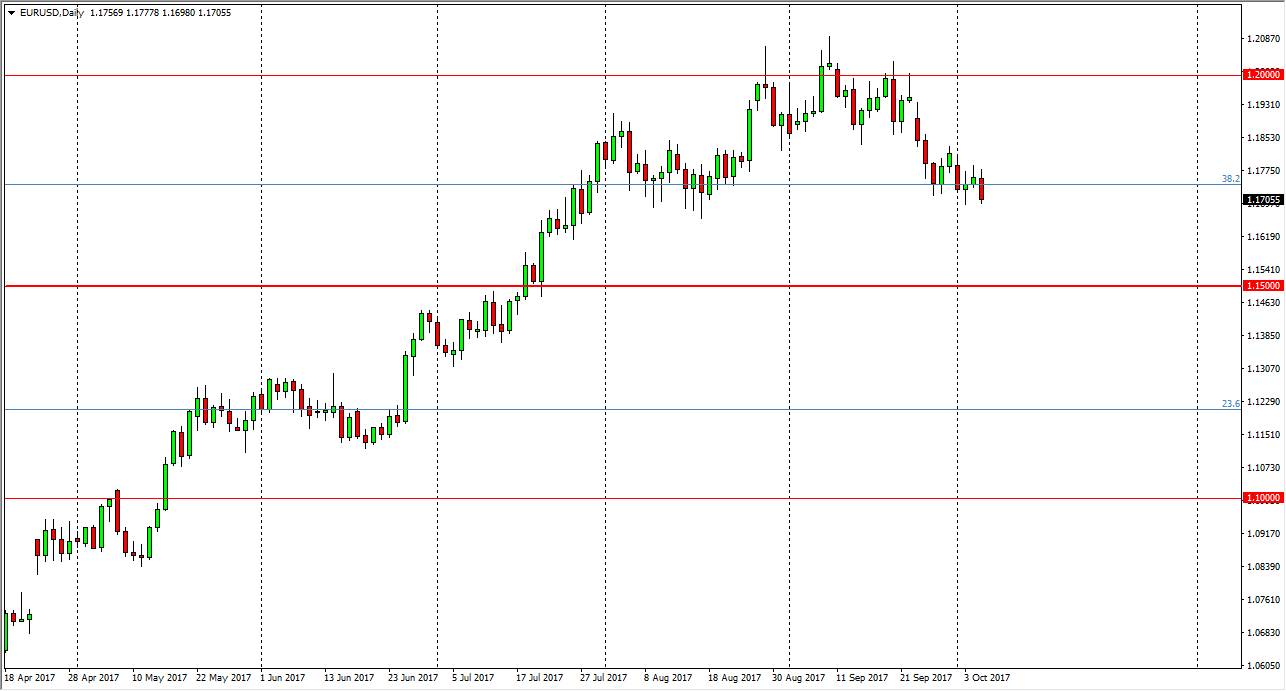

EUR/USD

The EUR/USD pair initially tried to rally during the Thursday session, but rolled over to reach towards the 1.17 level as the ECB failed to say anything hawkish during the session as expected. Because of this, we could find ourselves dropping below the 1.17 level, and perhaps reaching towards the 1.15 level underneath. That’s an area that was massively resistive, and breaking above there was a very bullish sign, and a signal that we could go as high as the 1.25 level over the longer term. The 1.20 level being massive resistance makes sense, because it is such a large, round, psychologically significant number. Ultimately, I think that we are going to drop a little bit lower, but given enough time I think that the buyers will come back to jump into this pair.

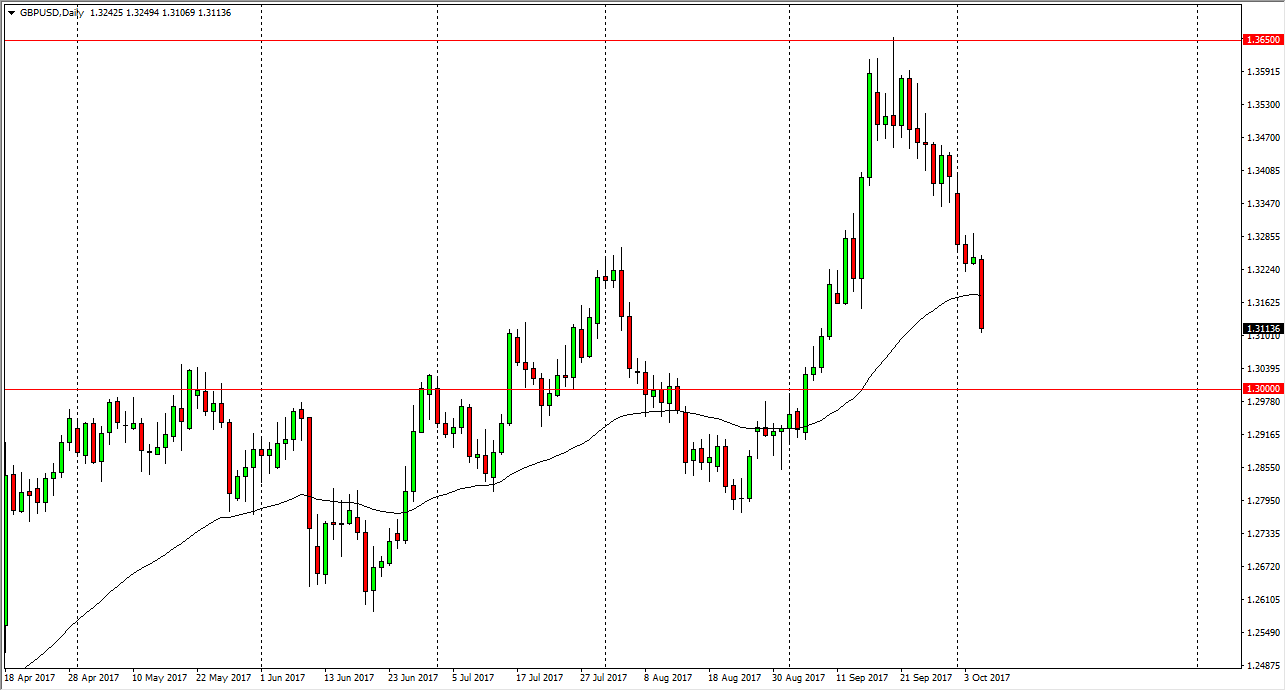

GBP/USD

The British pound fell significantly during the day as the British government continues to have issues coming to some type of consensus. Because of this, we could find ourselves dropping to the 1.30 level underneath, which is a large, round, psychologically significant number. The very negative candle for the session on Thursday suggests that we are going to see some continuation to the downside, and therefore I think that the buyers will wait for momentum to die out. The markets should continue to find buyers given enough time, mainly because the Bank of England looks all but assured to raise interest rates. Even though the Federal Reserve is looking to tighten monetary policy, most traders are starting to question whether they can. Either way, if we can break down below the 1.29 level, then the market should break down massively, and could continue to drop with significant momentum. The ride higher would be very choppy and slow though, so keep that in mind.