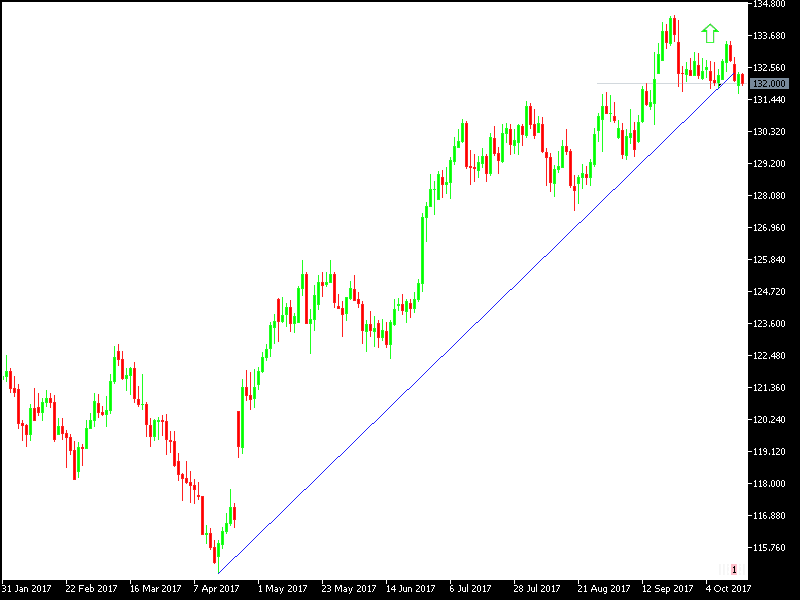

The EUR/JPY retreated yesterday to the support level at 131.65 during yesterday’s trades, in light of the correction path going on for three sessions after a gain to the peak at 133.48 during last week's transactions. The retreat was normal with the renewed geopolitical fears and increased move towards safe heaves and therefore more support for the JPY to achieve gains against other majors.

On the daily chart for the EUR/JPY, we can clearly see that the pair was facing strong resistance at 133.48 for two sessions before moving downwards. Despite that, the pair is still performing better than other Yen pairs. However, the gains are threatened by geopolitical fears with expectations of a flared situation between the US and North Korea, with the latter preparing for stronger test, as expected by South Korea. The Euro's current gains were supported by higher voices within the ECB and EU towards ending the stimulation plans adopted by the bank to revive European economy, which is supporting Euro gains against other majors.

We must take into consideration that any new political worries in the Eurozone, and the return of financial fears among international geopolitical fears, is considered strong opportunity for a bullish move on safe heaves led by JPY, CHF and gold. Therefore, the pair might move downwards to support at 132.00 and 131.00 levels if these fears mount, and there were updates on ground. Increasing pressure on the Euro was comments from the ECB’s governor, Draghi, on how strong the Euro is, affecting the Bank’s stimulation efforts.

Technically: As mentioned before, and reconfirmed now, as long as the pair is established on top of 130.00, the general look of the pair will continue upwards, the bullish on top of 132.00 will be a stronger technical bullish move for the pair, and establishing on top of there will support the move towards peaks at 133.75 and 134.20. On the bearish side, the nearest levels of support for the pair will be 131.80, 131.00 and 130.00. As mentioned in previous analysis, and confirmed now, buying from lower levels is the best strategy for this pair.

On the economic data front: The economic agenda today will focus on the market reactions towards inflation data from the Eurozone and the German ZEW index. Markets will also watch the political situation in Japan and will carefully watch for any developments for safe heave demands led by JPY in case of increased geopolitical fears around the US and North Korea, or any political anxiety within the Trump administration.