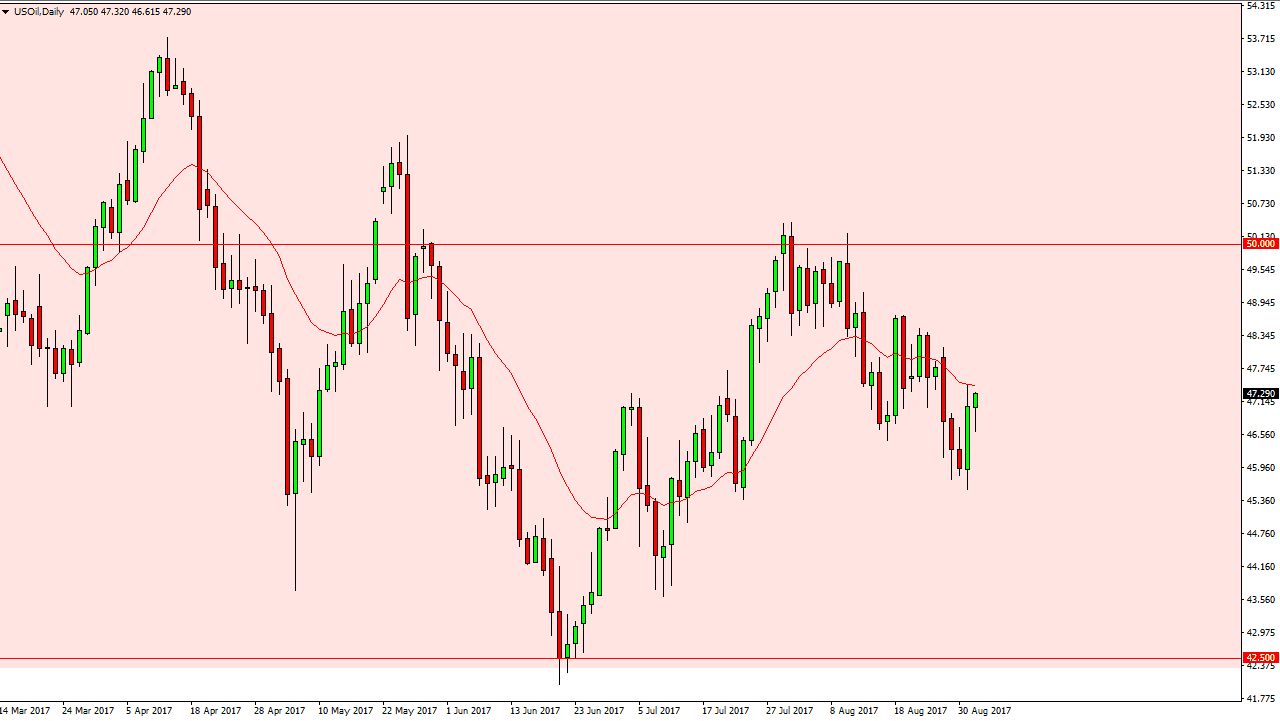

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Friday, but turned around to form a hammer. This is a very bullish sign, and I would also point out that the weekly candle is a hammer. That tells me that there is plenty of buying pressure underneath, and I think that at least in the short run, the market should continue to go higher. It’s going to be choppy, and it’s not to be easy to hang on to the trade, but I think we will probably go looking towards the $50 level above. I suspect that there is quite a bit of resistance in that area, so it would not surprise me at all to see the market turn right back around at that level.

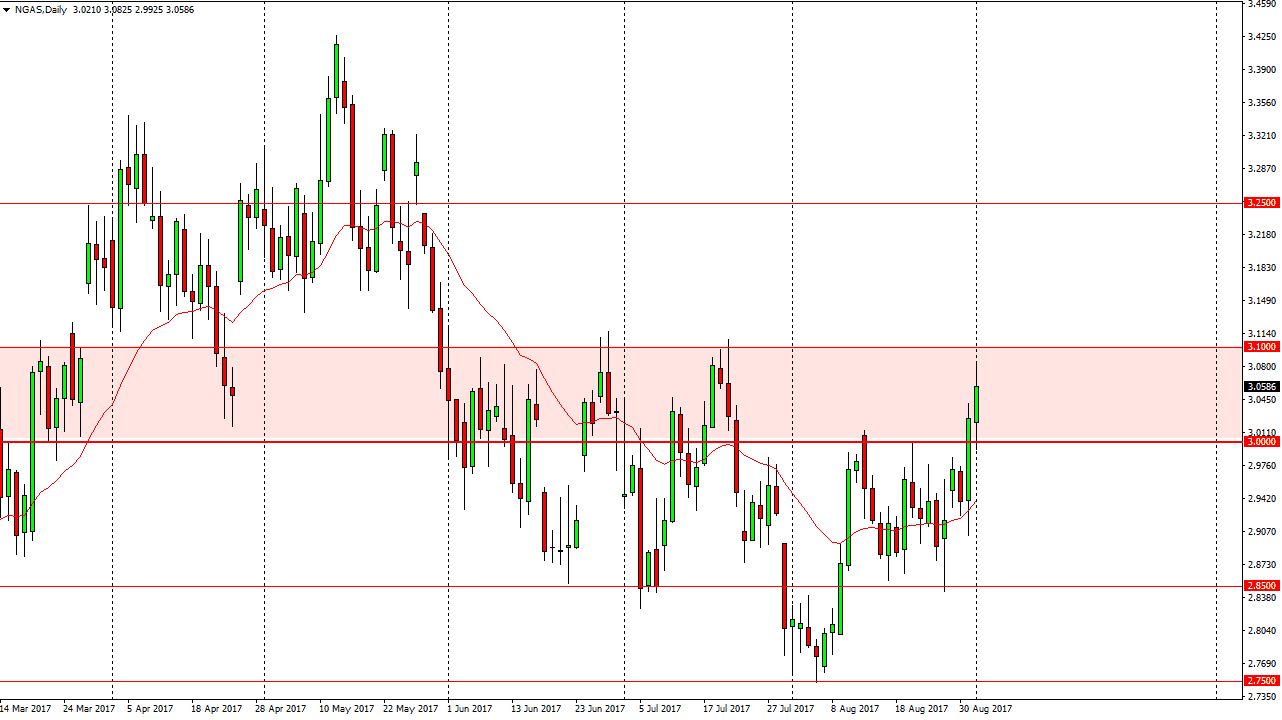

Natural Gas

Natural gas markets were very volatile during the Friday session, as we pulled back to the $3 level, and then exploded to the upside. The $3.10 level above seems to be massively resistive, but I think we will try to test that level. Ultimately, any type of resistance at that area could be a nice selling opportunity, but if we break out to the upside, the market should then go to the $3.25 level. If we break down below the $3 level, the market will continue to go lower. Where in a longer-term downtrend but I think a lot of this noise from hurricane Harvey will wear off eventually, and when it does we should have a nice selling opportunity. Until then, it’s likely that we will see a lot of choppiness of volatility, with the possibility of a short-term burst higher. I still believe in the longer-term negativity of this market, and therefore I’m not interested in trying to fight it, but rather would be more interested in waiting for exhaustion to jump on.