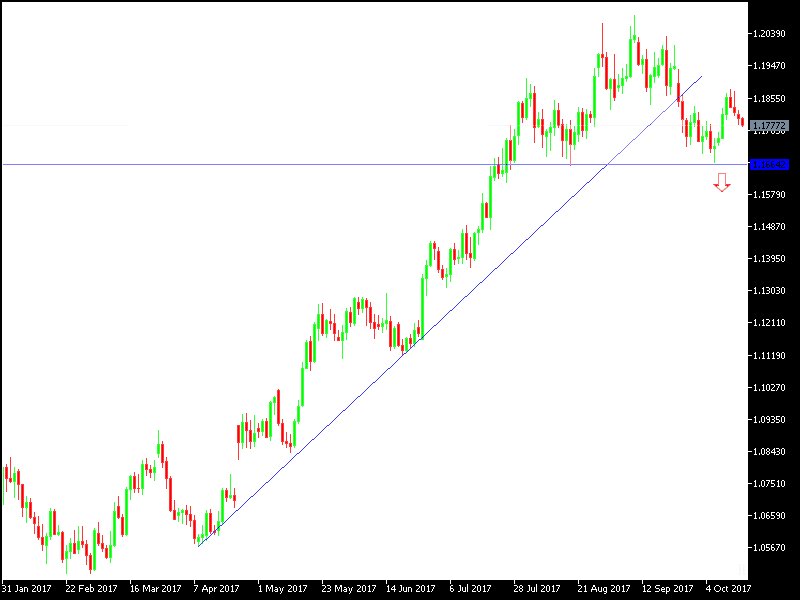

Before the release of the inflation data- CPI of the Eurozone, the EUR/USD was under bearish pressures for corrections to the support level at 1.1774 at the beginning of Tuesday’s trades, and the pair is established around that level at the time of writing. During the corrections movement of the pair reaching to the peak at 1.1880 during last week, with the USD strength coming back and the markets absorption of the US inflation data, which came below expectations, as there is still a chance for higher interest rates before the end of this year. The US stock markets continues achieving record highs and the USD index is increasing again towards 93.41 after retreating to 92.82. Today’s data might have an effect on the pair.

The recent gains for the Euro were based on the optimism of tighter monetary policy from the ECB and the latest pressure on the USD was due to contrast performance of the US jobs and what was mentioned in the last Fed’s minutes of meeting, all of which contributed to more support for gains to the EUR/USD. The content of the Fed’s last minutes of meeting showed a split between the Fed’s members regarding the path of higher interest rates in light of current inflation levels in the country, which are still far from the bank’s 2% target. This split increased the pressure on the USD, as the USD index, which measures the dollar’s performance against a basket of 6 major currencies, retreated to below 93 and reached to 92.82.

The US job data, was disappointing, and expections for the strong bounce of the wages in the country, and lower unemployment level, and all analyses showed the negative impact of the hurricanes that recently hit the country leading to lower US jobs for the first time in seven years. Despite what was in the Fed’s minutes, the USD is still supported by expectations of a third raise of interest rates before the end of this year, and 3 raises during next year.

Technically: The EUR/USD pair will continue its bearish movement in case of a move to support areas at 1.1700 and 1.1600. the bullish chance will stand and be stronger in case of a move on top of the peaks at 1.1800 and 1.1885, because that will support the pair’s move towards the psychologically important peak at 1.2000.

On the economic data front: The economic agenda today shows that the pair will be expecting the release of the ZEW confidence index from Germany and the CPI from the Eurozone. From the US, there will be an announcement of the manufacturing production data. The pair will continue moving based on the market sentiment with a contrast monetary policy between the Fed Reserve and the ECB.