The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 29th October 2017

Last week, I saw the best possible trades for the coming week as long USD/JPY, short NZD/USD, and long of the S&P 500 Index in U.S. Dollars. The overall result was positive, as the USD/JPY rose by 0.11%, the NZD/USD fell by 1.19%, and the S&P 500 Index rose by 0.13%, producing an average win of 0.48%.

The Forex market over the past week has continued in favor of the U.S. Dollar again, and may now have invalidated the long-term bearish trend in the greenback. The news was dominated by better than expected U.S. advance GDP data, although the U.S. Dollar fell in the hours after the release.

The news agenda this week is almost certainly going to be dominated by U.S. Non-Farm Payrolls data due Friday, as well as central bank input from the Bank of Japan.

The American stock market is still making new all-time highs which is always a bullish sign, despite the low volatility.

Following the current picture, I see the highest probability trades this week as long of the U.S. Dollar against the Swiss Franc and the Euro, and long of the S&P 500 in U.S. Dollar terms. Apart from the stock market, there are few clear strong trends in the market now.

Fundamental Analysis & Market Sentiment

Sentiment is currently more bullish on the U.S. Dollar and stocks following a more positive outlook on the U.S. economy as GDP data looks to be stronger than expected. As there are no major U.S. releases scheduled until Wednesday, this mood is likely to continue until that day at least. President Trump will during the week name the next Chair of the Federal Reserve, and it might not be the incumbent Janet Yellen, so the greenback is also likely to be affected by this.

The Japanese Yen has reached an important technical point ahead of the Bank of Japan’s monthly guidance due on Tuesday, so we might see an important move in the Yen after that.

Sentiment has been very bearish on the New Zealand Dollar following the establishment of a Labour coalition government in New Zealand,

Technical Analysis

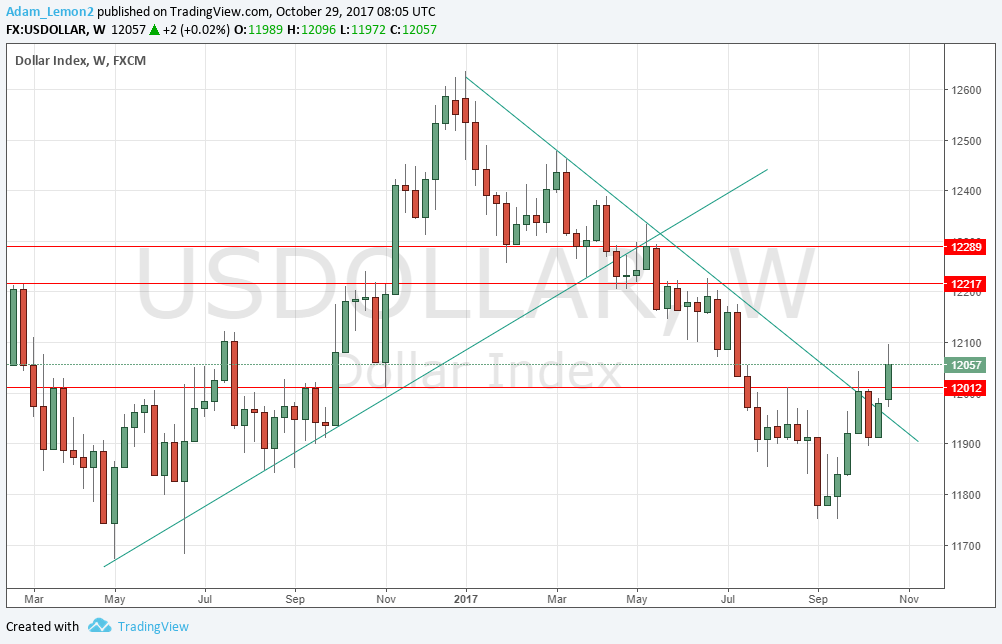

U.S. Dollar Index

This pair printed a reasonably large bullish break-out candlestick, invalidating the long-term bearish trend and closing above the former resistance level at 12012. However, there is an indication of the price running into resistance just below 12100 which may make a further immediate advance difficult. It would not be a surprise if we begin a period of consolidation and uncertainty following the end of the recent bearish trend.

USD/CHF

This pair is an upwards trend and has a lot of bullish momentum behind it. Although there is a long upper week on the latest weekly candlestick which can be seen in the chart below, as well as the very important psychological level of parity at 1.0000 above the weekly close, I still think it is likely that the price will rise further here. It is true that this pair usually does not like to trend, but it seems to be a in firm trend right now.

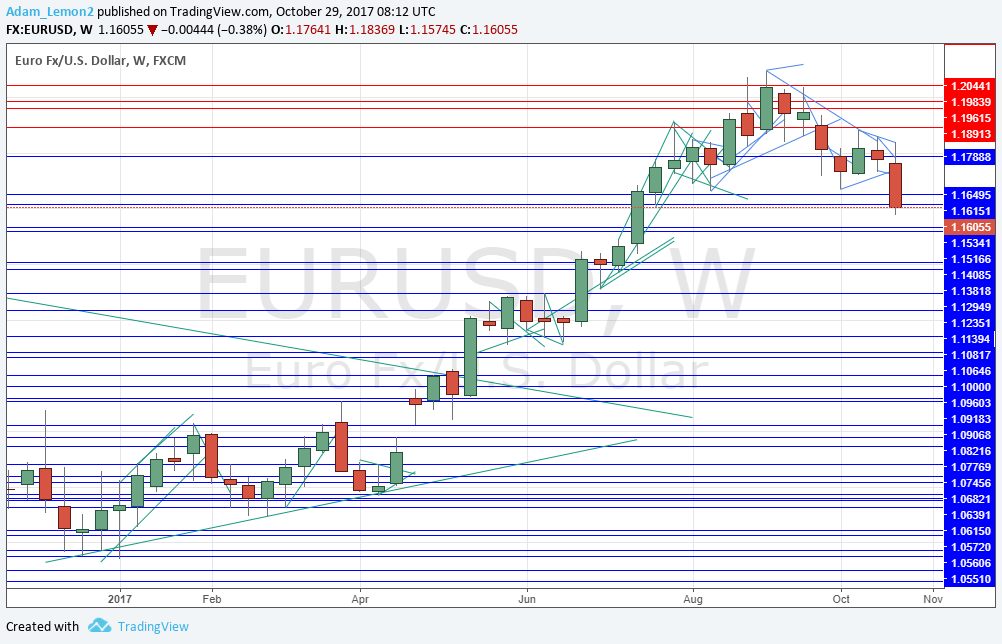

EUR/USD

The price former a large bearish candle closing near its low last week. The weekly close was the lowest in 14 weeks, so it must be said now that the long-term bullish trend is over. The action is very indicative of a turn and the momentum suggests that the price has further to fall. There is nothing obviously fundamental driving the bearish move, but the price now looks as if it will fall to about 1.1500 at least.

S&P 500

We again see new all-time highs here, and the chart below shows just how steadily bullish the trend has been. There is every reason to continue to be bullish despite the endless articles in the press forecasting an imminent market crash. This talk has been going on for months while the market just keeps going up and up, albeit on very low volatility. Trade what you see, not what the papers say, and what we see here is a strongly bullish market.

Conclusion

Bullish on the U.S. Dollar, and the S&P 500; bearish on the Swiss Franc and the Euro.