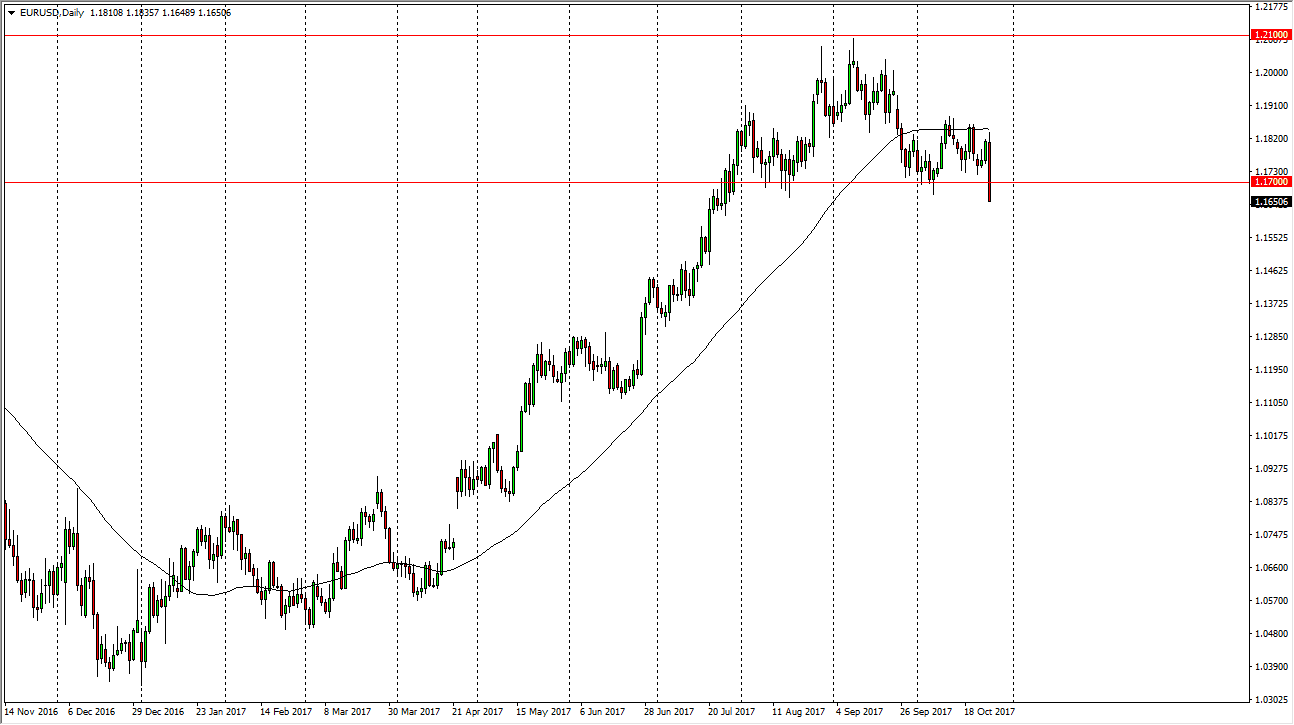

EUR/USD

The EUR/USD pair broke down significantly on Thursday, triggering a head and shoulders. Because of this, I think the market continues to go lower, and short-term rallies should end up being selling opportunities. The 1.17 level above will probably act as resistance now, and the head and shoulders shape suggesting that we go down to the 1.13 level longer term. Mario Draghi suggested also that we would have continued quantitative easing, at least for roughly a year, although it would only be half as much as previously found in the European Union. I think that the pair continues to find resistive, and I have no interest in buying this market until we clear the 50-day exponential moving average, currently near the 1.1850 handle. Is going to be volatile, but I think the US dollar is starting to pick up steam against most currencies anyway.

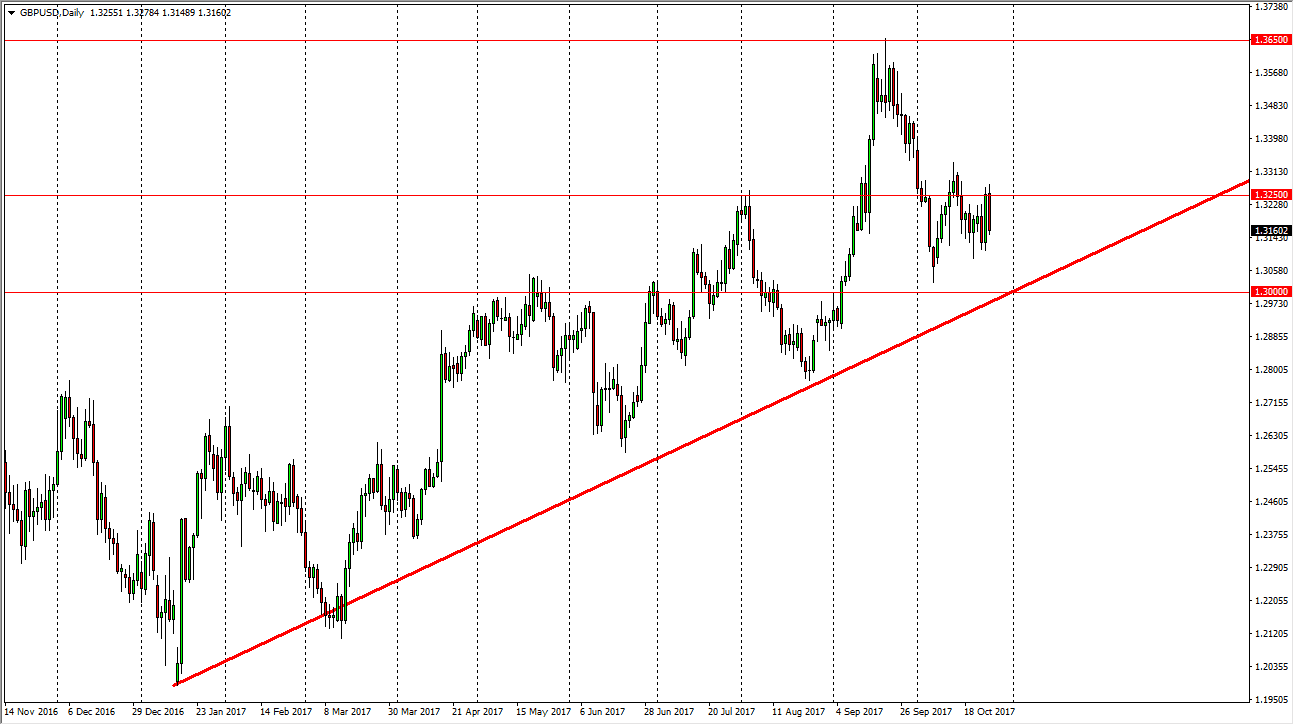

GBP/USD

The British pound initially tried to rally during the day on Thursday, but found the 1.3250 level to be a bit exhaustive. Because of this, the market rolled over and it now looks as if it’s going to go down to the 1.31 handle below, perhaps even the 1.30 level after that. I think that the market will continue to favor the upside longer-term though, because we do have a significant uptrend line that dissects the 1.30 level underneath, and of course we have the Bank of England looking likely to raise interest rates. I know that the Federal Reserve will raise interest rates as well, but the Bank of England has the benefit of a currency that is so undervalued that quite frankly it’s cheaper to buy it here that would be the US dollar longer term. Simply put, I think we’re going to try to reach towards the 1.3650 level above.