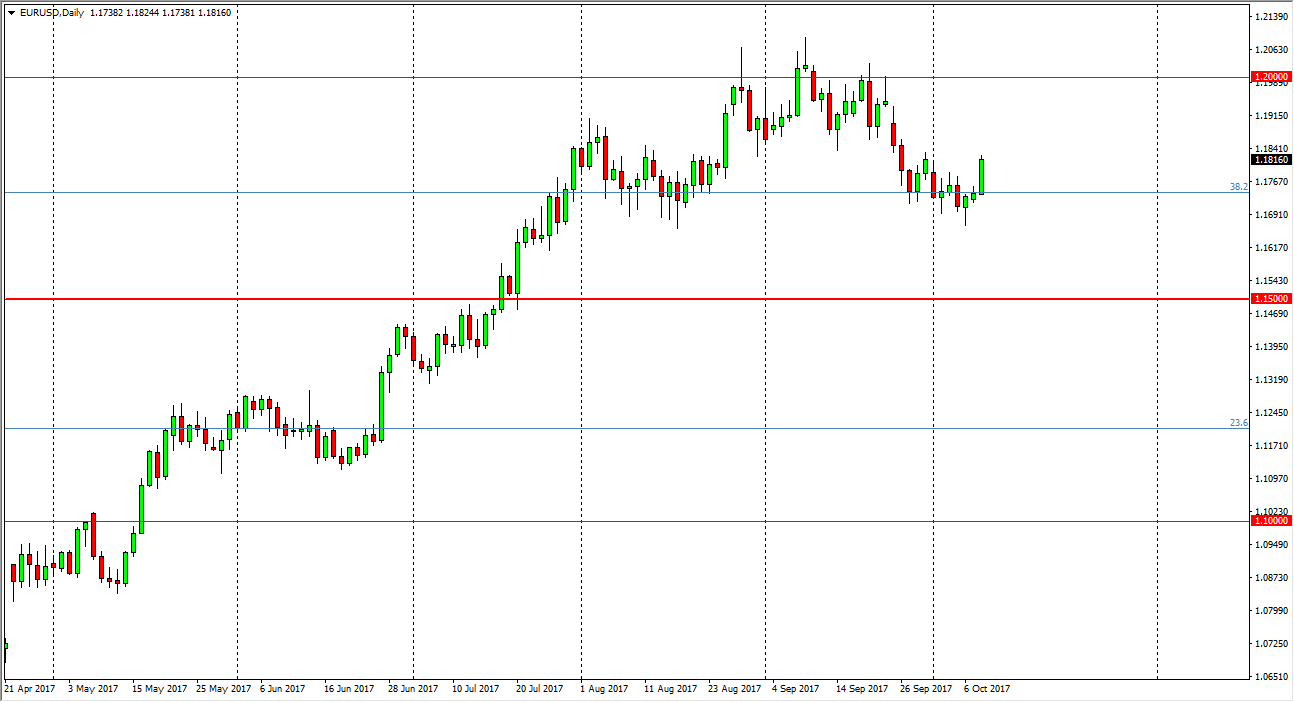

EUR/USD

The EUR/USD pair broke out to the upside during the trading session on Tuesday, slicing through the 1.18 level. Now that we are above there, I think that the market can continue to go higher, perhaps reaching towards the 1.20 level above. I think that short-term pullbacks will continue to be buying opportunities, and after the FOMC Meeting Minutes about during the day today, it’s likely that we will make a decision about the US dollar going forward. Ultimately, I believe in the longer-term uptrend, so I think that we will continue to try to break out to the upside, but I think there will be a lot of noise between now and then. Ultimately, I think that the 1.15 level underneath is the absolute “floor” in the uptrend. Longer-term, I’m expecting to see this market reach towards the 1.25 level.

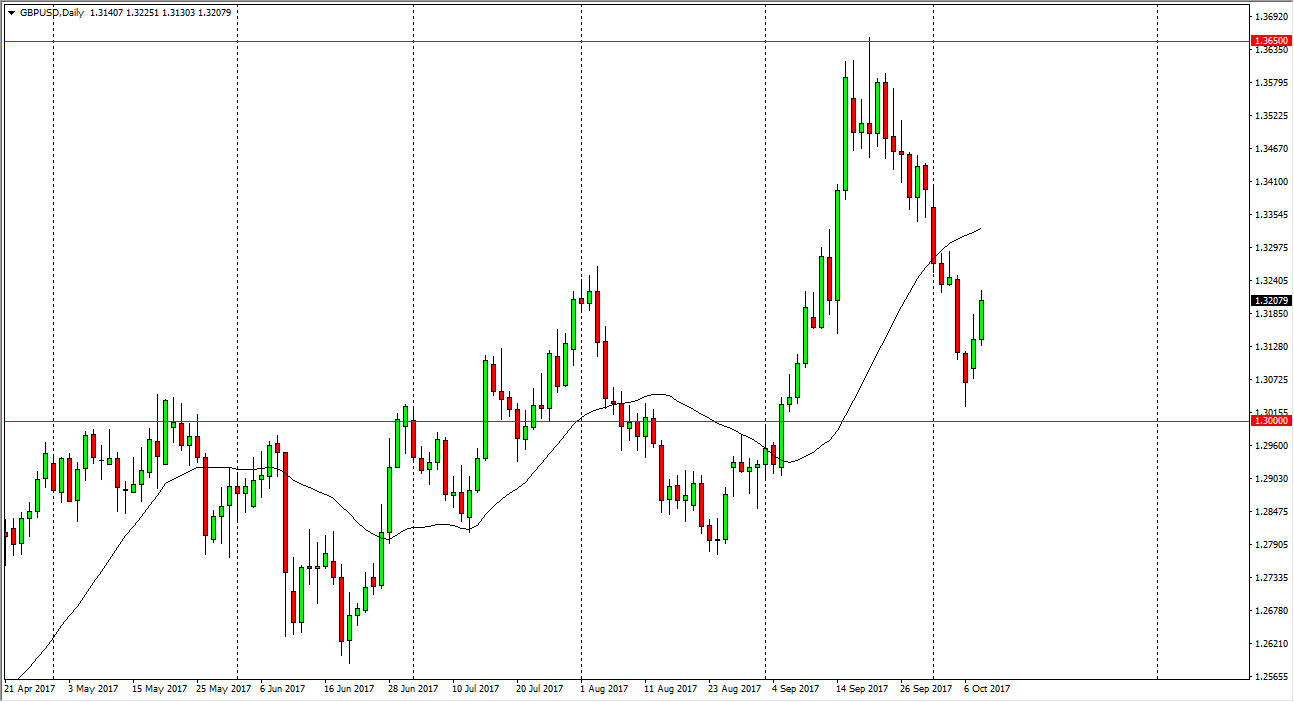

GBP/USD

The British pound rallied during the day on Tuesday, reaching towards the 1.32 level. If we can break above there, the market should continue to go higher, especially if we can break above the 1.33 level, because it should then send this market towards the 1.3650 level above. That’s an area where we had seen the pair break down significantly and gap lower after the vote to leave the European Union. I think eventually we will break above there, but it is going to take a significant amount of momentum to do so. Because of this, I think in the short term it’s a buying opportunity every time we dip, but we have a much longer-term outlook of higher interest rates coming out of both central banks. That being said, it looks like we are going to go higher but it will take several attempts to finally break free and have a “buy-and-hold” market. I believe the 1.30 level is essentially the floor.