The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 15th October 2017

Last week, I saw the best possible trades for the coming week as short GBP/USD, and long of the S&P 500 Index in U.S. Dollars. The overall result was negative, as the GBP/USD rose by 1.64%, while the S&P 500 Index rose by only 0.26%, producing an average loss of 0.69%.

The Forex market over the past week has moved against the U.S. Dollar again, in line with the long-term bearish trend in the greenback. The news was not really dominated by anything decisive beyond the weak Core CPI number, and the market’s movements were quite small.

The news agenda this week is almost certainly going to be dominated by British and Chinese economic data releases. The British Pound has been very volatile in recent weeks, and due to the calendar, this is likely to continue over the following week. It recovered quite strongly last week.

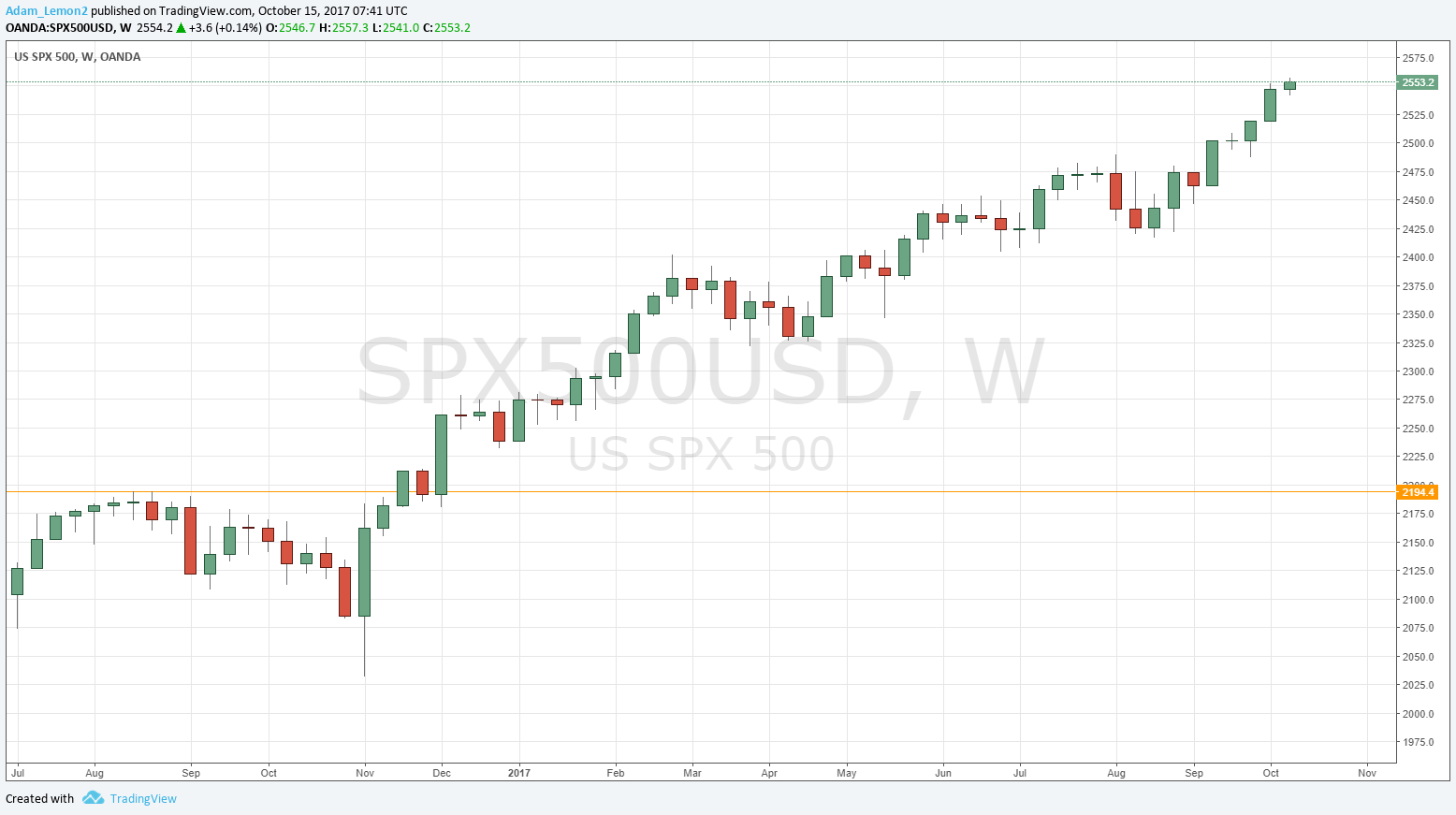

The American stock market is still making new all-time highs which is always a bullish sign.

Following the current picture, I see the highest probability trades this week as long of the British Pound against the U.S. Dollar, and long of the S&P 500 in U.S. Dollar terms.

Fundamental Analysis & Market Sentiment

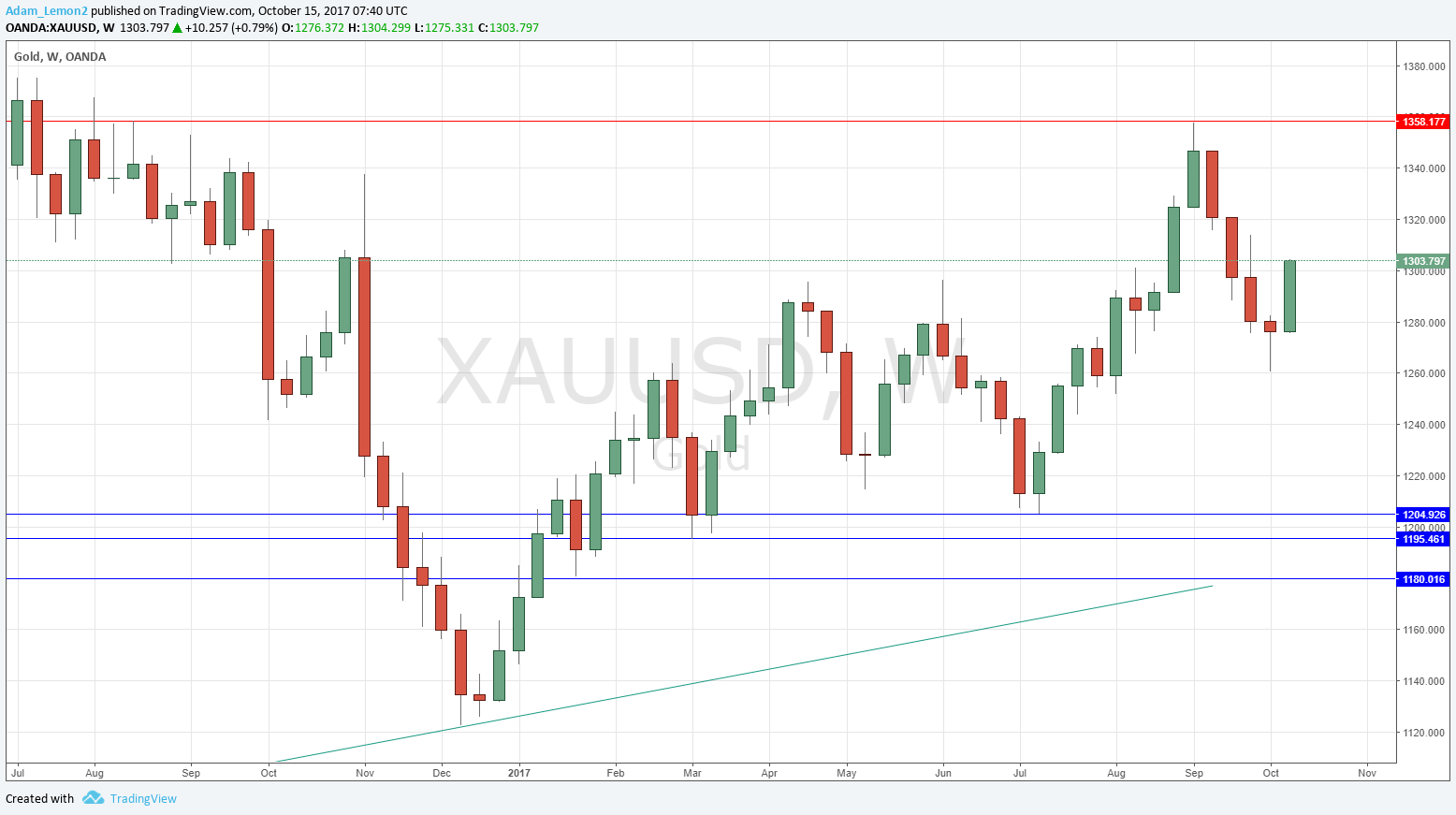

Sentiment is currently more bearish on the U.S. Dollar following last week’s worse than expected Core CPI data. Following President Trump’s decertification of the Iran deal, there may be an increase in geopolitical tension this week, which could weaken the U.S. Dollar against safe havens such as the Japanese Yen and precious metals such as Gold.

Technical Analysis

U.S. Dollar Index

This pair printed a large bearish candlestick, clearly rejecting the resistance level at 12012 which has held firmly. Another bearish sign is the weekly close back below the long-term bearish trend line, as shown in the chart below. The trend is clearly bearish and there is no reason not to expect that to continue, although the low of recent weeks is not far away, and this area could become supportive.

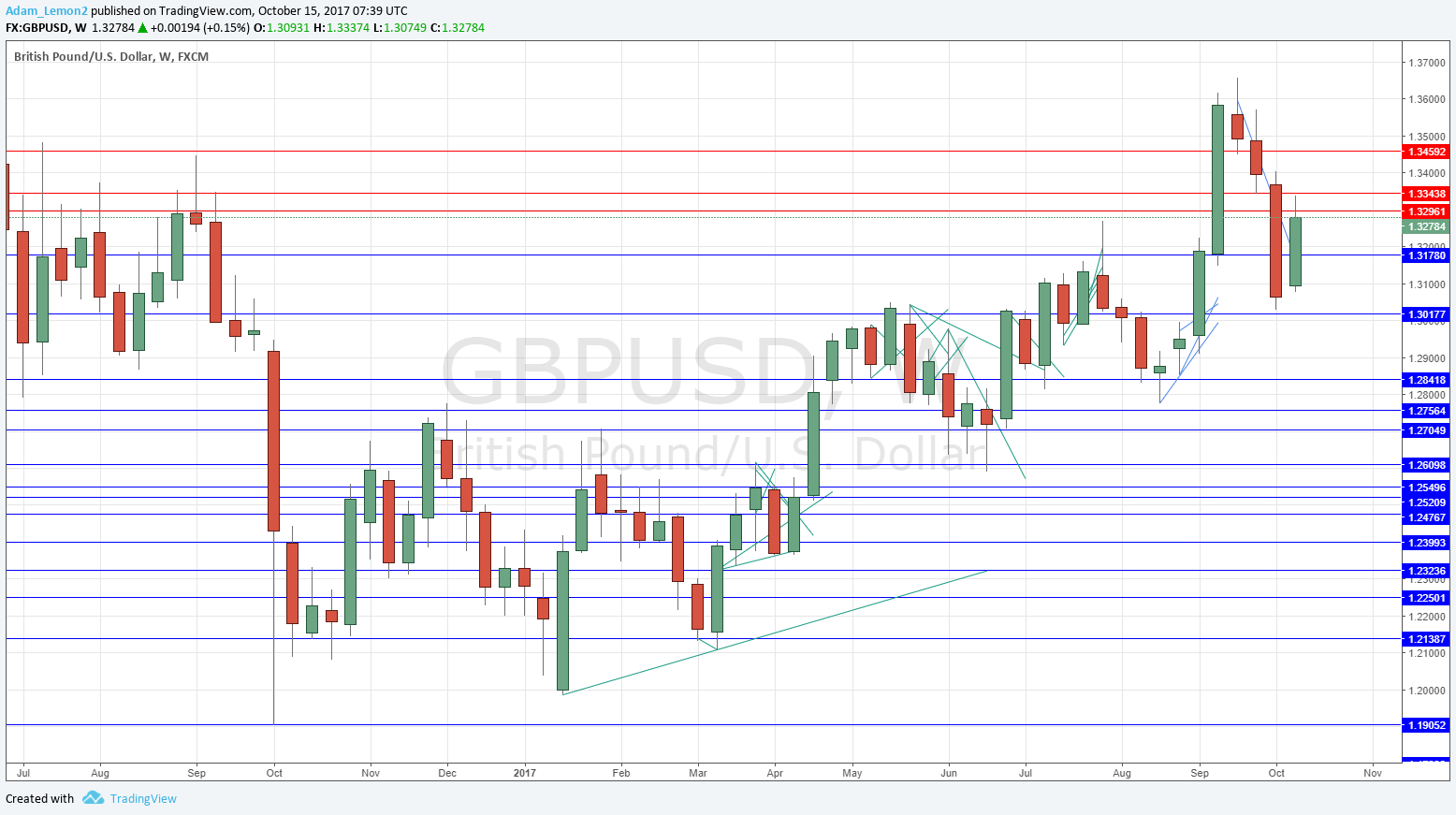

GBP/USD

This pair has the highest level of volatility among all the major Forex currency pairs. It looked very bearish last week, but has been able to recover quite strongly, and closed near the high of its weekly range. The price is technically still within a bullish trend, showing a sequence of higher lows and highs in the chart below as well as being above its levels from both three and six months ago. However, the nature of the last few weeks in the chart below suggests the action over the short-term might not be very strong directionally, so even though a further rise is most likely next week, it would not be surprising if any increase was not very strong.

S&P 500

We again see new all-time highs here, and the chart below shows just how steadily bullish the trend has been. There is every reason to continue to be bullish despite the endless articles in the press forecasting an imminent market crash. This talk has been going on for months while the market just keeps going up and up, albeit on very low volatility. Trade what you see, not what the papers say, and what we see here is a strongly bullish market.

GOLD

There is a clearly bullish trend, and we have just had an extremely bullish week thanks to weakness in the greenback and a focus on the Iranian nuclear issue. The price is above its levels of both 3 and 6 months ago and the long-term weekly chart below shows a continuing sequence of higher lows. It looks as if this has a good chance to rise higher still over the coming week, with no obvious strong resistance to watch out for until about $1350.

Conclusion

Bullish on the British Pound, Gold, and the S&P 500; bearish on the U.S. Dollar.