The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 8th October 2017

Last week, I saw the best possible trade for the coming week as long of the Euro, and short of the Japanese Yen. The result was negative, as the EUR/JPY fell by 0.56%.

The Forex market over the past week has moved more firmly into a U.S. Dollar counter-trend mode, along with a weak British Pound. The news was dominated by the U.S. Federal Reserve’s more hawkish expression of its anticipated monetary policy tack, and a mixed result on Friday with a tightening Labor market but weaker jobs numbers seeing the Dollar gain initially, but give up those gains at the end of the session.

The news agenda this week is almost certainly going to be dominated by U.S. data, the most important of which is likely to be the FOMC Meeting Minutes, as well as later CPI and Retail Sales data. There is also speculation as to whether the Trump administration will certify Iran as in compliance with the nuclear deal, the deadline for which is next Sunday. This question could create greater risk-on or risk-off sentiment.

The British Pound has been falling steadily for four weeks, and was by far the biggest mover of the major currencies last week. The position of the British government has continued to deteriorate following a disastrous party conference for the Government, prompting renewed speculation over the continuing leadership of Prime Minister May, as pessimism over Brexit and the political split within the governing Conservative Party deepens. There was also some poorer than expected economic data released.

The American stock market has again taken off, making new all-time highs which is always a bullish sign.

Following the current picture, I see the highest probability trades this week as long of the U.S. Dollar, and short of the British Pound, and long of the S&P 500 in U.S. Dollar terms.

Fundamental Analysis & Market Sentiment

Sentiment is currently quite bullish on the U.S. Dollar even though it is still technically in a downwards trend. The major event likely to dominate the market this week will be key U.S. data on Friday and Wednesday.

The market remains bearish on the British Pound.

Political events are likely to come more strongly into the foreground this week concerning potential conflict between the United States and Iran and North Korea.

Technical Analysis

U.S. Dollar Index

This pair printed a large bullish candlestick, although there is a sizable upper wick on the candle. This signifies a still deeper bullish retracement and hints at a major trend change from bearish to bullish. The outlook is now considerably more bullish. The resistance level at 12012 has been tested, but has held so far. Another bullish sign is the weekly close above the long-term bearish trend line, as shown in the chart below.

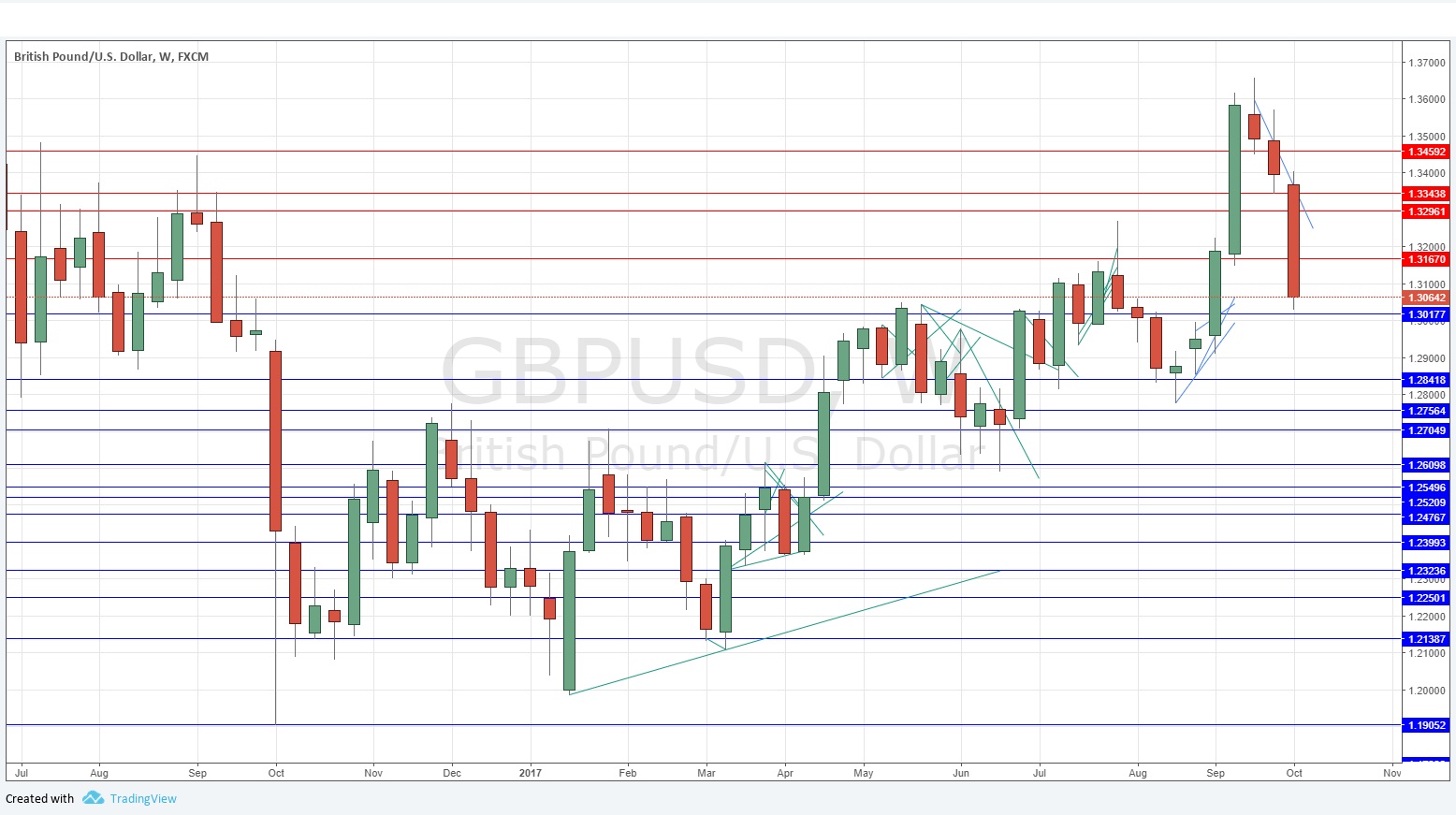

GBP/USD

Although this pair is technically still within a bullish trend, showing a sequence of higher lows and highs in the chart below as well as being above its levels from both three and six months ago, it is looking bearish. There is a steady, steeping drop in price, cutting through support levels like a knife through butter. Although the fall will probably stabilize soon, the Pound looks weaker than every other currency, and the momentum suggests that it has further to fall. A break below 1.3000 would suggest a further steep fall is imminent.

S&P 500

We see here new all-time highs and the chart below shows just how steadily bullish the trend has been. There is every reason to continue to be bullish despite the endless articles in the press forecasting an imminent market crash. This talk has been going on for months while the market just keeps going up and up, albeit on quite low volatility. Trade what you see, not what the papers say, and what we see here is a strongly bullish market.

Conclusion

Bullish on the S&P 500; bearish on the British Pound.