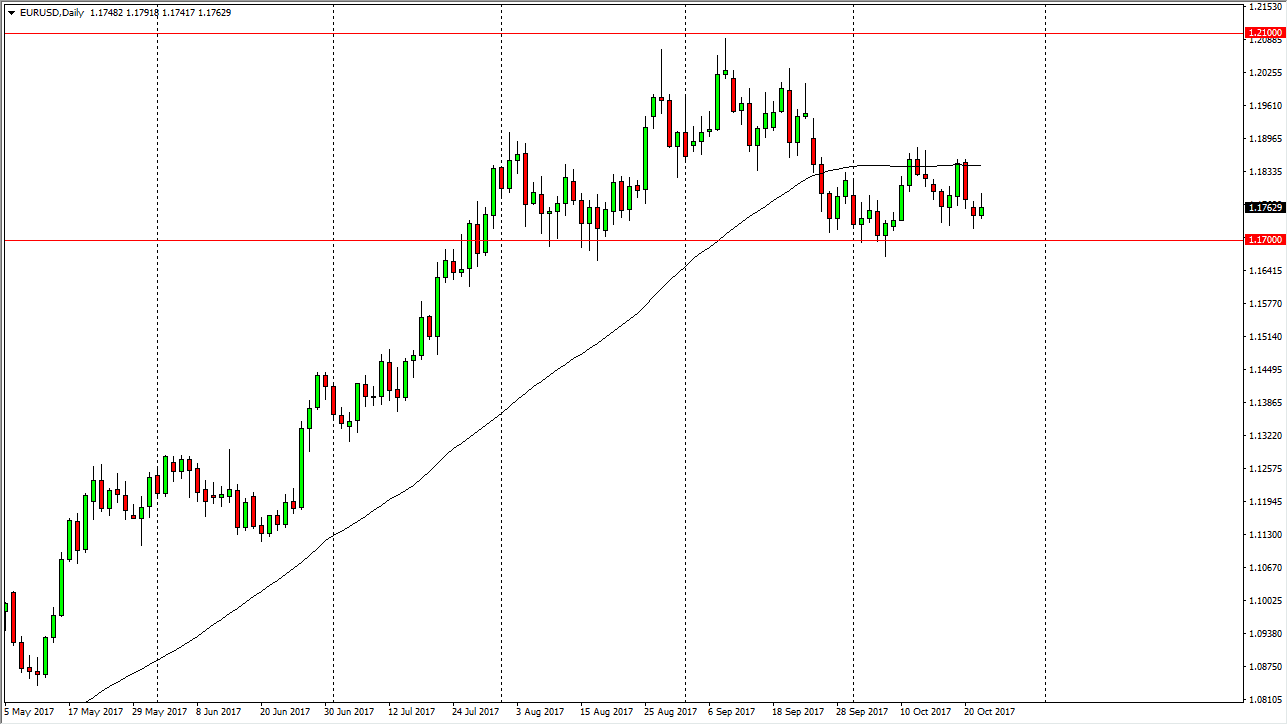

EUR/USD

The EUR/USD pair tried to rally during the day on Tuesday, but gave back most of the gains, to form a bit of a shooting star. The shooting star sits just above the significant 1.17 level, so I think at this point if we can make a fresh, new low, the market should be sold rather drastically, as it would be a head and shoulders pattern giving way and could send this market as low as the 1.13 level based upon the pattern. Alternately, if we can break above the 50-day exponential moving average, then I think the market will go looking towards the 1.20 level above, and then the 1.21 level. I think most of what we are about to see is due to central bank speed more than anything else, so having said that it’s likely we will continue to see a lot of noise.

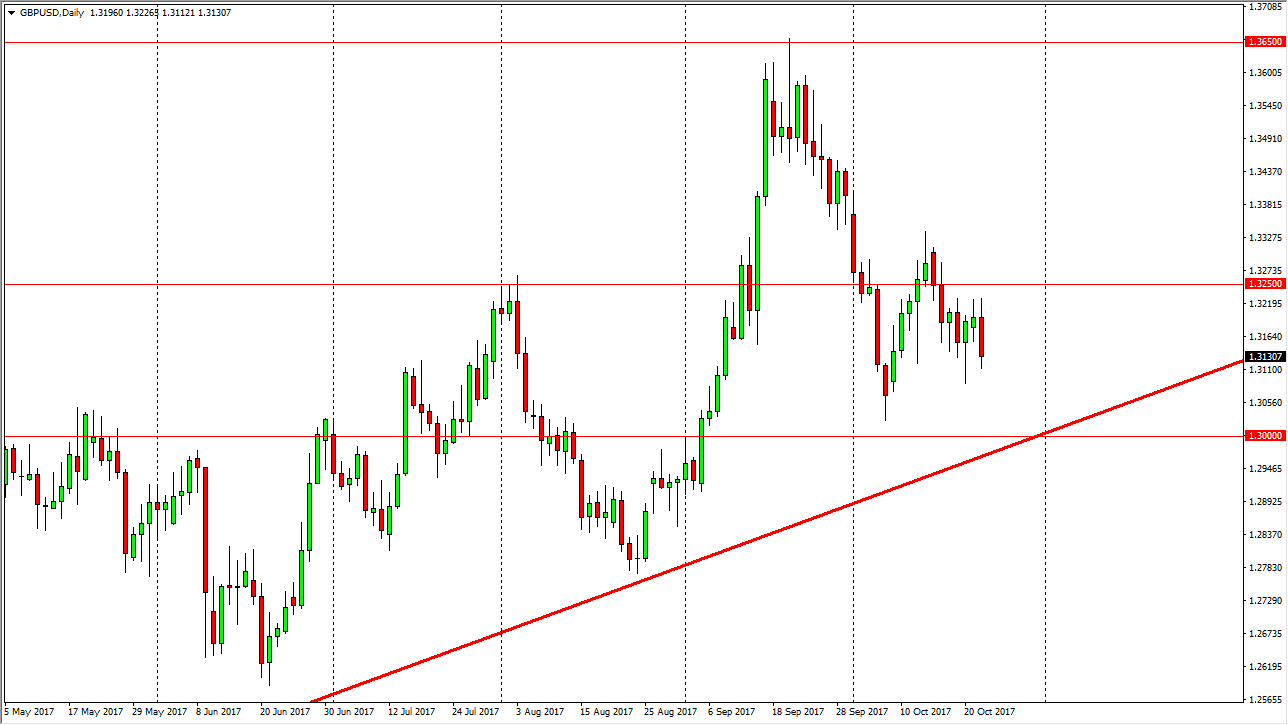

GBP/USD

The British pound initially tried to rally during the day but ended up finding the 1.32 level to be a bit too resistive. We turned around to show signs of weakness, testing the hammer from the Friday session. I believe that the uptrend line below should continue to keep the market afloat, with a bit of a “floor” at the 1.30 level. Ultimately, I believe that the buyers will return to this market, so I’m looking for a reason to go long, probably from the short-term charts. A break above the 1.3250 level should send this market much higher, but until then, I think you must deal with significant volatility but also look for value in this market. If we were to break down below the 1.30 level, that would be very negative and send this market much lower.