiations with the UK have reached an impasse. This week the Pound is going to closely monitor important British data in the form of inflation levels, job market numbers, wages, retail sales and comments around the monetary policy of the Bank of England.

The Pound is still supported by the BoE near tightening of the monetary policy, as despite the bank maintaining interest rates as is, voices have risen within the bank calling for more hawkish policy and higher rates, as in comments of the Carney, the governor of BoE, after inflation level became higher than the bank’s 2% target and reached 2.9%, along with a better UK job data, while the wages average remained as is.

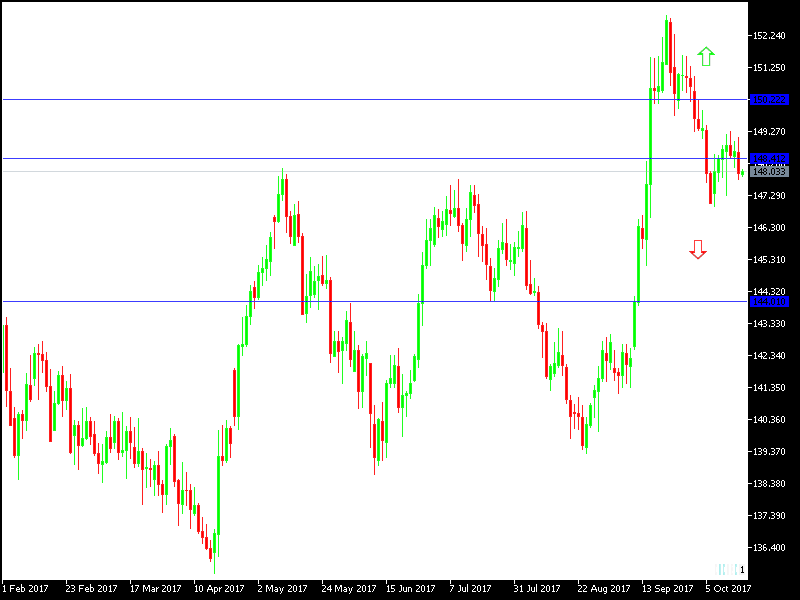

Technically: The GBP/JPY pair broke the upward movement and went below the psychologically important level at 150.00. As expected in previous analysis, moving below that level supports strong bearish trend. Nearest support levels are currently at 148, 147 and 146. On the bullish side, there will be no chance for the pair to move upwards without breaking above 150.

On the economic data front: The pair isn’t waiting for any important data today, and will focus on job data and wages from the UK. The pair’s movement is going to be on lookout for save heaven appeal led by the Yen, in case of any renewed geopolitical fears at any time.