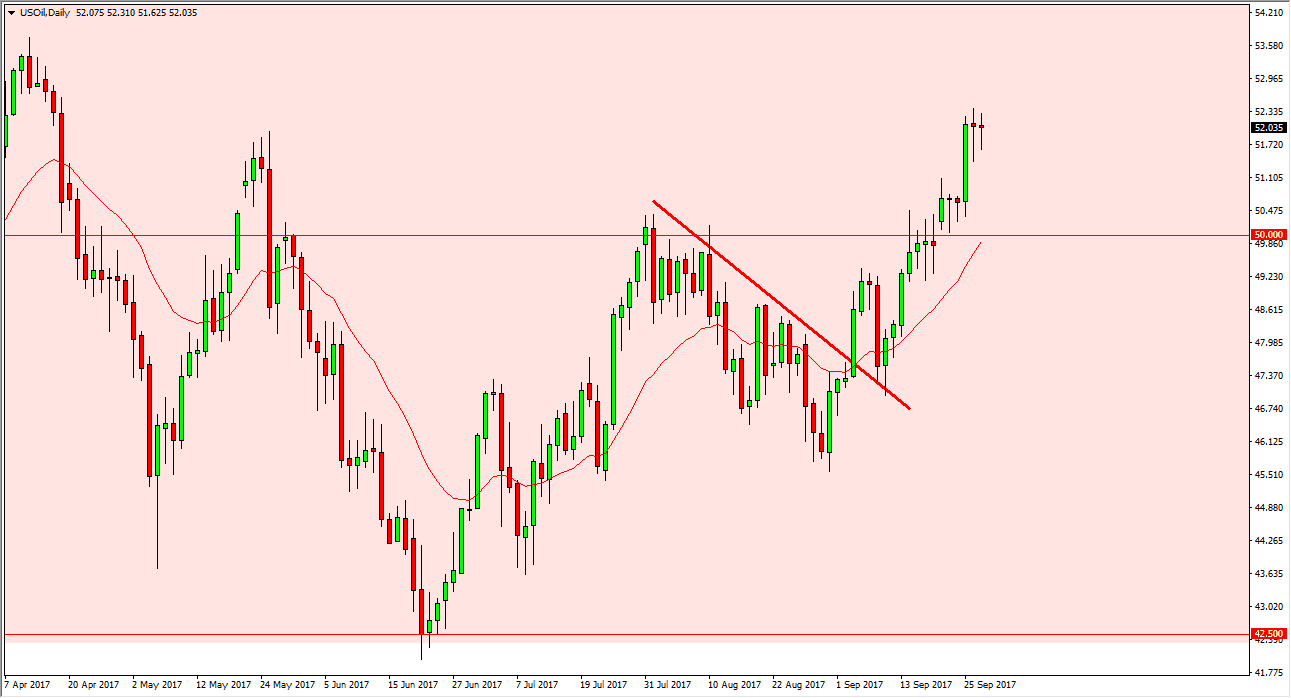

WTI Crude Oil

Oil markets were reasonably quiet during the session on Wednesday, considering that we get an inventory number release, and although we initially pulled back, we turned around to form a hammer again. This was preceded by a hammer on Tuesday, so I suspect that we are going to continue to see bullish pressure and eventually go looking towards the $55 level above. I believe the pullbacks continue to offer value, and that the $50 level is now going to offer a floor in the market. Ultimately, I think that the $55 level is going to be rather resistive, so I don’t think we sliced through their immediately. However, I do look at pullbacks as value, and I think most of the trading public does as well. If we were to break down below $49, that would change everything but right now there’s no signs of that happening.

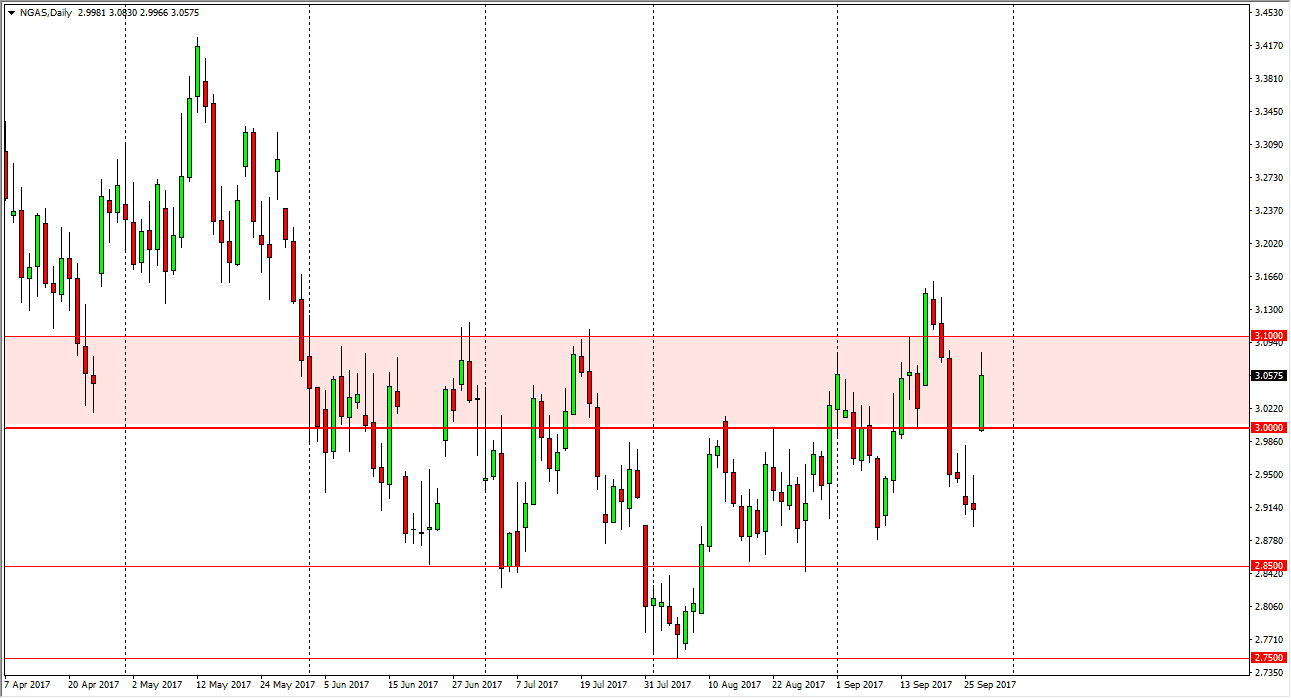

Natural Gas

Natural gas markets exploded to the upside, gapping above the $3 level at the open. However, towards the end of the session we started to see selling again as we get close to the $3.08 level, so I think that we are about to see this market roll over and try to fill the gap. I believe that the $3 level underneath will be supportive, but once we break through the filling of the gap is almost inevitable. The futures markets don’t like gaps, and typically will turn around to try and fill them as soon as possible. Right now, I still see the $3.10 level as a major barrier, but we did slice through it recently. In other words, this is going to continue to be a very messy market. I believe volatility is going to continue to be a major problem.