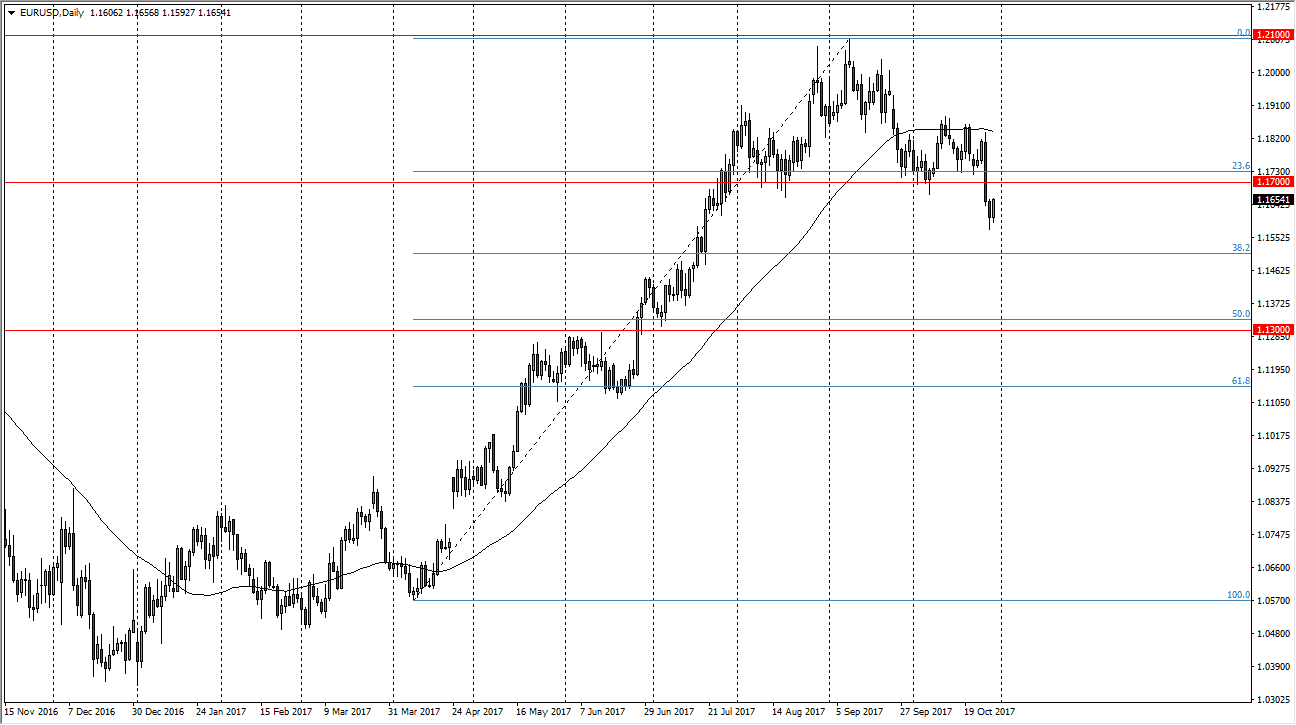

EUR/USD

The EUR/USD pair rallied a bit during the day on Monday, as we look likely to reach towards the 1.17 level above. That’s an area that has been supportive in the past, and should now be resistive. It was the neckline of the head and shoulders, but given enough time I think the market should reach towards the 1.13 level, as it is that the measurement for the head and shoulders pattern. If we were to break above the 1.1750 level, the market would probably go higher. I think eventually the buyers will return, but right now it looks likely that we need to pull back in that makes quite a bit of sense considering that the ECB has suddenly sounded so dovish. If we were to break down below the 1.13 level, I think we would then go looking to fill the gap below, somewhere near the 1.08 handle.

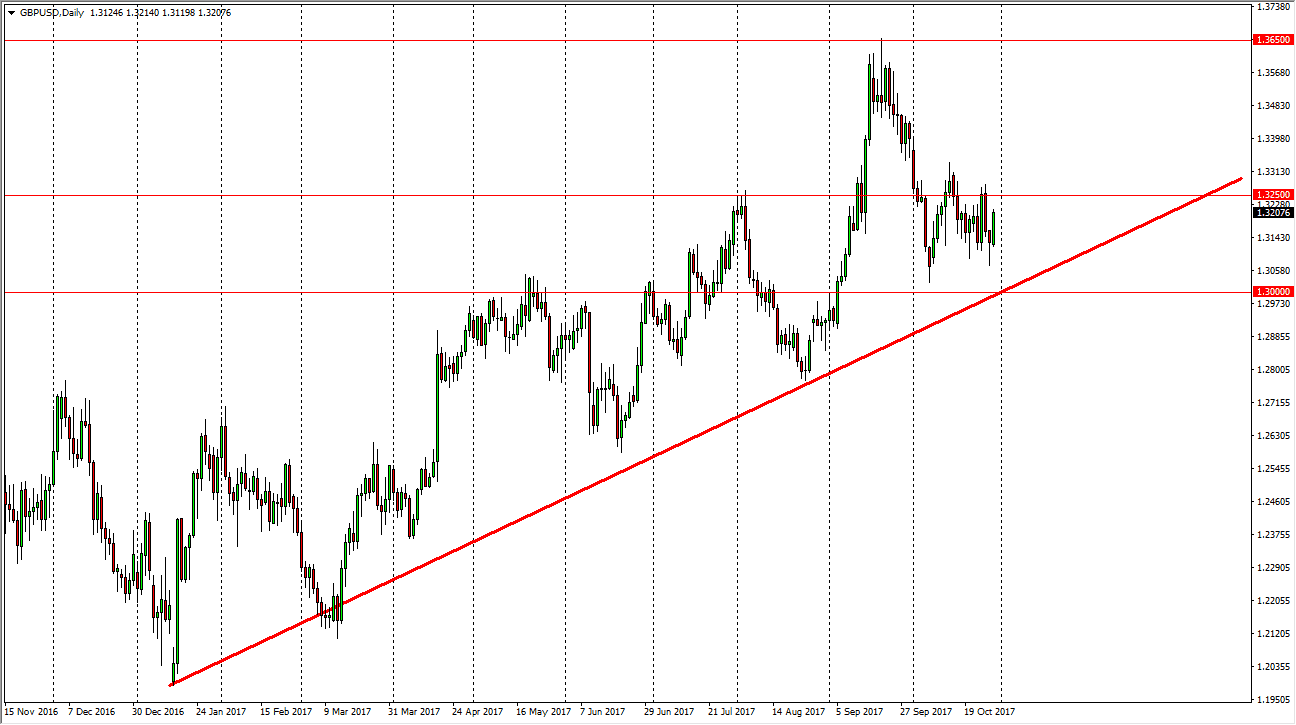

GBP/USD

The British pound rallied during the day on Monday, breaking the top of a hammer. That is a very good sign, and I think we will probably test the 1.3250 level. If we can break above the 1.33 handle, the market should then go to the psychologically significant 1.35 handle, and then eventually the recent highs at the 1.3650 level. Ultimately, that’s the area where the market gapped lower after the vote to leave the European Union was announced, so it makes sense that we should continue to see that area be massively resistive. If we were to break above there, that would be an extraordinarily bullish sign. In the meantime, I’m looking at the uptrend line as a guide, so therefore I like buying dips. The Bank of England looks likely to raise interest rates rather soon, as inflation has been picking up.