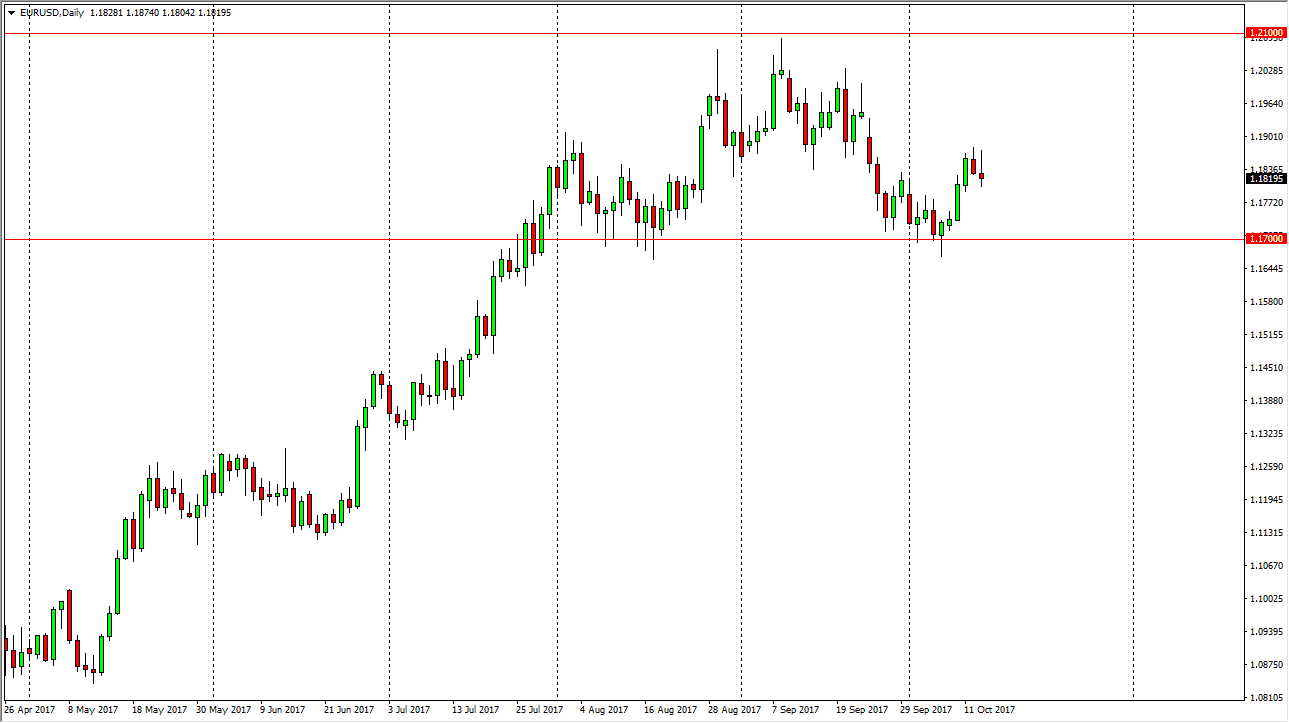

EUR/USD

The EUR/USD pair tried to rally on Friday, but found enough trouble at the 1.19 level to turn around and form a shooting star like candle. This suggests that we may see a bit of selling in the short-term, but the longer-term still looks healthy to me. The overall attitude of the market still looks like it’s bullish to me, and I think that we will go looking for higher levels. The 1.17 level underneath should continue to be supportive, and I think that buyers will return after this dip, and I think that there is enough support at the 1.17 level to turn the market around. However, if we were to break down below there, the market should then go looking towards the 1.15 level which is psychologically important. I still have a target of 1.20 or even higher, and then a longer-term target of 1.25.

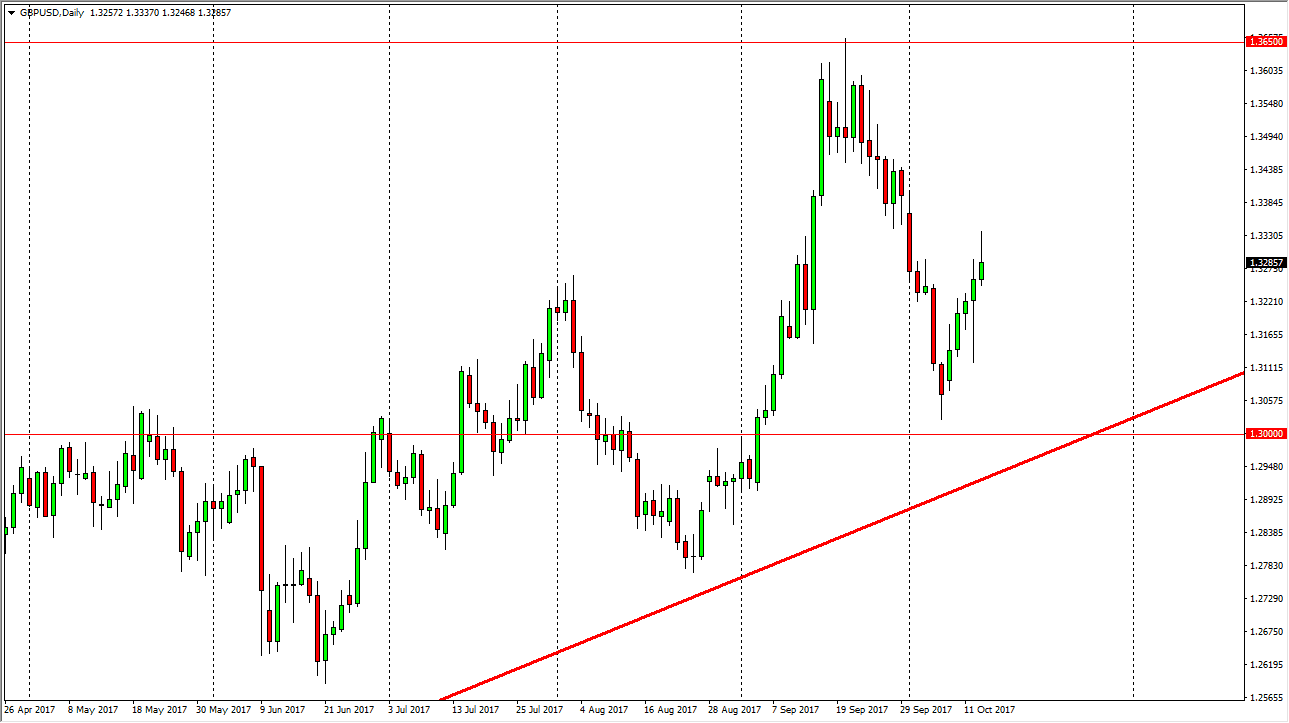

GBP/USD

The British pound has had a good week, but you can see that the 1.33 level has offered a bit of resistance. The shooting star on Friday suggests that we may need to pull back but after the action on Thursday, I believe that the buyers will return rather quickly. I look at this dip as a value proposition, and will treat it as such. However, we could break above the top of the shooting star first, and if we do the am a buyer there as well. I think ultimately that this continues to be a “buy on the dips market, and that we will go looking towards the 1.3650 level again rather soon. I am bullish of this market and have no interest in shorting until we break significantly below the 1.30 level. Expect choppiness, but quite frankly that’s normal in this market.