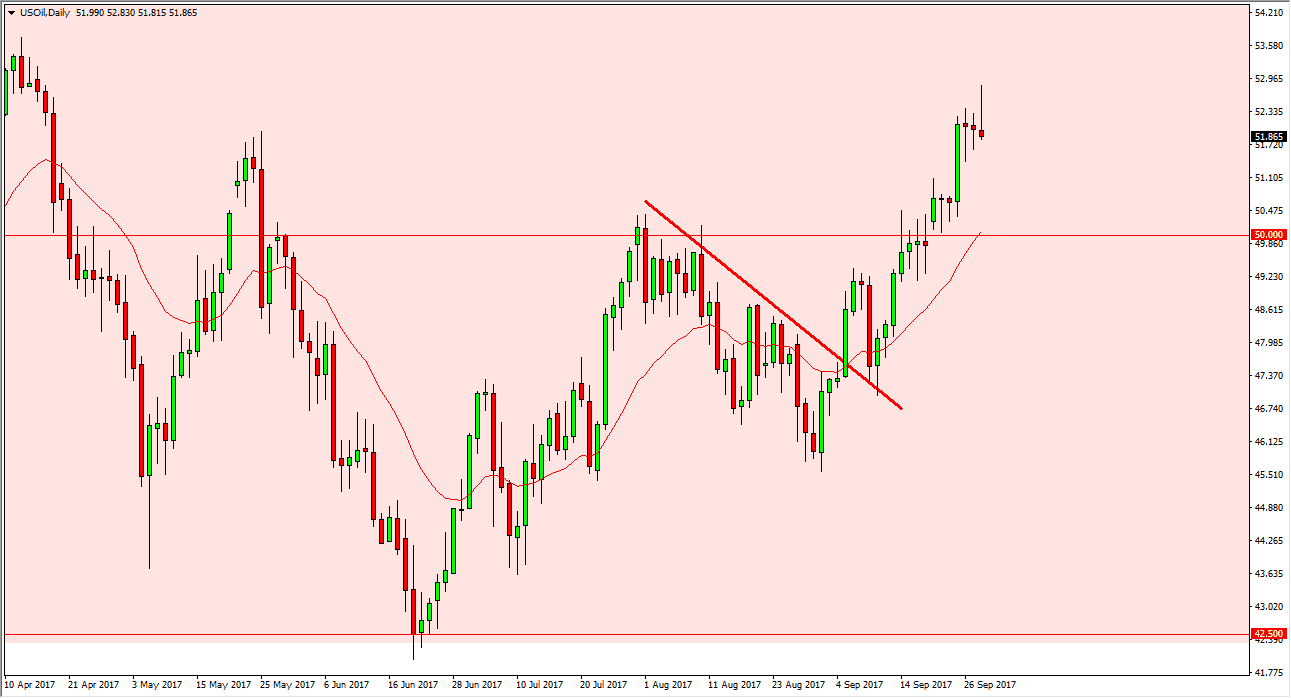

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day but turned around to form a massive shooting star. There is a lot of noise in this general vicinity, so I think it’s good to be a very choppy market to deal with. If we were to break down below the $51 level, I feel that point the market goes looking towards the $50 handle. A breakdown below the $49 level census market much lower. Alternately, we break above the $53 level, the market should continue to go towards the $55 level. This is a very choppy market, and I think will continue to be volatile to say the least. Given enough time, we will make a decision, but right now I think you are probably better off to wait.

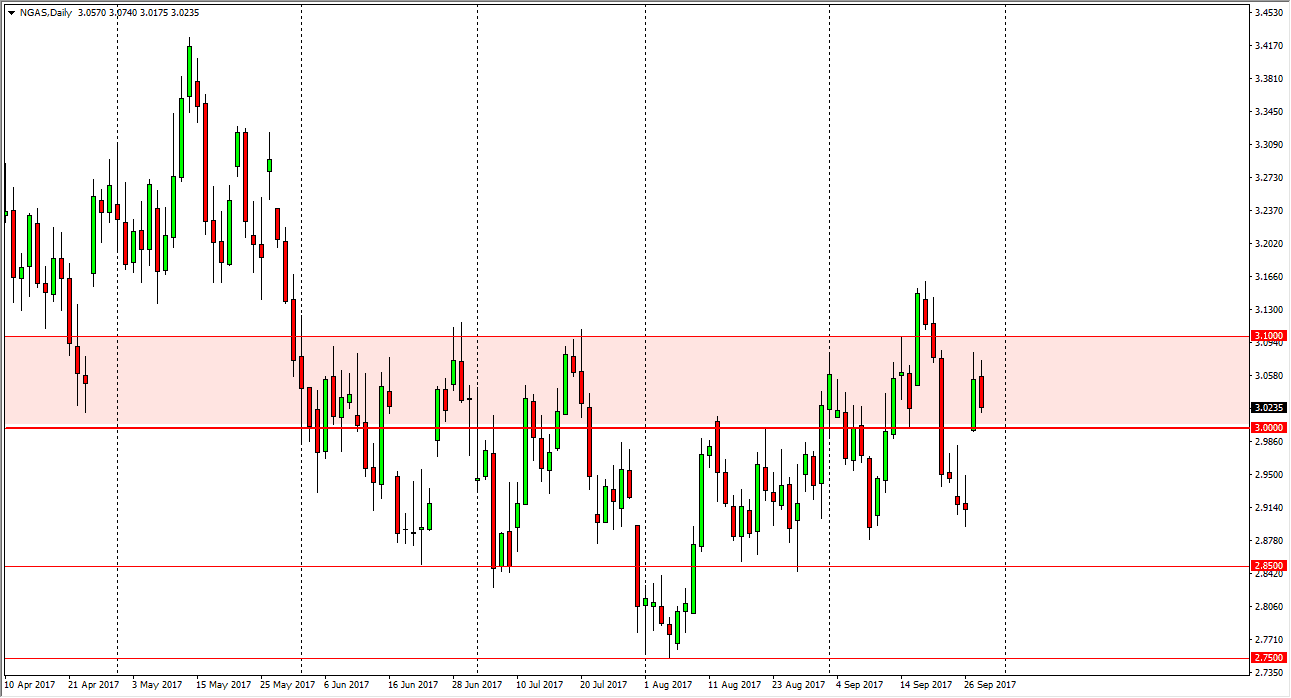

Natural Gas

The natural gas markets initially tried to rally but then rolled over during the day on Thursday, as we continue to see a lot of noise between the $3 and the $3.10 level. If we break down below the $3 level, the market will probably fall to fill the gap. Alternately, if we break above the $3.10 level, we could go higher, but obviously there is a lot of resistance up there as well. Quite frankly, I think this is a market that is going to continue to be noisy, and unless you have the ability to withstand massive amounts of volatility, I think you will probably be best served being on the sidelines. I do think that the gap gets fell initially, but I think that the volatility between now and then will cause quite a bit of confusion. The overall oversupply of natural gas continues to be a major issue in pricing of this commodity.