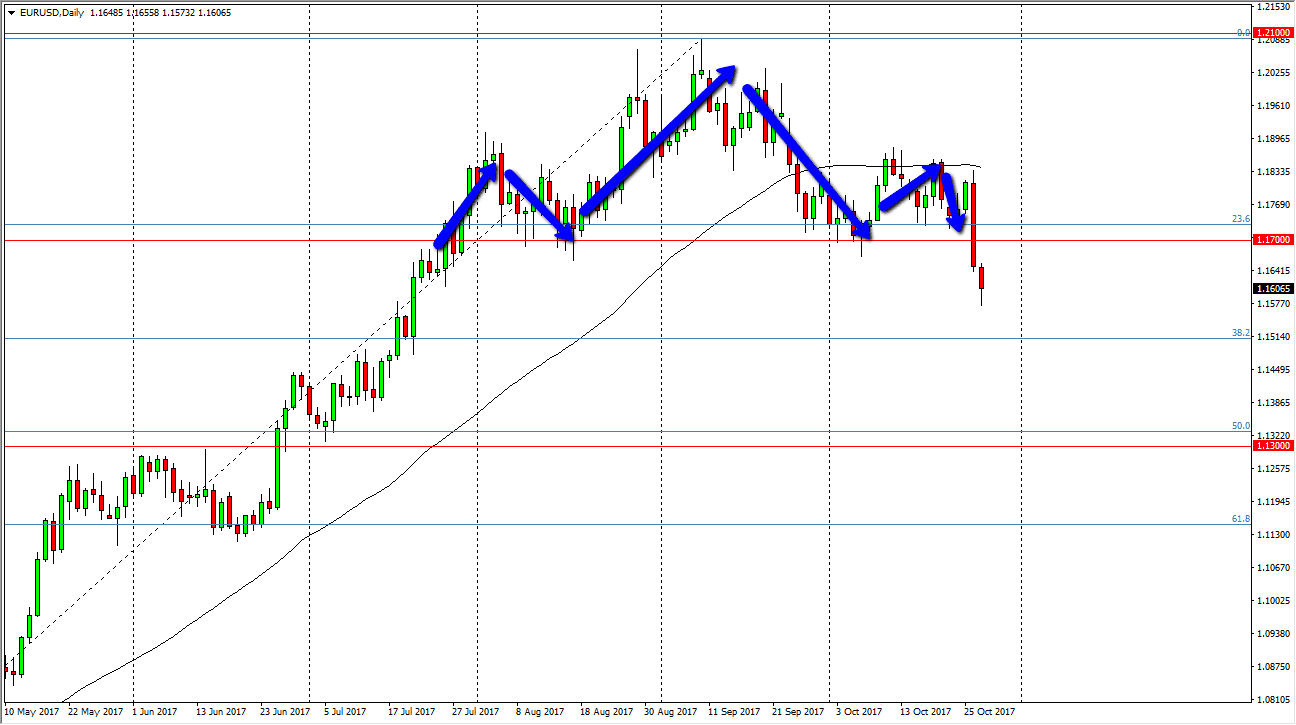

EUR/USD

The EUR/USD pair broke down on Friday, continuing the nasty looking fall that we had on Thursday. We now have broken the neckline of a head and shoulders pattern, so I think we will go looking towards the 1.13 level over the longer term. I anticipate that any rally at this point will probably find sellers near the 1.17 level, and any signs of exhaustion would be a nice opportunity to pick up value in the US dollar. With the Federal Reserve looking to raise interest rates and Mario Draghi looking dovish, it makes sense that we continue to drop. The 1.13 level also coincides nicely with the 50% Fibonacci retracement level from the massive move higher. I believe that the next several sessions should be negative, and as a result I have no interest in buying. If we did break above the 50-day moving average, that might change everything.

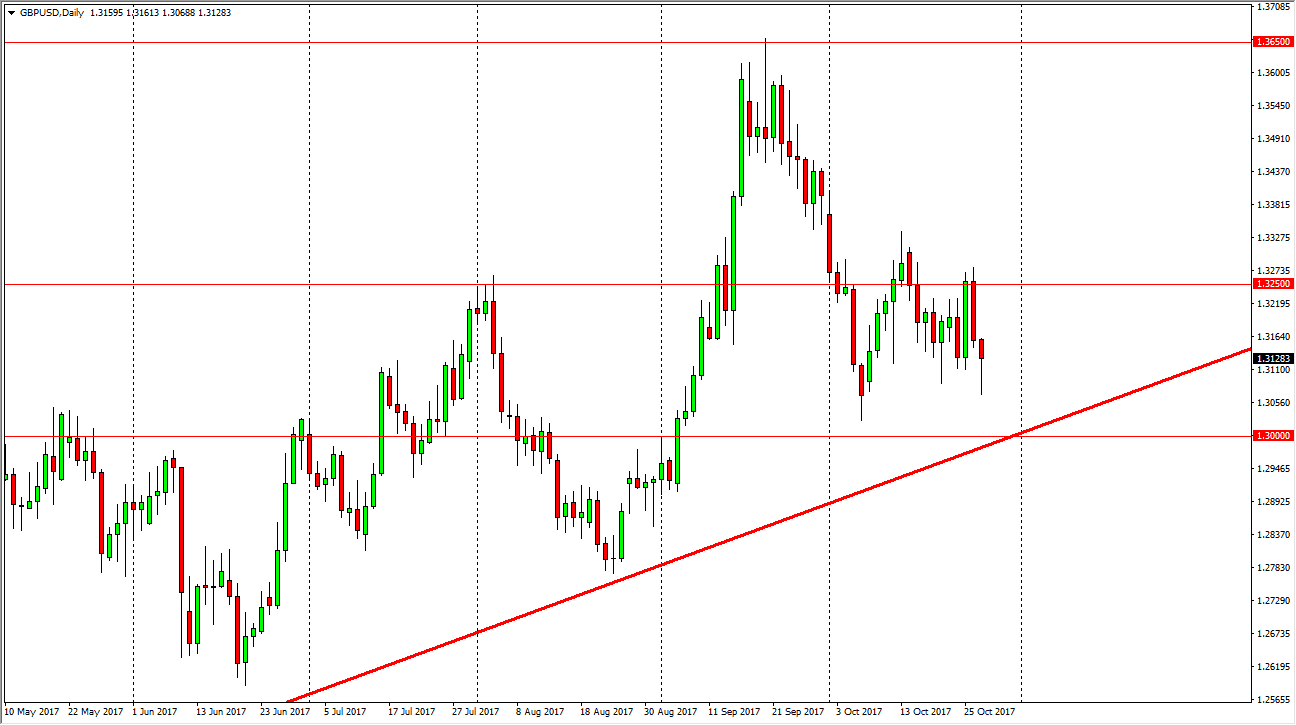

GBP/USD

The British pound fell significantly on Friday, but as you can see by the daily close, when it up forming a nice-looking hammer. The hammer of course is a bullish sign, and we have a significant amount of support below, especially near the 1.30 level. I think we are going to continue to find buyers in this general vicinity, and that we will go looking towards the 1.3250 level above. That’s an area that will offer resistance, but a break above there, the market should then go to the 1.35 handle, and then eventually the 1.3650 level after that. Ultimately, I think that the market is a “buy on the dips” situation, but if we break down below the 1.30 level, then I think the British pound may be in trouble, perhaps reaching down to the 1.27 level after that.